Market Brief

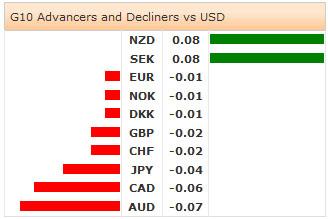

The international flows continue favoring the US dollars as EU and US officials prepare to impose further package of sanctions against Russia. Although the USD is better bid across the board, the US 10-year yields remain capped below 2.50% before traders’ focus shift to economic calendar/events in US open. The most expected event of the day is the FOMC policy verdict. The FOMC is expected to continue tapering its monthly bond purchases by additional (regular) 10bn dollars in the continuation of the QE exit program. The accompanying statement will be in focus as well as Fed dots to monitor the hawk-dove balance in the heart of the FOMC. Given the recent flow into the US dollars, there is no need for sizeable disappointment to reverse the USD appetite. Before the FOMC verdict, traders will be focused on the ADP employment change and the US second quarter GDP (advance release). The consensus is +3.0% growth in 2Q versus -2.9% printed in the first quarter mostly due to difficult winter conditions US went through.

USD/JPY tests the 200-dma (102.13) on the upside as the industrial production grew at the slower pace of 3.2% in year to June (according to preliminary data) versus 5.2% expected. The soft industrial data reinforced the Yen weakness in Tokyo. The technical indicators remain flat pre-FOMC. The pair is now above the daily Ichimoku cloud base (101.90/92), a daily close above 101.77 (MACD pivot) should preserve the slight positive bias. Japanese exporters are reported short above 102.50 facing the option related bids in charge at these levels. The upside remains challenging. EUR/JPY traded in the tight range of 136.84/98 in Tokyo. Key support zone remains at 136.23/75, then 135.70 (March-July downtrend base).

EUR/USD extends weakness to 1.3402 in Asia, the selling pressures intensify yet traders’ remain reluctant to pull the levels lower before US data and the FOMC. The US appetite is subject to important event risk today. Soft US data and/or dovish FOMC may reverse the appetite in USD and temporary release pressure on EUR/USD. Technically, EUR/USD sits on the bottom of the steep July downtrend channel. Breakout below will open the way to 1.3296 target (November 2013 downspike). Downside rallies are likely to see support given the oversold conditions (RSI at 25%, 30-day lower BB at 1.3404). EUR/GBP remains offered below the 21-dma (0.79257). More resistance is eyed at 0.79572 (June-July downtrend top).

The EM currencies are weaker given the fading appetite in carry trades this week. The geopolitical tensions between Israel and Gaza, as well as the escalating pressures on Russia keep investors away from risk assets. In addition, Argentina will announce in New York open whether it will service its debt, default or process with second injunction (not likely).

The economic calendar consists of Swiss June UBS Consumption Indicator and July KOF Leading Indicator, French July Consumer Confidence, Swedish July Consumer, Manufacturing Confidence and Economic Tendency Survey, Swedish 2Q (Prelim) GDP q/q & y/y, Norwegian May Unemployment Rate and 2Q Industrial Confidence, German and Spanish July (Prelim) CPI y/y, Euro-Zone July (Final) Economic, Industrial, Services, Consumer Confidence and Business Climate Indicator, US Juy 25th MBA Mortgage Applications, US July ADP Employment Change, US 2Q (Advance) GDP Annualized q/q, Personal Consumption, GDP Price Index and Core PCE q/q, Canadian June Industrial Product Price and Raw Materials Price Index m/m.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.