Market Brief

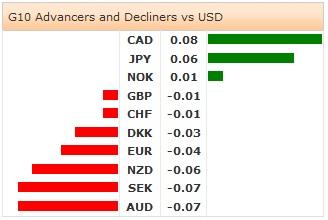

The risk appetite has been greatly squeezed amid fears of insolvency in Portugal triggered aggressive sell-off in European stocks and peripheral bonds. US and Asian stocks followed the panic unwinding. Quickly, the issue is about panicked investors after Espirito Santo International missed payments to “few clients” and lead to an aggressive 17% drop in its biggest shareholder Espirito Santo Financial Group’s shares. The stock has been suspended after hitting 51 euro / share. The panic fueled fears across the European continent. Portugal’s PSI20 index lost 4.4%, IBEX wrote-off more than 2.0%, followed by FTSE (-0.7%), CAC40 (-1.3%), S&P500 (-0.4%), Dow Jones (-0.4%), Nikkei (-0.3%) and Hang Seng (-0.3%). Euro-zone peripheral yields rallied; led by 10-year Portuguese government yields, Greek, Italian and Spanish bonds sold-off. Inflows eased Swedish, German, Netherlands and Swiss government yields. The sell-off in EZ peripheral bonds lead to weakness in EUR/USD. The pair hit 1.3589 in New York yesterday and remains offered below its 21-dma (1.3613). Technically, June-July uptrend channel rotates/flattens. We see limited upside today as the uncertainties should continue weighing on the entire EUR-complex. A weekly close below 1.3576/80 (Jul 7 low / MACD pivot) should further decrease the short-term appetite in EUR/USD. The key issue of the day is developments around the Portugal situation. In fact, Espirito Santo Bank is not big enough to generate a systemic risk, yet large enough to trigger a contagion. The downside pressures on high-beta and EM currencies should continue.

The reaction due to Fed minutes remained short-lived due to these more challenging headlines. Right before the Portugal panic started, USD/JPY has hit 101.07, the pair recovered to 101.39 in Tokyo as Japanese traders preferred to take advantage on lower levels rather than jump on the bearish trend. Trend and momentum indicators are flat-to-negative, the key support stands at 100.76 (2014 low). If the Portugal situation gains momentum, risk-off returns may push the levels towards 2014 lower bound. Stops are eyed below. EUR/JPY consolidated losses in the tight range of 137.68/92. Technicals turn mild.

AUD/USD remains offered below 0.9400 (21-dma / optionality). The technical bias is marginally negative, first line of bids are seen at 0.9339/51 (Fib 61.8% on Oct’13 – Jan’14 drop), selling pressures should intensify below. Action on AUD/NZD is limited below 1.0660 (former support becomes short-term resistance) pre-weekend (intraday range 1.0645/59).

Canada will release jobs data today; markets anticipate a steady unemployment rate at 7.0%. USD/CAD has stabilized within 1.0600-1.0700 range since June 27th, the short-term bearish momentum vanishes. The labor data is important today. Although we believe that the probability for further BoC easing is no more up-to-date, any negative surprise on labor side will suggest renewed attempt to 1.0700-resistance. A breakout on either side of the current trading range is required to talk about short-term direction.

The economic calendar of the day: German June Wholesale Price Index m/m & y/y, German and Spanish June (Final) CPI m/m & y/y, French May Current Account Balance, UK May Construction Output SA m/m & y/y, Canadian June Unemployment and Participation Rate and finally US June Monthly Budget Statement.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.