Market Brief

The US yields couldn’t make it higher after Friday’s payroll report surprised on the upside. The US economy added 288'000 new nonfarm jobs in April; the private and manufacturing payrolls printed 273K and 12K respectively. The unemployment rate significantly improved from 6.7% to 6.3% (thus the former Fed Chair Bernanke’s prior 6.5% target would have been hit). The only dark issue was that the recent improvement in participation rate faded down to 62.8% - lowest levels since 1978. The good NFPs boosted the USD demand in New York on Friday yet the enthusiasm remained short lived. The US 10 year government yields traded below 2.60% for the first time in three months, DXY shortly spiked to 79.852, yet gave back gains into the New York close.

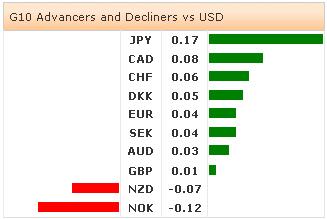

JPY crosses opened the weak downbeat. USD/JPY failed to clear resistance at 103.00 post-NFPs. The disappointment on less dovish BoJ and the failure in US yields to pick up triggered an early sell-off in Asia. USD/JPY ran into stops below 102.00 to hit 101.87 in Tokyo. Option related offers trail down from 102.00; the selling pressure is likely to intensify below 101.80-support. EUR/JPY rebounded from 141.29 – daily Ichimoku cloud base, yet the bias turns negative on JPY leg.

AUD/USD kick-started the week, rallying to 0.9317 at session opening. The corrective shorts remained limited at 0.9253 as the faster securities inflation of 2.8% y-o-y (vs. 2.7% last) revived RBA hawks. The RBA meets tomorrow and is expected to keep the policy rate unchanged at 2.50%. AUD/USD is stuck within 0.9209-0.9339 range (Fibonacci 50% and 61.8% on Oct’13 - Jan’14 drop), the negative bias places the lower band at higher risk. AUD/NZD is offered below the 100-dma (1.0758), tests the broad downtrend base (1.0680).

EUR/USD rebounded from our 1.3812 support post-NFPs. The USD inability to strengthen activated a decent dip-buying trend. EUR/USD rallied to 1.3887 in Asia. Trend and momentum indicators are marginally bullish before ECB meeting on Thursday. The first resistance is at 1.3906 (April high) with stops eyed above. Key resistance remains at 1.3967 (2014 high).

The Cable saw resistance at 1.6823 post-NFPs, yet the recovery remained limited below 1.6900. The 30-day RSI now stands at 66% (slightly lower than 70% overbought limit). The pair trades comfortably at the mid-range of Mar-April uptrend channel. The key short-term resistance stands at 1.6920 (year high), then 1.7043 (five year high). EUR/GBP consolidates losses below 0.82370. MACD (12, 26) turns positive, suggesting further upside correction for a daily close above 21-dma (0.82370) with target unchanged at 0.82800.

The economic calendar of the day is light. The European Commission will publish the spring economic forecasts while traders watch Swedish March Service and Industrial Production, Norwegian March Credit Indicator Growth y/y, Euro-Zone May Investor Confidence by Sentix, Euro-Zone March PPI m/m & y/y, US April Services and Composite PMI by Markit, and finally US April ISM Non-Manufacturing Composite.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.