Despite the sharp fall in commodity prices, especially milk, the NZ dollar has remained “unsustainably” high according to the RBNZ.

GROWTH EXPECTATIONS:

GDP figures surprised the markets in this quarter as it lifted to 1.0% q/q, well above the forecasted 0.7%. This came as a surprise to the market, but domestic growth has remained strong in the face of falling export prices. GDP y/y fell to 3.2% (exp 3.3%), which was more in line with what was expected in the long run for the NZ economy.

Commodity prices have continued to tumble, led in part by further drops in milk prices, which showed a drop of 48% in 2014. The ANZ commodity index has also experienced falls for the past quarter, however, these look to be slowing compared to other months. Many are now expecting for milk prices to find a floor and hopefully push higher in the coming quarter.

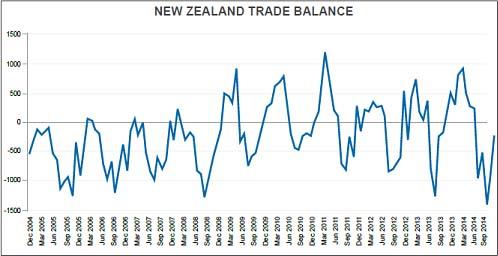

Trade balance data was seen in the last quarter to be worsening with strong falls of -1350M (NZD) and -908M from October to November. This was finally reversed with a stronger return of -213M for December’s release. However, with weak commodity prices, it’s likely that trade balance data will continue to be much weaker compared to previous years’ levels.

Unemployment continued to improve in the previous quarter with the Unemployment Rate dropping to 5.4%. This bodes well for the economy as it is well below the average of 6.27%. However, wage growth has been mixed for the most part, and many economists are surprised that we have not seen a more robust pick up in wage growth.

MONETARY POLICY:

The Reserve Bank of New Zealand is expected to possibly lift interest rates in the coming year, however, they will likely be cautious to do so unless they see a rise in inflation figures for the country as it so far has been weaker than expected (0.3% q/q). This is possible, though as the RBNZ has commented on domestic growth remaining strong and elevated for some time, we could see expectations rise for further interest rate rises.

However, it’s likely they will not be on par with the raises in 2014. The main headache for the RBNZ has been the currency with repeated calls of “unsustainable and unjustifiable” in relation to the currencies present value relative to commodity prices. At present, the RBNZ would like to see the currency drop further and may try to talk it down further, especially as the AUDNZD starts to approach parity and threaten economic exports between NZ’s largest economic trading partner.

FISCAL POLICY:

The New Zealand government and treasury had forecast a surplus for the year 2014, however, with the large drop in commodity prices in the primary sector, it managed to miss a surplus altogether. Initial forecasts from the treasury now show the government once again walking on a shoestring in the coming year of 2015.

FX OUTLOOK:

The New Zealand dollar has dropped as expected in our previous quarterly report. The months ahead for the start of 2015 look unlikely to be much different if we see weak data on the back of commodity prices. However, there is the possibility of future interest rate rises and it is likely that the market will be pricing this in. So we expect the NZD to remain in the 80-70 range for some time, with a dip lower but certainly not breaking out.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.