Market Brief

As widely expected, the BoJ kept the monetary policy unchanged at today’s meeting; the monetary base will continue increasing at the annual pace of 60-70 trillion yen. USD/JPY and JPY crosses traded mixed in Tokyo, the Nikkei stocks wrote-off 1.36%. The Japanese balance of payments improved from Yen -1,589bn to record a surplus of Yen 612.7B (slightly lower than Yen 618.1bn expected). USD/JPY traded down to 102.75, offers kept the upside limited at the daily Ichimoku cloud top (103.10.) The bias remains on the upside with option bids are placed at 102.75, stops are eyed below. EUR/JPY turns offered below 21-dma (141.68). A close below 141.80 will keep the bias on the downside according to MACD (12, 26) analysis.

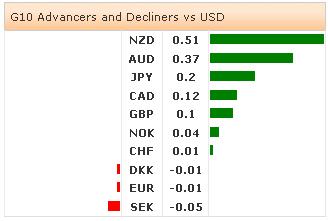

In Australia, AUD gained against all of its G10 counterparts (except NZD). NAB report showed lower business confidence in March, the business conditions improved slightly. AUD/USD advanced to 0.9306 (at the time of writing). The bias is on the upside with option bets mixed at 0.9300. The key short-term resistances remain at 0.9339 (Fibonacci 61.8% on Nov’13 – Jan’14 pullback) and 0.9499/0.9500 (Fib 76.4% & psychological level). On the downside, the first line of support stands at 0.9209 (Fib 50%), then 0.9139/56 (200 & 21 dma). AUD/NZD eases from 1.0805 (broad downtrend channel top & 100 dma). A close below 50-dma (1.0733) should signal deeper downside correction.

EUR/USD slowly recovers from ECB doves. Comments from ECB’s Mersch and Nowotny stating there is no need to rush into more easing helped EUR/USD to advance to 1.3745. We see resistance at 1.3738/52 zone (50-dma & Fib 23.6% on Nov-Dec rally), more offers are eyed walking towards 21-dma (1.3809). We remain seller on rallies.

The Cable picks momentum on the upside. Yesterday’s close above 1.6590/1.6600 suggests the extension of gains as long as 21-dma holds (1.6593). EUR/GBP consolidates weakness below 50-dma (0.82820), the selling interest remains. Option barriers with today expiry are placed at 0.82850/0.83000.

Today, the economic calendar consists of Swiss February Retail Sales & March Unemployment Rate, French February Budget & Trade Balance, UK February Industrial & Manufacturing Production m/m & y/y, US March NFIB Small Business Optimism, Canadian March Housing Starts and Building Permits and US JOLTs February Job Openings.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.