Market Brief

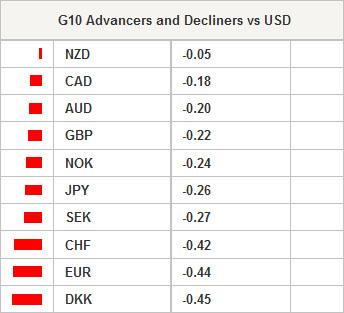

Forex strategies have shifted towards buying USD on the back of the Federal Reserve announcement to end QE. The Fed announcement ended its current round of QE by cutting purchases of Treasuries and MBS $15 billion to $0. In addition, the FOMC announcement linked any increase in the fed funds rate to economic data, giving the central bank a bit more flexibility in policy setting. In a slight shift in tone, the statement sounded more hawks than expected. The Fed upgraded its outlook on the job market noting that “labour market conditions improved somewhat further, with solid job gains and a lower unemployment rate”. While policymakers repeated that rates should remain unchanged "for a considerable time" there is an increased probability that the first fed fund rate hike could come prior to mid-2015, contingent on the development of economic data. The final vote to end QE was 9-1, with Minneapolis Fed President Kocherlakota dissenting arguing that QE3 should have been continued. The post –Fed reaction was heavy buying USD verse most G10 and EM currencies, supported by higher yields. USDJPY was well bid rallying to 109.26 with little pause or pullbacks along the way. EURUSD fell sharply for most of the Asian session dropping to 1.2571. AUD and NZD were both sold heavily verse the USD on monetary policy divergence falling to 0.8757 and 0.7780 respectively. AUDNZD rallied to 1.1261 preceding a more dovish than anticipated policy statement from the Reserve Bank of New Zealand. Long only commodity trading systems were hit hard as gold and silver fell sharply to 1201.53 and 16.80 respectively, after a false recovery. Asia equity markets were able to shrug off the end of the US QE program as the Nikkei rallied 0.67%, Shanghai composite rose 0.79% yet the Hang Seng fell 0.55%. US S&P 500 futures are currently trading in the green.

In New Zealand, the RBNZ held the official cash rate at 3.50%. In the accompanying statement, guidance was maintained suggesting a " period of assessment remains appropriate before considering further policy adjustment'", specifically inflation outlook to firm, prior to any policy modification. The one noticeable change was the subtraction of the guidance "further policy tightening will be necessary", giving the statement an overall dovish tone. Given domestic and regional conditions it’s dubious the RNBZ will be satisfied with the level of inflation outlook any time soon (despite currently above trend in inflation and growth). This indicates that the market current expectation of mid-2015 rate hike are optimistic and more likely to be pushed to late 2015 or even into 2016. Finally RBNZ data indicated that FX intervention was only to the level of NZ$30mn in September much lower than NZ$521mn sold in August. Elsewhere, Australia HIA new home sales remained unchanged in September after rising 3.3% mom in August.

On the docket today, Swiss KOF leading indicator to increase from 99.1 to 99.3 in October slightly above consensus estimate of 99.2. We anticipate EURCHF to continue to grind lower, especially since the Swiss gold referendum is showing an strong lean toward “yes.” And in the US, Q3 real GDP growth is anticipated to come in at 3.0% due to strong contributions from equipment investment, and residential investment yet still dragged by consumer spending.

Swissquote Sqore Trade Ideas: www.swissquote.com/fx/news/sqore

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.