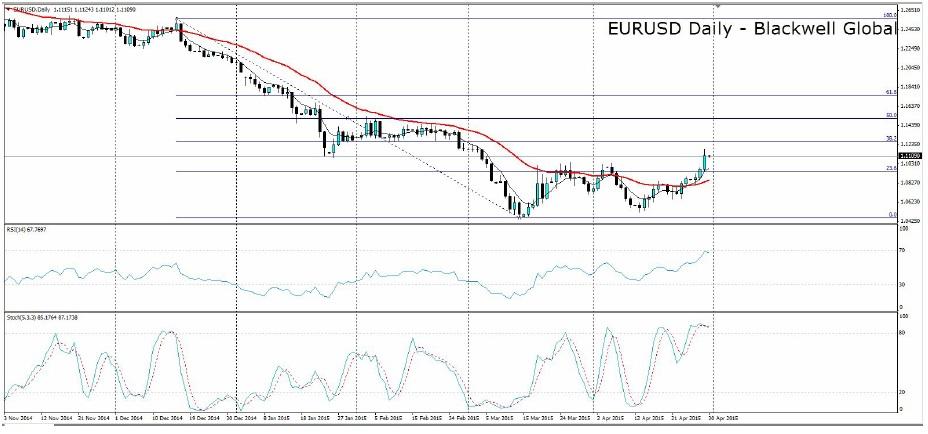

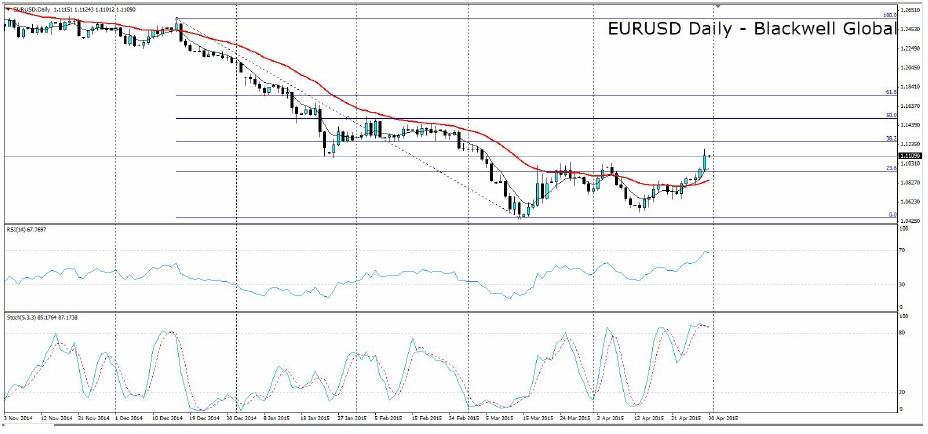

The Euro’s concerted climb, through the top of the month and half’s high, caught many traders by surprise today. The FOMC’s decision to leave rates unchanged along with the poor US GDP result at 0.2% left the market in dollar sell off mode. Subsequently, the Euro climbed through 1.1100, proving, yet again, that the pair is currently driven by US weakness rather than European strength.

Despite the strong rally, the Euro faltered and declined back towards support at 1.11 demonstrating that the bears are still very much in control. Despite many market pundits lauding the new rise of the Euro, I am less convinced and see plenty of downside action left to play out in the coming days.

In the near‐term, resistance exists at 1.1266, in the form of the 38.2% Fibonacci retracement level, will likely act to cap any further gains. A breakthrough of that resistance places the 50.0% level, at 1.1515, into play. Considering the Euro’s broadly bearish trend, any upward move must be seen in the context of temporary corrections and an opportunity to find short entries.

Looking at the 4 hourly charts, it shows the bears starting to win the battle as both RSI and stochastic oscillators have crossed into over‐sold territory and have started to trend lower. A strong move below 1.11, and 30SMA crossover, would signal that a potential fall back towards the 23.6% support level is in play. Any further bearish indicator signals is likely to signal that a short biased opportunity is imminent.

Ultimately, technical indicators are likely to dominate the Euro in the coming days as eagle eyed bears look to profit from the intra‐day shorts. However, watch out for the Eurozone Flash CPI estimate and US Unemployment claims data, due out later today, as it is likely to impact the pair.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.