A large consolidation pattern is forming between the US dollar and the Canadian dollar on the daily/H4 charts. The strength in the US dollar and weakness in the oil price has seen a large push up the USDCAD charts, but for now it consolidates as it awaits the next move from oil.

The Canadian dollar has weakened considerably over the last six to nine months thanks to a sharp drop in oil prices. Canada exports a considerable amount of Oil to the US, which make up a large portion of export receipts. So it’s no real surprise to see the Canadian dollar fall alongside oil.

To counteract falling oil receipts, the Bank of Canada recently cut interest rates, which surprised the market. They are not expected to cut again when they meet later this week, but another cut would certainly push the USDCAD pair up to the recent highs.

US dollar strength has also played its part. The market expects the US Federal Reserve to begin to raise interest rates by September this year. Last week two Fed officials said that interest rates may rise sooner than the market expects. Yellen herself has remained committed to raising interest rates by “mid-year”. Certainly the contrast of the two central banks alone is enough to drive the pair higher.

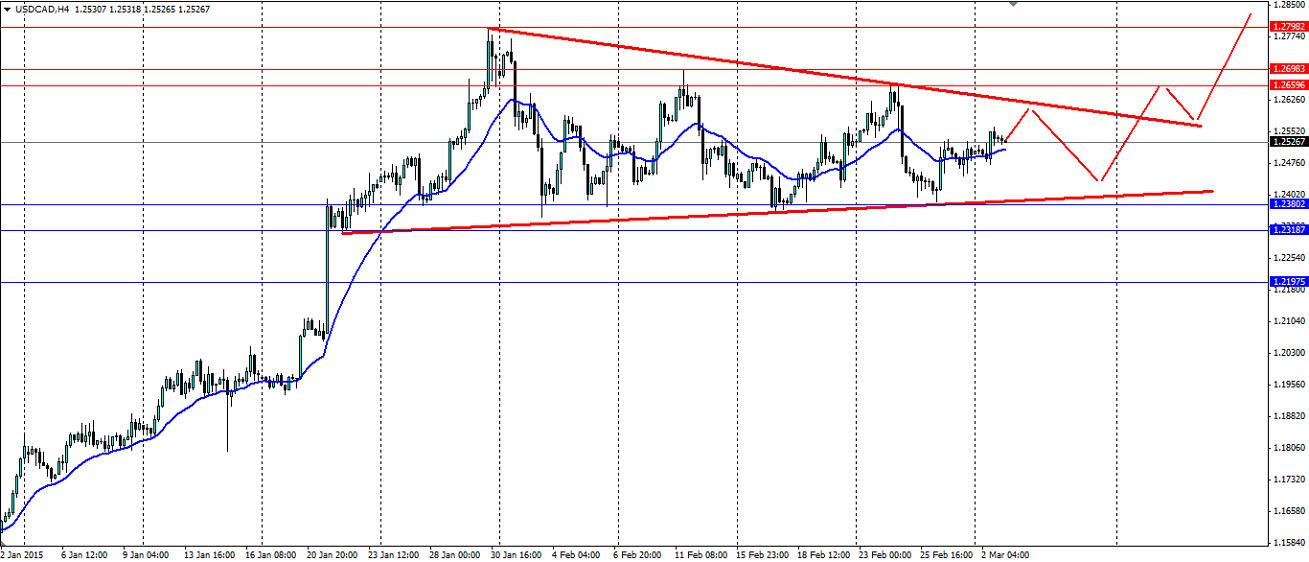

The below H4 chart shows clearly the consolidation seen in the USDCAD pair. Oil seems to have found its new equilibrium price for now and the dollar bulls take a breather. This has kept the pair within the range of the pennant shape. Before we see a breakout, we are likely to have another wave within the shape which trades may look to play. Sell off the dynamic resistance at the top or buy off the dynamic support at the bottom, either way the range play will keep you occupied while the consolidation plays out.

A breakout is likely to be towards the upside given that a pennant is known as a continuation pattern, therefore we are looking for a continuation of the recent bullish trend. For an entry, look for a pull back to the top of the shape which will act as support and will confirm the breakout if it holds. Resistance is likely to be found at 1.1259, 1.2698 and the previous high of 1.2798. Support is likely to be found at 1.2380, 1.2318 and 1.2197.

The USDCAD pair has been consolidating as the market looks for direction from either oil or the US dollar. A breakout to the upside is the likely outcome, but a range play within the shape may keep traders busy in the meantime.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.