Market Brief

The Japanese consumer price inflation slightly retreated from 3.7% to 3.6% year to June, prices ex-food and energy advanced 3.3% y/y (vs. 3.4% last). In Tokyo, the headline CPI decelerated from 3.0% to 2.8% in year to June, while ex-food and energy advanced from 2.0% to 2.1%. USD/JPY and JPY crosses did little in Tokyo as the BoJ has already anticipated and communicated the current slowdown in consumer prices, thus the June inflation report didn’t trigger speculations in favor of additional monetary stimulus. USD/JPY gained to 101.83, offers at 102.80/102.07 (June-July downtrend top and 50-200 dma) region continue capping the upside, stops are mixed above 102.00. EUR/JPY remains ranged with trend momentum marginally bearish. Bids above 136.23 (2014 low) continue giving support, more bids are eyed at 135.80 (Feb-July downtrend channel base).

The significant improvement in July preliminary PMI readings have clearly helped lifting the EUR-complex higher in the second half of the week. EUR/USD remained capped at 1.3485 yesterday as the overall bias remains comfortably negative. We remain seller on rallies. Option related offers trail below 1.3450 due before the closing bell.

GBP/USD deepens correction. The pair retreated to 1.6967 in New York yesterday; option offers at 1.7000/25 intensified the selling pressures at this region. The negative short-term technicals suggest further extension of weakness with first line of support seen at 1.6923/64 (June 18th low / 50-dma). In the mid-run, the pair remains comfortably in its year-to-date uptrend channel (1.6894/1.7367). EUR/GBP advanced to 0.79396, offers pre-21-dma remained intact. We remain seller on rallies as long as resistance at 0.79385/0.79664 (21-dma today & June-July downtrend top) holds.

In New Zealand, the Kiwi consolidates post-RBNZ weakness. NZD/USD retreated to 0.8561 overnight, fresh offers capped the upside pre-0.8600. The kiwi remains an interesting currency for carry strategists, the current weakness is likely to attract dip buyers approaching 0.8546 (year-to-date uptrend base), the market remains net long. In Tokyo, NZD/JPY recovers above 87.000; the pair is expected to head back towards the daily Ichimoku cloud cover (87.578/87.732).

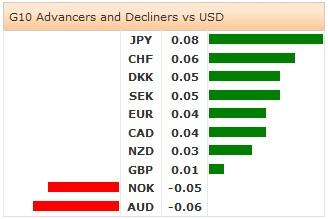

The US 10-year government yields tested 2.52% amid supportive US jobless claims decline in week to July 19th. In an interview to CNBC, the US President Obama said Fed’s focus to reduce unemployment has been appropriate while the lower rates have likely boosted the stock markets. The DXY index continue gaining field at the highest levels over a month. We will be closely monitoring June durable goods data before the weekly closing bell.

Today, the economic calendar consists of German August GfK Consumer Confidence, Spanish June PPI m/m & y/y, Swedish June Trade Balance, Household Lending y/y and Retail Sales m/m & y/y, German IFO Business Climate, Current Assessment and Expectations in July , Euro-Zone June M3 Money Supply y/y, UK 2Q (Prelim) GDP q/q & y/y, UK May Index of Services, US June Durable Goods and French June Jobseeker change and Total Jobseekers.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.