Market Brief

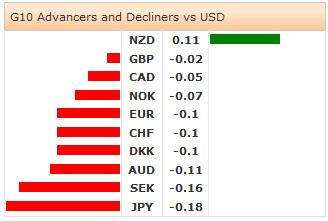

The FX traders’ focus shift to economic events/data as the geopolitical tensions de-escalate. The Japanese Yen recorded the largest downside versus USD since Tokyo open as, on top of the significant contraction in GDP (-6.8% q/q annualized according to 2Q (P) data), the machine orders grew at slower pace of 8.8% in month to June (vs. 15.3% exp. & -19.5% last). The April-June contraction has been -10.4% on quarter, although the expectations for July-September are more optimistic (+2.9% q/q on Reuters poll). JPY crosses were well bid on speculations for more BoJ stimulus. USD/JPY hold support at the 200-dma (former resistance) and advanced to 102.66 (at the time of writing). Offers line up pre-103.00, if cleared, should boost the bullish momentum. EUR/JPY tests the 21-dma on the upside. EUR remains under selling pressures.

Euro-zone July final inflation and 2Q preliminary GDP data are due today. Expectations are soft, the bias is firmly negative. Yesterday’s spike to 1.3415 triggered rapid profit taking. We see solid support zone at 1.3296/1.3333 (Nov 2013 low/Aug 6th low). A daily close above 1.3345 (MACD pivot) should keep the EUR bears timid. Offers line up above 1.3400/25 (optionality/21-dma). We remain seller on rallies. EUR/GBP trades above 0.80000, option barriers are solid at 0.80500/0.81000 before the weekly closing bell.

In the UK, the contraction in average wage growth offset enthusiasm on further improvement in unemployment and claimant count rate. The sentiment in GBP/USD turned mild as the quarterly Inflation Report revised the annual wage growth forecasts down to 1.25% from 2.50% in May. The BoE Governor Carney said there is no rush for the first rate hike given the uncertainties on how the economy would react to tighter bank rates. GBP/USD sold-off to 1.6670. The critical support stands at the 200-dma (1.6664). The oversold conditions (RSI at 26% , 30-day lower BB at 1.6683) suggests a pause at the current levels.

Kiwi gained the most vs. USD in Asia as the NZ retail sales (ex-inflation) advanced 1.2% in the second quarter (vs. 0.7% a quarter ago). The pair rallied to 0.8489, offers pre-0.8500 capped the rally. As the bearish momentum slows, a break above 0.8500/25 region (psychological level/MACD pivot) should suggest a short-term bullish reversal. Option bids are placed at 0.8425/45 for today expiry, the first set of barriers appear at 0.8550. NZD/JPY sits above its 200-dma (86.622). Technicals suggest further gains towards the daily Ichimoku cloud cover (87.786/88.580) as risk appetite stabilizes. AUD/NZD technicals are perfectly flat, the antipodean cross remains stuck within 1.0911/1.1040 range (Fib 38.2% & 50.0% levels on Nov’13 – Jan’14 drop). Breakout on either side is required to define fresh short-term direction.

The ECB publishes monthly report today. Traders watch French, German and Euro-Zone 2Q (Preliminary) GDP q/q & y/y, French 2Q(P) Nonfarm Payrolls and Wages, Swiss July Producer & Import Prices m/m & y/y, Euro-Zone July (Final) CPI m/m & y/y, Canadian June New Housing Price Index m/m & y/y, US Aug 9th Initial Jobless Claims & Aug 2nd Continuing Claims and US July Import Price Index m/m & y/y.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.