Market Brief

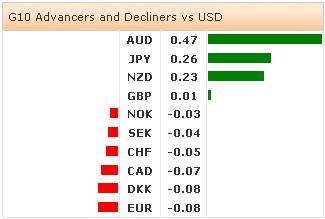

The FOMC minutes intensified downside pressures on USD. Although all members agreed to drop existing thresholds (unemployment & inflation) for the first rate hike, minutes didn’t reflect any concrete comment on Yellen’s “6 months” after tapering ends to proceed with the first hike. Some participants prefer keeping the rates low as long as the inflation remains below 2%. The US 10-year government yields retreated below 2.70%, the DXY hit three week low (79.542).

GBP/USD extends gains to 1.6820, a stone’s throw lower than the previous year high (1.6823). The BoE will announce policy today and is likely to keep the bank rate stable at the historical low of 0.50% and the asset purchases target unchanged at GBP 375bn. We do not expect the BoE decision to significantly impact the current bullish dynamics in GBP-complex. The bullish momentum in GBP/USD intensifies, option bids trail above 1.6640/1.6700/1.6725 and 1.6800 for today’s expiry. A major resistance stands at 1.7043 (05/08/2009 high). EUR/GBP consolidated losses at the tight range of 0.82410/510 in Asia, trend and momentum indicators remain comfortably bearish suggesting extension of weakness towards 0.82042 (March 5th low).

The sentiment in EUR/USD turns cautiously bullish in continuation of USD weakness. EUR/USD rallied to 1.3871 despite expectations of a potential QE in the foreseeable future. The MACD (12, 26) turned positive post-Fed minutes rally and will remain positive for a daily close above 1.3815. The key resistance stands at 1.3967 (Mar 13th & 2014 high).

China printed USD 7.7bn trade surplus in March, the exports contracted by -6.6% (vs. -18.1% in Feb) while the imports slid by -11.3% (vs. +10.1% in Feb). The Chinese Premier Li said not to plan short-term stimulus plan to deal with short-term vol, adding his will to further open the capital market and service industries. USD/CNY spiked to 6.2130 early in Asia; Hang Seng and Shanghai’s stocks rallied 1.48% and 1.84% (at the time of writing) perhaps on Li’s comments on more economic freedom.

The Australian economy added 18’100 new jobs during March (vs. 2.5K exp. & 47.3K last). The unemployment rate retreated from 6.1% to 5.8%, yet the participation rate declined from 64.9% to 6.7%. AUD/USD advanced to 0.9400 post-FOMC minutes, corrected to 0.9371 on China exports then rallied to 0.9440 on stops (above 0.9400). The 30-RSI now stands at the overbought region (75%). The next key resistance stands at 0.9499/0.9500 (Fib 76.4% on Nov’13 – Jan’14 pullback & psychological level).

On a similar pattern, NZD/USD hit our 0.8745 target before corrective gains jumped to limit the upside. The short-term trend turns positive; the MACD will suggest the extension of gains for a daily close above 0.8675. Given the overbought conditions (RSI at 69%), a downside correction would be healthy at this levels.

The BoE will announce policy at 11:00 GMT. The economic calendar consists of French February Industrial/Manufacturing Production m/m & y/y, French and Swedish March CPI m/m & y/y, Norwegian March CPI and PPI m/m & y/y, ECB Monthly Report, Italian February Industrial Production m/m & y/y, Canadian February New Housing Price Index m/m & y/y, US April 5th Initial Jobless Claims & March 29th Continuing Claims, US March Import Price Index m/m & y/y and US Monthly Budget Statement.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.