Market Brief

The week started with optimism on good news out of China. The majority of Asian shares advanced amid China’s industrial profits y/y surprised to the upside (5.3% vs. exp.3.0%). The Shanghai’s Composite index surged 2.29%, Hang Seng and Taiex added 0.43% and 0.55%, while Nikkei and Kospi retreated 0.94% and 0.36% respectively. The US stock futures traded to the upside; the S&P, Dow Jones and Nasdaq futures extended Friday’s gains.

USDJPY tested new highs early in the session. The currency hit 91.26, before slipping under 91.00 on profit taking. EURJPY and GBPJPY followed the downside correction. According to Wall Street Journal, the Ex- Japanese Econmin and Abe’s advisor Takenaka stated that JPY has room to fall further, pointing 95.00 level.

On Friday, UK GDP disappointed the already low expectations (GDP q/q: -0.3%, vs. -0.1% exp. and 0.9% prior & GDP y/y: 0.00%, vs. 0.2% exp. and 0.00% prior). GBPUSD extended losses in the Asian session, and collapsed to 1.5728 in European opening, while the BoE head and Financial Stability Board Chairman Mark Carney gave insight of a further monetary stimulus this week-end. Carney will give a conference in Zurich this afternoon (15.00 GMT).

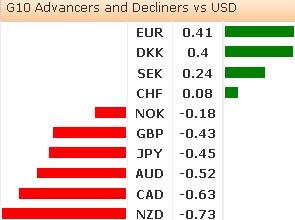

In Euro-Zone, the LTRO payback announcement came in line with expectations. The yield spread between German and Spanish 10-year bonds narrowed, while EURUSD traded in a tight range of 1.3450 / 70 in the Asian session. The option players, including sovereign names, have been the most aggressive sellers according to market rumors. EURGBP rallied to 0.85544 in European opening, its-highest level since December 2011. ECB’s Asmussen warned against unilateral FX moves, being the biggest risk against EU reforms. In Switzerland, the SNB keeps the monetary tools ready to control CHF, still seen as highly valued.

Today’s agenda consists of UK Halifax House Price Index, Swedish December Retail Sales and Trade Balance, Swiss m/m and y/y Retail Sales, Italian Consumer Confidence index and Wage Inflation, Euro-Zone December M3 and December Private Loans, US December Durable Goods Orders, and Durables ex-Transportation, US Dallas fed Manufacturing Activity, and New Zealand December Trade Balance, Exports, and Import.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD steadies above 1.0600, awaits German ZEW and Powell speech

EUR/USD is holding above 1.0600 in the European morning on Tuesday, having hit fresh five-month lows. The pair draws support from sluggish US Treasury bond yields but the rebound appears capped amid a stronger US Dollar and risk-aversion. Germany's ZEW survey and Powell awaited.

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

Will Gold reclaim $2,400 ahead of Powell speech?

Gold price consolidates the rebound below $2,400 amid risk-aversion. Dollar gains on strong US Retail Sales data despite easing Middle East tensions. Bullish potential for Gold price still intact on favorable four-hour technical setup.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Canada CPI Preview: Inflation expected to accelerate in March, snapping two-month downtrend

The Canadian Consumer Price Index is seen gathering some upside traction in March. The BoC deems risks to the inflation outlook to be balanced. The Canadian Dollar navigates five-month lows against the US Dollar.