Growth remained firm at the end of 2014 but falling energy prices will impact growth and the Canadian dollar in the months to come.

GROWTH EXPECTATIONS:

The latest GDP released late December showed 0.3% monthly growth. This comes on the back of 0.4% in November to end the year on a high after a disappointing result in October (-0.1%). GDP is expected to take a hit early on in 2015 as the plunge in oil prices will be felt by the export sector. Bank of Canada (BoC) Governor Stephen Poloz has said the fall in energy prices will cut 0.3% off 2015 growth, even as the currency weakens. That will see 2015 growth at 2.2% vs the expected 2.5%.

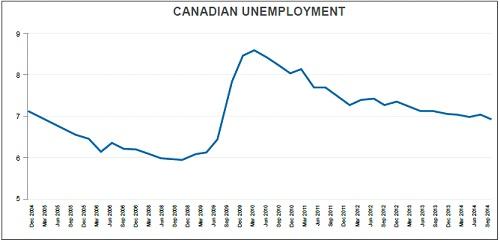

Unemployment has continued to trend in the right direction, falling from 7.0% at the beginning of the quarter to the latest reading of 6.6%. Weaker crude prices may see some layoffs in the energy sector but on the whole, the Canadian job market looks robust.

The Ivey PMI, which surveys businesses to reflect the economy as a whole, has been a mixed bag as usual. During the quarter, it pushed up to 58.6 and quickly fell back to 51.2 only to end at 56.9. The bottom line here is that it remains above 50, which will please Mr Poloz and the BoC.

MONETARY POLICY:

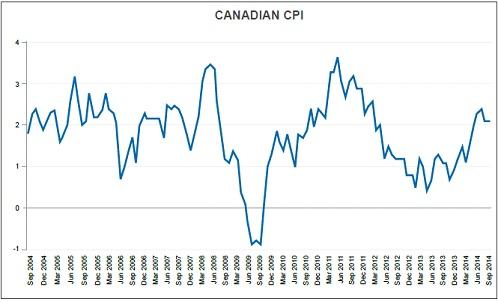

Interest rates were once again held steady at 1.00%, now the 35th time in a row the BoC has kept rates there (at the time of writing). Governor Poloz is happy to remain neutral on interest rates for now as inflation falls along with oil prices. Many Canadians are picking 2015 as the time to raise interest rates and the BoC may follow the lead of the US Federal Reserve if they begin to raise rates.

Inflation has returned to the BoC’s 2.0% target in December after a spike to 2.4% in November. The outlook for inflation is certainly on the downside with lower oil prices. The Bank of Canada will be watching this closely along with the robust housing market, which is adding fuel to inflation.

FISCAL POLICY:

The Canadian government is set to balance the books in 2015 despite the recent fall in crude prices. Prime Minister Stephen Harper said, “You should be under no doubt that the government will balance its budget next year (2015). We are well within that range. Even with dramatically lower oil prices, we will balance the budget.” This will be a good result for Canada and will no doubt add strength to the currency.

FX OUTLOOK:

The calls for intervention in the currency markets has quietened down for now as the falling crude prices has done the job and weakened the Loonie. $1.10 now looks a distant memory as the drastic drop in oil prices sends the Canadian towards the $1.20 level against the US dollar. The longer energy prices stay depressed, the weaker the Canadian dollar will become.

The US Federal Reserve has made no secret about its intentions of raising interest rates in 2015. This will certainly strengthen the USD further against the CAD, however, it may be short lived if the Bank of Canada follows suit. The USD/CAD pair will certainly be one to watch in 2015 from a fundamental perspective.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.