Market Brief

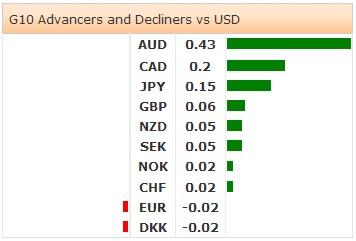

Economic news from China is mixed in September. The HSBC flash PMI suggests expansion of manufacturing activity this month, while the employment sub-index falls to 46.9 – 5 ½ year low. Despite soft employment, high beta currencies came in demand overnight. Traders continue watching the PMIs in European and US sessions. We do not expect significant volatility in the FX trading.

The Aussie-complex was better bid in Sydney. Lift in AUD/JPY pulled AUD/USD up to 0.8923 in Sydney, the ASX stocks gained (appr. 1%). Trend and momentum indicators remain comfortably bearish, decent option barriers at 0.8900 are tipped in New York settlement. NZD/USD remains supported above the critical 0.8052 (year low), yet the buying interest remains limited due to looming dairy prices. According to Rabobank, 37% of farmers expect more deterioration (vs. 24% in 2Q), while 47% see worsening business performance over the next 12 months. The bias remains negative. AUD/NZD rebounds from the 100-dma (1.0923) for the second consecutive day. Break below 1.0900/23 should intensify the selling pressures.

USD/JPY and JPY crosses traded ranged in Tokyo. USD/JPY sees decent offers pre-109.00/50. In the absence of fresh catalyzer, the 110-psychological resistance is expected to stay solid. The softness in US yields (despite hawkish Fed and broad USD strength) contains the upside limited in USD/JPY. Consolidation is underway between 107.50 - 110.00. EUR/JPY stabilizes at about its 200-dma (139.78).

EUR/USD consolidates weakness below 1.2870. Technical indicators are flat; break out of 1.2825/1.2900 is monitored to assess fresh short-term direction. EUR/GBP trades at two-year lows. Solid option barriers trail below 0.7900 for the week ahead and should keep the upside limited. GBP/USD continues paring past weeks’ losses. Positive technicals suggest a re-test of 1.6500/25 zone (Scottish no victory reaction high).

Today traders watch the September (Prelim) Manufacturing PMI in France, Germany, Euro-Zone, UK and US, French 2Q (Final) GDP q/q & y/y, French September Own-Company Production Outlook, Manufacturing and Business Confidence, UK August BBA Loans for House Purchase, Public finances and Public sector Net Borrowing, Canadian Retail Sales m/m and Richmond Fed September Manufacturing Index.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD consolidates gains below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery below 1.0700 in the European session on Thursday. The US Dollar holds its corrective decline amid improving market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD clings to moderate gains above 1.2450 on US Dollar weakness

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold price shines amid fears of fresh escalation in Middle East tensions

Gold price rebounds to $2,380 in Thursday’s European session after posting losses on Wednesday. The precious metal holds gains amid fears that Middle East tensions could worsen and spread beyond Gaza if Israel responds brutally to Iran.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.