Market Brief

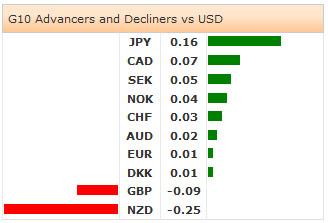

In the second day of her semi-annual testimony, FOMC Chair Yellen faced the Financial Services Committee. Yellen said that the economic recovery should lead to the end of the QE program in October, and yet declined to specify timing for the main Fed fund rate hike. The main exit tool would be the IOER (interest on excess reserves) rise, with limited flexibility on use of RRP to insure financial stability. She insisted on the fact that no mathematical formulas should be set to conduct Fed’s policy as such rules would be a “grave mistake” and would only limit Fed’s independence. In addition, Fed Fisher said that the rate hike may come by next year or sooner, adding that he doesn’t see interest rates rising sufficiently to damage Fed’s portfolio. USD rally slowed, DXY index consolidates gains at about 80.500 – a month high levels, while the US 10-year yields seem little convinced, unable to break above 50/100-dma at 2.5668/70 respectively. USD/JPY couldn’t make it higher than its 21-dma (101.71), technicals are perfectly neutral waiting for fresh direction.

EUR/USD extended losses to 1.3521 post-Yellen and remained tight ranged in Asia. If the pair holds ground above yesterday and the Asian session low (1.3521), the formation of tweezer bottom should signal a minor bullish reversal. Yet the bias is clearly negative. The key support zone stands at 1.3477/1.3503 (2014 low/June 5th ECB reaction low). Decent option barriers are seen pre- 1.3550/80 for today expiry. Euro-Zone releases final inflation report in June and the expectations remain soft. EUR/GBP cleared support at 0.79000 and legged down to 0.78888 overnight. Short term technicals signal the end of the upside correction. Decent option barriers trail above 0.79000 for today and Friday expiries.

In UK, the unemployment rate improved to 6.5% in May, while the earnings growth disappointed over the same month. GBP/USD’s bullish momentum cooled down in London yesterday. The pair is still in June-July ascending channel, bids are seen at 1.7096/7100 (21-dma / optionality). No barriers are eyed on the upside. Resistance are placed at 1.7180/92 (year high levels) and then 1.7270 (uptrend top & 30-day upper Bollinger band).

Offers in AUD/USD remain solid pre-0.9400 (21-dma/optionality), light stops are eyed above. The key short-term support is at 0.9330/39 (June 16th low / Fib 61.8% on Oct’13 – Jan’14 pullback). AUD/NZD breaks above 1.0751 (Fib 76.4% on Oct’13 – Jan’14 drop) mainly due to selling pressures in NZD. The short-term technicals are now positive suggesting deeper upside correction to 1.0820/23 July highs. NZD/USD extends weakness to 0.8683 despite 5.7% increase in jobs advertisement in month to June. Dip-buyers are still willing to stay given the rate expectations. The RBNZ gives verdict next week.

As widely expected, the BOC kept the bank rate unchanged at 1.00%. USD/CAD rallied to 1.0794 for the first time since June 20th, as the Canadian policy makers said that the latest inflation pick-up should remain temporary. The BoC Governor Poloz aims to keep the CAD weak to maintain favorable conditions for stronger exports and business investments. USD/CAD trades within our key 1.0550/1.0800 range, with solid offers on the upper end and stops eyed above 1.0800. Option bids are eyed at 1.0750/75 for today expiry.

The economic calendar of the day: Eu27 June New Car Registrations, Euro-Zone May Construction Output m/m & y/y, Euro-Zone June (Final) CPI m/m & y/y, Italian May Current Account Balance, Canadian May International Securities Transactions, US June Housing Starts and Building Permits m/m, US July 12th Initial Jobless Claims and July 5th Continuing Claims and Philadelphia Fed July Business Outlook.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.