Market Brief

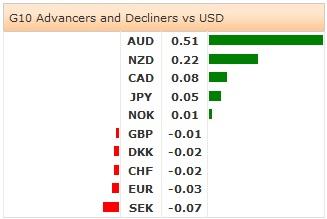

The Australian CPI accelerated at the slower pace of 0.5% in the second quarter (vs. 0.7% exp.), the CPI y/y advanced to 3.0% as expected. AUD/USD cleared resistance pre- 0.9400 (21-dma) and rallied to 0.9439 on stops. Technicals signal a short-term bullish reversal for a daily close above 0.9445 (MACD pivot). Support is seen at 21-dma (0.9400), while option related offers abound below this level. AUD/NZD rallied to 1.0877, offers pre-200-dma (1.0879) capped the upside. The bias is clearly positive. The next resistances stand at 1.0911 (Fibonacci 61.8% on Nov’13 – Jan’14 drop), then 1.1040 (Fibonacci 50.0%).

NZD/USD remains well supported above the 50-dma before RBNZ decision. The RBNZ is expected to hike its OCR by an additional 25 basis points. The rate hike widely priced-in, the expectations on less hawkish statement keep the upside limited.

The US inflation figures generated mixed market reaction in New York yesterday. Despite soft CPI reading in June, the USD came sharply in demand against EUR and CHF. EUR/USD broke the former year low at 1.3477, and immediately hit 1.3459. The pair consolidated losses at the tight range of 1.3458/71 in Asia. The bias is negative with decent option barriers trailing below 1.3480 for today expiry. The critical support now stands at the distant 1.3296 (Nov 7th, 2013 low). USD/CHF rallied to 0.9027 (highest since June 5th), the next key level is 0.9037 (June 5th high), if broken should open the way to 0.9156 (January high & May-July uptrend top). EUR/CHF hovers around its 21-dma (1.21500), lower EUR/USD should keep EUR/CHF well bid given the significant negative correlation. The 40-day trailing correlation currently stands at -43%.

The Cable steadily grinds lower. After hitting 1.7040 post-US CPI yesterday, the pair is offered pre-1.7100/05 (21-dma). The BoE minutes are in focus today, the dove-hawk balance in the heart of the MPC will be closely monitored. GBP/USD trades comfortable in the mid-range of year-to-date uptrend channel (1.6883-1.7356).

USD/CAD remains stuck in between 1.0697/1.0765 (21-dma/Mar-Jun declining triangle top). The bullish momentum slowly fades while traders remain reluctant on long CAD positions before retail sales data; expectations are soft. Any negative surprise should lead to a breakout above the triangle top, placing 1.0794/1.0825 (50/200 dma) at risk.

Today, the BoE releases July meeting minutes. The economic calendar: French Business Survey Overall Demand, Production Outlook, Manufacturing and Business Confidence for July, UK June BBA Loans for House Purchase, UK July CPI Reported Sales, US July 18th MBA Mortgage Applications,, Canadian May Retail Sales m/m & y/y, Euro-zone July (Prelim) Consumer Confidence.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.