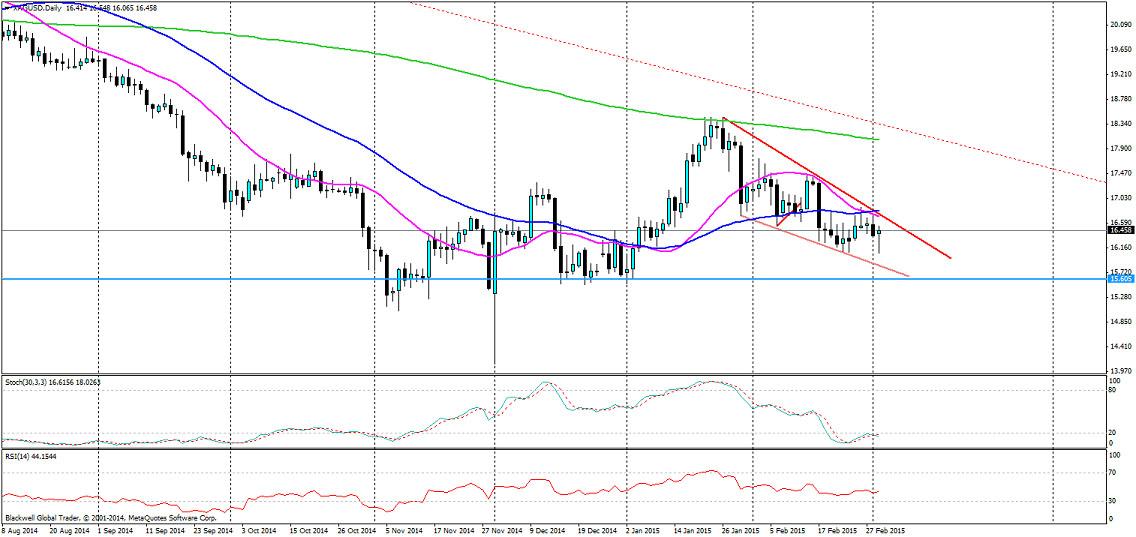

The silver wedge continues to tighten as markets look to shift into a lower gear and drop down the charts.

The question is how much further can we drop at present with the silver market looking very timid. Not much further I feel as currently we have seen a strong resistance patch at 15.065 and the market will most certainly be looking to play to this level at least.

What the market this week will be focused on is labour data and the build-up for FED action. The labour market has so far been quite positive, and as a result the market will be looking for driving points to get it lower. Each time we have the prospect of rate rises on the horizon in a talk we see silver shift lower and non-farm this week is expected to be 238K, a rather weak reading to previous ones, so there its certainly room for a large drop lower.

So with Yellen wanting to talk up the prospect of interest rate rises to the market, it’s inevitable that we will see lower lows in silver, at least down to the 15.065 level. But from a technical perspective, we have a solid wedge forming and we also have a golden cross forming as the 20 MA crosses through the 50 MA pointing to bearish sentiment picking up the pace.

Long term a descending wedge is a breakout pattern upwards, however, we have some more time to go before that is a reality and once we have a touch on the 15.065 level, there will be scope for a breakout higher for the silver market; just not right now while we continue to trend lower.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.