Market Brief

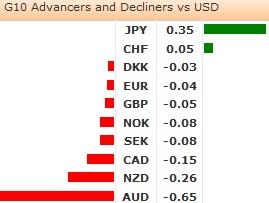

The Reserve Bank of Australia cut its official cash rate to the record low 2.75% to boost the Australian growth still below the trend. Aussie dropped to 1.0178 - its lowest level since March 4th, while ASX 200 retreated 0.24% despite the better-than-expected trade surplus in March. The market news on George Soros selling AUD clearly helped to push the AUD-complex further down. AUDJPY traded to 100.841, while AUDNZD crossed below 1.20 for the first time in almost four years. The sentiment in AUD remains solidly bearish.

In Japan, the FinMin Aso stated that the monetary policy alone cannot fix the Japanese economy and announced that the fiscal reform plan is scheduled by mid-year. USDJPY and JPY crosses were offered in Tokyo. USDJPY remained capped by solid offers towards 99.50 and higher. Japanese exporters sales helped to push the Yen-complex lower. USDJPY is still subject to very strong option resistance around 100-area.

The Asian equity markets were dominated by the Japanese stocks’ rally. The Nikkei 225 rushed 3.55%, Hang Seng and Shanghai’s Composite added 0.22% and 0.05%, while Taiex and Kospi index dropped 0.07% and 0.36%.

Dovish comments from the ECB President Draghi sent the Euro a leg down yesterday afternoon. EURUSD sank as Draghi stated that the ECB is ready to act again if needed. The downside remained well supported at 1.3054. Demand came from Asian sovereign names overnight. EURUSD advanced to 1.3095, yet opened the day on negative sentiment in Europe. EURCHF spiked down to 1.2255 while USDCHF sold-off to 0.9370. The unemployment rate in Switzerland remained unchanged at 3.1% in April while the consumer confidence did not show the expected improvement.

Back from Holidays, the sterling opened the week on the downside in UK. Cable was seen below its 100-day MA (1.5536) this morning, while EURGBP stabilized at 0.8410/20 area after yesterday’s heavy sell-off to 0.8400.

Today, the focus is on the Swiss Foreign Currency Reserves in April, French March Industrial and Manufacturing Production m/m & y/y, Swedish March Industrial Production, German March Factory Orders m/m & y/y and US May IBD/TIPP Economic Optimism.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.