“It isn’t my fault” – those words will not be used, but Bernanke certainly made it clear yesterday that the reason they “did not taper” lay right up the street. It was Capitol Hill that has forced the Fed’s hand and not reduce market liquidity. Ben’s “Helicopter” legacy is surely to remain intact once he leaves office. It seems that the US politicians have backed the Fed into a corner and has them “kicking the can further down the road.” Trust and transparency have all been thrown out the window and the market is now returning to focusing on each US fundamental release. Fair warning, if not tuned it, data will end up biting any bull or bear.

Future tapering has probably ended up being a meeting-to-meeting call once again, beholding to a small handful of economic data points, market developments and most certainly a safe passage through US fiscal legislation. The Fed is correct to be hesitant. Global growth is precarious at best, and turning the taps too tight too soon, would have a huge global domino effect. It probably it would not be for the better if you were listening to the IMF’s Lagarde, ECB’s Draghi, BoE’s Carney, BoJ’s Kuroda and the RBA’s Stevens to name but a few.

US policymakers were less confidant that improvements in the economy and labor markets in particular would be sustained. All one has to do is just look at last week’s participation rate for starters – 63.3% (the lowest since 1978) and the headline job growth. Despite the UER (unemployment rate) shifting, the US job sector is ‘not’ that of an economy in a convincingly ‘bullish growth position.’ Ben is correct to be concerned about the recent “rapid” tightening in financial conditions and it’s prudent to want to see the response to higher rates in housing and across economic activity. It’s not surprise that the Fed is frustrated with politicians. While policy makers bust everything to keep the US economy on track, it’s what is currently happening on Capitol Hill that’s the real worry. Ben et al remain uncertain about the effects of fiscal restraint and have highlighted the possibility that the upcoming debate over government spending and debt authority will enhance downside risks.

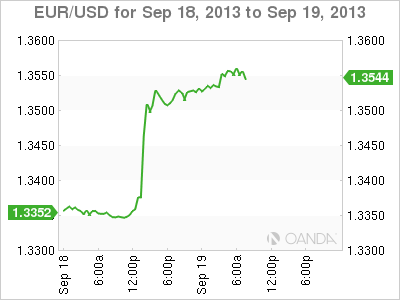

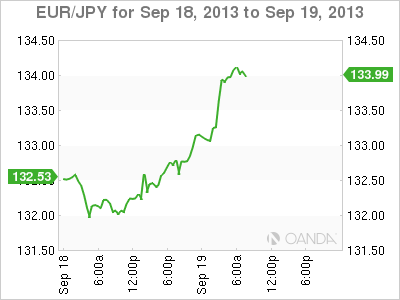

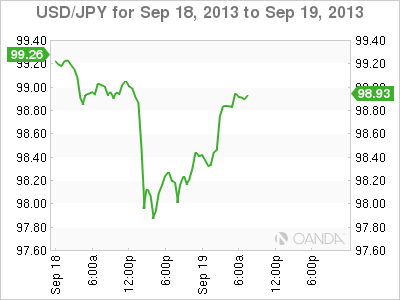

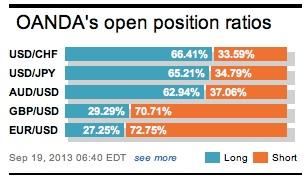

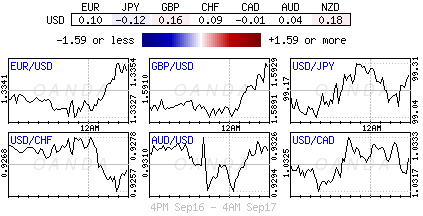

Yesterday’s summary of economic projections emphasizes the view that policy would likely remain very accommodative deep into recovery. The sharp market reaction – dumping the “mighty” dollar, buying risk again – is indicative of the bias in the consensus. The market was caught flatfooted and wrong on the Fed’s announcement, dealers and investors alike expected a partial reprieve for the USD that had been sold ever since L. Summers dropped out of consideration for Ben’s job at the weekend.

Yesterday’s decision will bring into question the validity of the previously outlined thresholds by the Fed. It seems that the Fed’s definition of ‘transparency’ is about to leave capital markets a tad more confused on the Fed’s entire policy transition process – the market cannot rely on the Fed’s map for directions.

The immediate and overnight reaction in the various asset classes is justified; US accommodative policy is not over. Global equity investors can breath again, and for the fixed income supporters, it’s going to be difficult to see and justify the upward pressure on bond yields being preserved. It will all come down to the various upcoming fundamental releases to shift bond rates higher. Probably the biggest concern will continue to lie with the FX market. Accommodation is supportive of risk assets, which is a positive factor, however, a continued USD weakness could be a concern for asset prices elsewhere. For now, a big winner has been the emerging market in the overnight session – the INR and MYR have stood out, rallying +2.6% and +2.3% vs. the dollar.

The big looser in yesterday’s “not to taper decision” is the Fed’s push for better communication and transparency. Ben and his fellow cohorts knew September was aggressively being priced in – investors have been certainly signposting it for them. Nobody at the Fed tried to dissuade the market. All anyone had to say, probably again and again, was that to taper was based on economic recovery, which appears to be somewhat fragile. Instead, lets blame them on the hill!

Risk continues to have the green light until the fundamentals say otherwise.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.