Market Brief

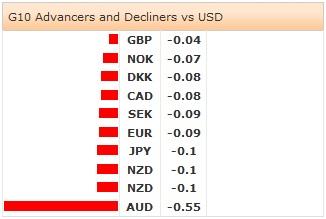

The good economic data failed to boost enthusiasm in New York yesterday, yet the fading risk sentiment due to geopolitical tensions in Iraq lifted the safe-haven demand in US dollars. The US sent troops back to Iraq, 275 armed forces for protection of diplomatic posts. Traders should be ready to face a carry unwind and get positioned accordingly.

Data-wise, the US empire manufacturing survey in June unexpectedly improved to 19.28 (vs. 15.00 exp. & 19.01 last). The US industrial production expanded by 0.6% in May (vs. 0.5% exp. & -0.6% last), the capacity utilization improved above expectations from 78.6% to 79.1% over the same month. The US 10-year government yields shortly advanced to 2.61%, while the DXY index rebounded from 80.400 overnight. The focus is on Fed verdict on June 18th. The consensus leans towards a deceleration in monthly QE tapering from 45bn to 35bn dollars. In Canada, the increase in existing home sales in May (from 2.8% to 5.9%) limited the USD/CAD upside attempt at the 21-dma (1.0883). The MACD (12, 26) stepped in the bearish zone, yet the rising USD demand should keep the downside above the key 1.0804 Fibonacci support (38.2% on 2009-2011 drop).

In China, the foreign direct investment turned unexpectedly negative in May (-6.7% in May, vs. 3.2% exp. & 3.4% last). The Yuan upside attempt has been limited sub-6.2000; USD/CNY returned to its 50-dma (6.2358). While technicals stay in the Yuan-supportive zone, decent option bids are placed at 6.2000/50 for today expiry.

JPY-crosses were slightly better bid in Tokyo. USD/JPY holds ground above the critical 200-dma support (101.60), resistance is eyed at the daily Ichimoku cloud cover (102.23/66). EUR/JPY trades with steady negative bias below the 200-dma (138.86), subject to broad based EUR bias.

EUR/USD continues testing 1.3580/1.3600 offers, while technicals are mixed. The 50-dma (1.3729) crossed below the 100-dma (1.3734) favoring technical shorts, while the MACD turns neutral. A daily close above 1.3552 should send the MACD in the positive territories.

In UK, the Cable consolidates strength right below 1.7000/11 area before the CPI release (due at 08:30 GMT). The inflation reading has surprised on the upside last month, a similar surprise should reinforce the upside attempt in GBP-complex. The critical resistance stands at 1.7043 (5-yr high). As suspected, the oversold conditions in EUR/GBP sent the pair towards 0.80000, yet offers (& option related expiries) keep the upside capped at 0.80000/0.80500 region. The RSI now stands at 22%, the 30-day lower BB at 0.79996. We believe that deeper correction is needed at the current levels, while keeping our mid-term call on the bearish side.

Today’s economic calendar consists of Swedish May Unemployment Rate, EU27 May New Car Registrations, Spanish and Euro-zone 1Q Labor Costs, Swiss May Producer & Import Prices m/m & y/y, Italian April Trade Balance, UK May CPI, PPI and RPI m/m & y/y, ZEW June Survey on German Current Situation and Expectations in June for Germany and Euro-zone, US May CPI m/m & y/y, US May Housing Starts and Building Permits m/m.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.