Market focus this morning has turned to Q1 U.S earning season. Thus far, global equities have started with some mild gains after yesterday’s evening’s open season earning’s surprise beating expectations. It’s somewhat of a steady start compared to the rabid market fallout produced by the new governor at the Bank of Japan last week. The Central Bank from the “Rising Sun” came, saw and delivered its new ‘shock’ therapy “Reflation Policy – Qualitative and Quantitative Program – market participants have been trying to adapt as quickly to the policy’s ever since.

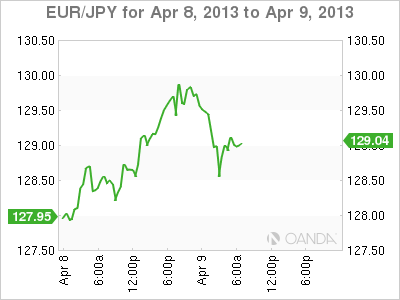

The new BoJ monetary easing is currently exceeding market expectations. Governor Kuroda has stated that he will aggressively implement his “new balance sheet approach” – pledging to double bond-holdings to the equivalent of +1.3% of GDP, unlike the much smaller amount from the Fed, +0.6% of their GDP. This will result in the Yen continuing to trade under pressure amongst the crosses and 10-year JGB’s to fall to new record low-yields. Market analysts have since been wildly picking USD/JPY upside targets expected to be achieved by year-end. They range between 108-114.

Asian FX, particularly the emerging currency’s with the high carry (IDR, INR) and sound macro fundamentals (PHP, MYR, THB) are likely to benefit as investors increase their hunger for higher yield/spreads. Since the beginning of April, the BoJ monetary policy easing has triggered a rate rally across 10-year emerging market rates and selectively supporting high carry currencies like PLN, TRY, BRL, ZAR and MXN.

It was BoJ easing and the Yen carry trade that helped Asian economies to recover strongly from the post FED tightening during the 1990 along with the Asian Crisis. This time around any aggressive Japanese easing could lead to a two-tiered Asian FX Market with the North Asian Block (KRW, TWD and CNY) expected to maintain their underperformance. Despite USD/JPY being a crowded trade, the outright pair is expected to be trading north of 103 within three-months. Strong Yen depreciation is expected to affect Asian FX mainly through the regions FX policy response – intervention, rate cuts and potential capital flow controls.

The Bank of Korea could be the first to respond to Governor Kuroda aggressive policy easing by finally cutting rates by -25bp to +2.50% this Thursday. Their economy is struggling to regain momentum amid declining export competitiveness. Obviously intensifying tensions with North Korea are an added risk, but inflation is a non-issue to the BoK’s easy policy stance – similar to other global inflation concerns, there are none.

The market now expects the dominant Asian currencies to react differently during Governor Kuroda ‘anything at all cost’ reign. The BoJ’s actions supports riskier assets, encouraging renewed risk behavior by global investors ahead of a shift in domestic Japanese investor flow.

The Chinese Yuan or CNY is expected to trade flat for now but eventually lower against the USD – that is not much different to their pre-aggressive BoJ levels.

The ‘Upstart or the Young pretender,’ the KRW – obviously is currently weak against the USD on event risk, but the market anticipates the currency to trade back to pre-crisis strength against the JPY.

Taiwan or TWD under current macro-economic conditions is expected to trade higher, but to under perform the troubled nation of South Korea (KRW).

The problem with this lemming “train of thought” is that today’s conditions are very different to the Asian crises of old on a number of fronts:

Emerging Yield structure is dramatically lower as too are global yields– So technically; it’s not a Carry Trade except for India (+8.5%).

For Policy: Both growth and inflation are very much lower than previous. In Asia some economies GDP and Yield is lower than U.S, along with some current account balances.

Problem: Emerging countries have already complained about policies that are driving competitive economies currencies lower.

This has resulted in the new BoJ Governor Kuroda to already play down any potential negative fallout from his monetary policy stimulus – Japanese policy makers are weary of creating potential asset bubbles.

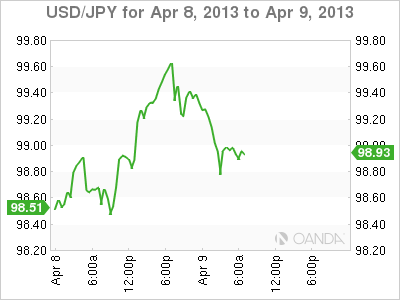

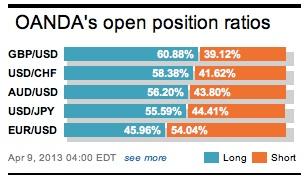

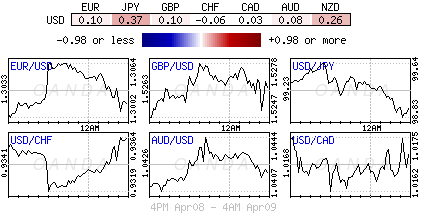

So far this month weaker global data has led to a sea of equity red, with global safe haven bonds in demand and historical low yields on display. Currently, the mighty “buck” is in trouble with other G10 members short-term, because of no early signs of a Fed exit strategy. Political and Event Risk has snapped risk appetite some what, especially after last weeks dismal North American employment numbers. Weaker U.S data has investors more concerned about the strength of the US recovery. However, one thing seems inevitable and that’s the BoJ expansion policy pushing USD/JPY through Y100. There are only two questions on traders lips and that is how high? And what can slow its rapid ascent?

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.