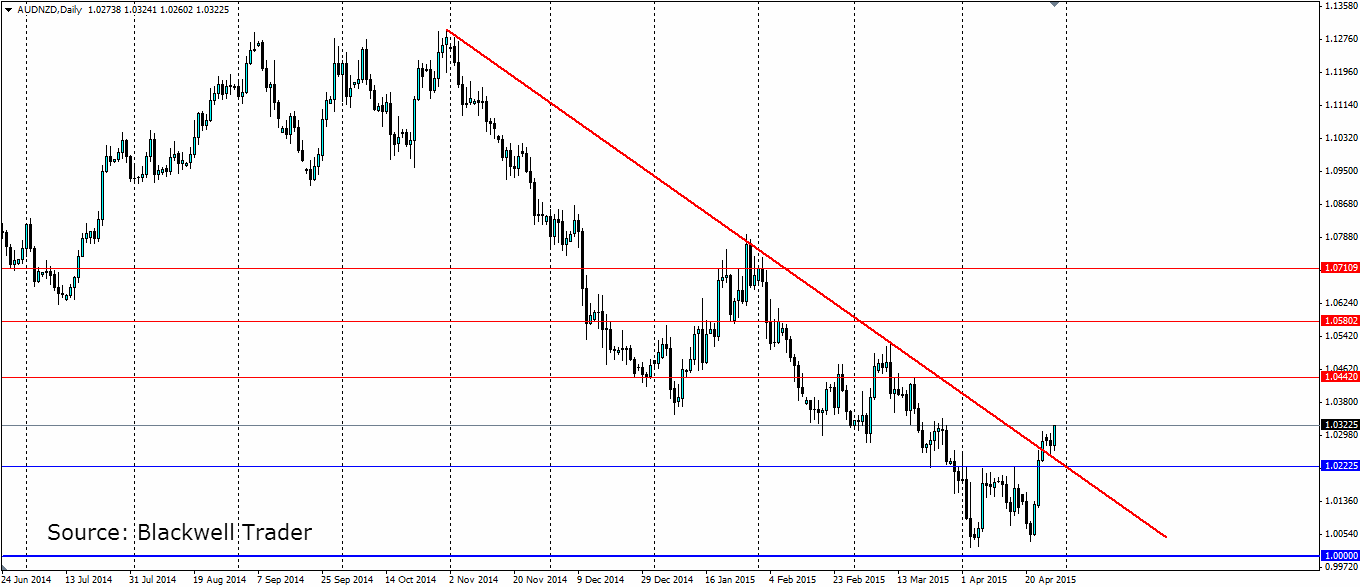

The Aussie Dollar came very close to parity with the Kiwi dollar thanks to expected cuts in interest rates. But the parity party in NZ never got started with the pair lifting from the lows and breaking out of the bearish trend.

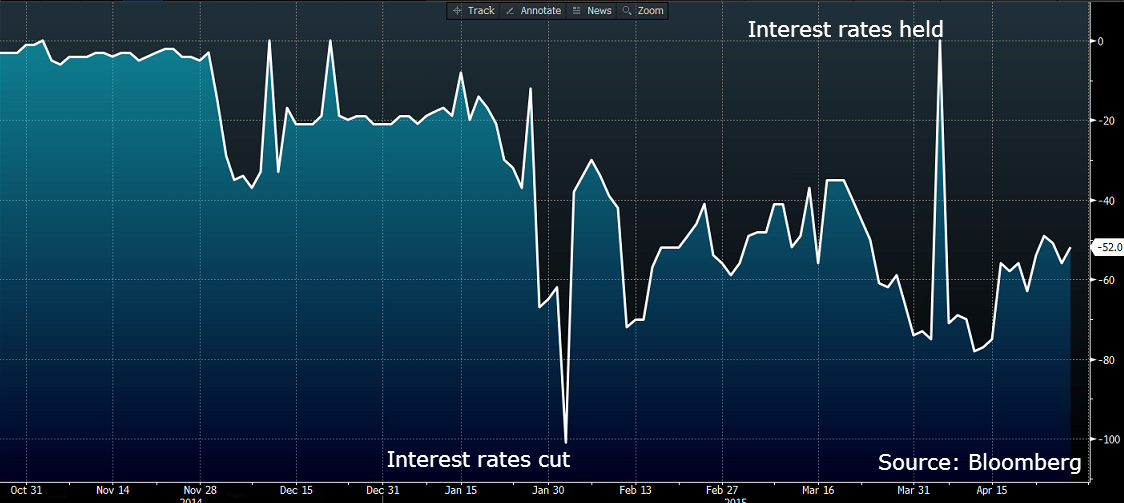

The pair has been in a bearish trend since the beginning of November last year when the market first started to speculate about an interest rate cut from the RBA. We did eventually see one cut from the RBA in early February, and the market has been expecting another one this year. Just a few weeks ago the market was pricing in an 80% chance of a rate cut at the May 5th meeting, which has now fallen to 52% with the Aussie gaining strength accordingly.

The main reason for the turnaround is the fact that Australian employment figures have not been as dismal as many had expected. The Unemployment rate surprised the market as it dipped from 6.3% to 6.1%, after hitting a high in Feb of 6.4%. Retail sales too have surprised the market as they lifted in April by 0.7% m/m vs the expected 0.4%. The Trade Balance was another economic indicator that did not fall as much as expected. All of these point to a halt in the economic slide in Australia and the RBA will be encouraged to keep interest rates on hold.

On the other hand we have the Reserve Bank of New Zealand, which for a long time was seen as the hawks of the South Pacific. Governor Wheeler is keen to cool the domestic housing market, but at the same time he is concerned the slowdown in China could cause a recession in New Zealand. In recent weeks the market has begun to speculate that the RBNZ could hint at a rate cut of its own. We believe there is little chance given the overheated housing market, but nonetheless, the speculation is causing weakness in the Kiwi.

This turnaround has left the AUDNZD pair looking rather bullish as it pushes higher out of the bearish trend. If the markets expectations continue in their current forms we could see this pair retrace the majority of this trend over the course of the next two months. The pair will look for resistance at 1.0442, 1.0580 and 1.0710 as it moves higher, otherwise support will be found at 1.0222 and of course the psychological level at parity (1.0000).

The Aussie has found some strength recently against the Kiwi dollar as the market reassesses its positions of the respective monetary policy outlooks. Parity for now looks to have been dodged.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.