Market Brief

The Asian session started the week in green. The majortiy of stock markets extended gains overnight. The Nikkei 225 advanced by 0.62%, Hang Seng , Shanghai’s composite and Taiex added 0.34%, 0.30% and 0.86% respectively. Korean’s Kospi and ASX200 index retreated, while the US stock index futures were little changed.

Overnight, Chinese January non-manufacturing index slightly increased. The Australian inflation remained in line with expectations, the monthly and yearly building approvals fell since December, while the January job advertisements improved to -0.9% from -3.8% since last month’s reading. In New Zealand, the commodity price index added 0.3%, reaching its 10-month high after 6 months of consecutive increase.

In US, the NFP figures slightly increased; yet fell short of market expectations. In January, the US added 157’000 jobs (excluding farm, private household and government workers), lower than the 165’000 expected. The US unemployment remained stable at 7.9% (vs. 7.8% for last two previous months). The US stocks didn’t react to data, Gold spiked to 1,682.27, while CHF and JPY consolidated.

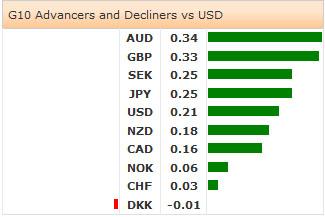

Swiss franc hit its two-week low versus EUR, and ten-month low against USD. USDJPY reached a new high at 92.91, before falling back to bids at 92.50. AUDUSD registered a fresh year-low at 1.0361, while USDCAD failed to break the strong 1.00 resistance, and retreated to 99.60 / 80 zone since Friday. EURUSD rallied to 1.3711 Friday afternoon, yet corrected to the downside after some profit taking and position adjustments on the fears that Mario Draghi may sound concerned about the Euro strengthening on Thursday’s ECB policy meeting.

Today, the focus is on the Swiss UBS 4Q Real Estate Bubble Index, Spanish Unemployment m/m, EC February Sentix Investor Confidence, UK January PMI Construction, Euro-Zone PPI m/m and y/y, and US Dec Factory Orders.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.