The grass is not always greener on the other side, even with Ireland being thrown into the mix.

Persistently soft European data certainly opens the door for the ECB to be proactive once again, and perhaps even as early as at tomorrows ECB meeting. A plethora of Central Bank monetary decisions announcements will be dominating this week, at least until Friday's US non-farm payrolls. Late Monday, the RBA down-under did not deviate from their last meetings script, holding rates steady at +2.5%. Governor Stevens even took time out to continue to whine about their overvalued AUD. Today, the Bank of Canada gets to hog the limelight, albeit briefly, before investors have to once again square off with the "Old Lady" and the ECB tomorrow.

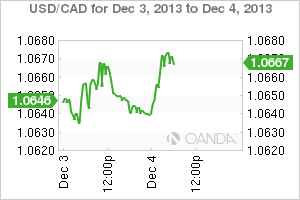

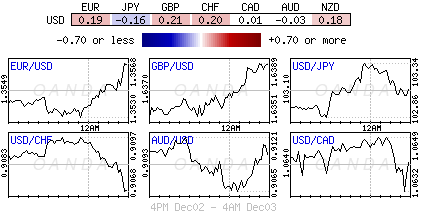

Governor Poloz at the Bank of Canada is expected to hold the line, and keep benchmark lending rates on hold at +1.00%, with no significant change in guidance. Since the previous decision, data have been mostly in line with consensus, and global inflation pressures have been contained. Last time out, the committee was notably more "neutral" than in their previous decision. Has recent data any cause for Canadian policy makers to waiver again? No, not at all - current data does not warrant another change in Canadian policy stance for the time being. The market remains relatively bearish on the loonie. Obviously any further dovish hints and the CAD will be expected to come under further attack. As NFP draws closer, dealers will expect the principal US dollar to dominate price action. The market believes that the reporting of a strong job environment stateside is proof enough for a December taper.

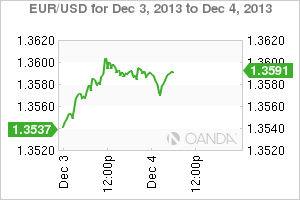

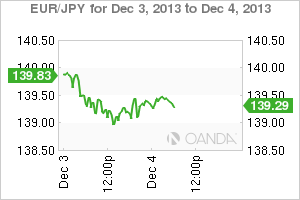

The trend remains – the Euro-zone continues to rely on Germany to support whatever economic growth the region is producing. This morning's mid-week Purchasing Managing surveys suggest that the relationship is perhaps even more symbiotic than the market had perceived. The Euro PMI fell to 51.7 last month from 51.9 in October. The report is a strong indicator that the private sector activity once again slowed during that month. Nationally, Germany continues to independently play the dominant role in pushing forward the whole regions economic development. It's own composite PMI rose again to 55.4 on the month, backed by a rise in the service sector. Analysts note that activity in the country's private sector grew at the fastest pace in two-and-a-half years. A stark reminder of how perilous growth is in the region, both France and Italy's private sectors contracted at the fastest pace in nearly six-month.

It's no surprise that the data should suggest that growth in Germany is expected to develop in Q4 by as much as +0.5%. However, the Euro-zones number two and three economies outlook do not look so rosy. France and Italy are expected to continue to battle their own growth concerns. The dismal composite data for either country this week would again suggest further contraction in either economy in Q4. Germany's superior services sector boomed last month, jumping to 55.7 from 52.9 – a new 10-month high. By contrast, the French and Italian service sector contracted for the first time in three months.

The Euro-zones service sector basically has put in a repeat performance to Monday's manufacturing PMI's. France and Italy have both come in weaker than expected, while Germany and a few of the peripheries, continue to surprise to the upside. With divergence appearing within the core (Germany and France) and the periphery (Spain and Italy) there is certainly room for Draghi and company at the ECB to follow up its rate cut last month with further easing tomorrow.

Fixed income traders believer there remains a case for the ECB to deal with the decline in excess liquidity, which is starting to "increase volatility in money markets." There remain a number of innovative options open for ECB policy makers, ranging from cutting the reserve requirement to leaving the SMP program "partially or fully unsterilized." But, will Draghi and company have the gall to proceed as early as tomorrow?

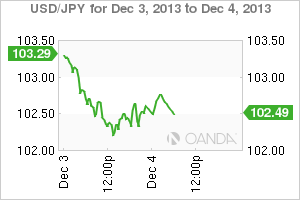

But before Draghi can ever give the "nod" investors will have to deal with US ADP and ISM data points for further Fed clues towards a December taper. ADP of late has had little bearing on the monthly NFP numbers for awhile, however, expect many market participants to make a strong argument particularly if the outcome strongly surprises. Be aware, that a particularly strong indication for Friday carries the risk of the market assigning a higher probability to a December taper, which should support a stronger USD and higher US 10-year yields.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.