Market Brief

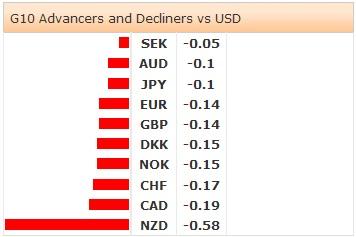

The New Zealand house sales drop by 13.0% in year to July according to REINZ, pulling the price index an additional 0.7% down on month. The NZD recorded the biggest losses against USD among G10. The break of the 200-dma (0.8462) feels heavy. The critical support stands at 0.8402 (June 4th low), a shift below should keep the bias on the downside (as Fed expectations sustain USD broadly). AUD/NZD trades within 1.0911/1.1040 range (Fibonacci 61.8% & 50% on Nov’13 – Jan’14 fall), a break on either side is required to define short-term direction.

In Australia, the house price index increased unexpectedly in the second quarter, the house price index advanced 10.1% y/y (vs. 9.3% exp. & 10.9% last). The business conditions and confidence improved according to NAB indicators. Supportive news halted AUD/USD sell-off in Sydney yet the selling pressures remain tight. Technicals are steadily bearish suggesting further weakness. The key support stands at 0.9200/09 (April-to date support and Fib 50% on Oct’13 – Jan’14 pullback). Option bids trail above 0.9200 and should give support to the pair through the week.

JPY-crosses traded mixed in Tokyo. USD/JPY continues testing the 200-dma (102.32) on the upside, offers trail above reinforced by decent option barriers pre-103.00. The geopolitical tensions and low US yields should continue limiting the upside. Bids keep the pair above 101.90/102.00 (daily Ichimoku base / 21-dma). More support is seen at 101.50 (Aug 8th downspike). EUR/JPY remains offered below the 21-dma (137.09). We see higher selling interest for a daily close below 136.70/75 (MACD pivot / Fib 38.2% on Nov-Dec rally).

GBP/USD grinds lower before jobs and quarterly Inflation Report due tomorrow. Option bids trail above 1.6755 for today expiry, more buyers camp above 200-dma (1.6657). The pair is at the edge of oversold limits (RSI at 28.5%, 30-day BB at 1.6738). Any positive surprise should lift the pair back towards its ascending Ichimoku cloud cover (1.6937/1.7007). EUR/GBP holds ground above 50-dma (0.79724), decent option barriers stand at 0.80000/0.80500.

EUR/USD is heavy today; selling interest remains strong above 1.3400. The critical support zone is 1.3296/1.3333 (Nov 2013 low / Aug 6th low). Traders monitor ZEW survey results today, upside attempts are seen as good opportunities to strengthen EUR-short positions. We remain seller on rallies.

The economic calendar of the day consists of Swedish July CPI m/m & y/y, ZEW Survey of German Current Situation, Expectations August & Euro-Zone Expectations, Italian July (Final) CPI m/m & y/y, US July NFIB Small Business Optimism, June JOLTS Job Openings and July Monthly Budget Statement.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold clings to strong daily gains above $2,380

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.