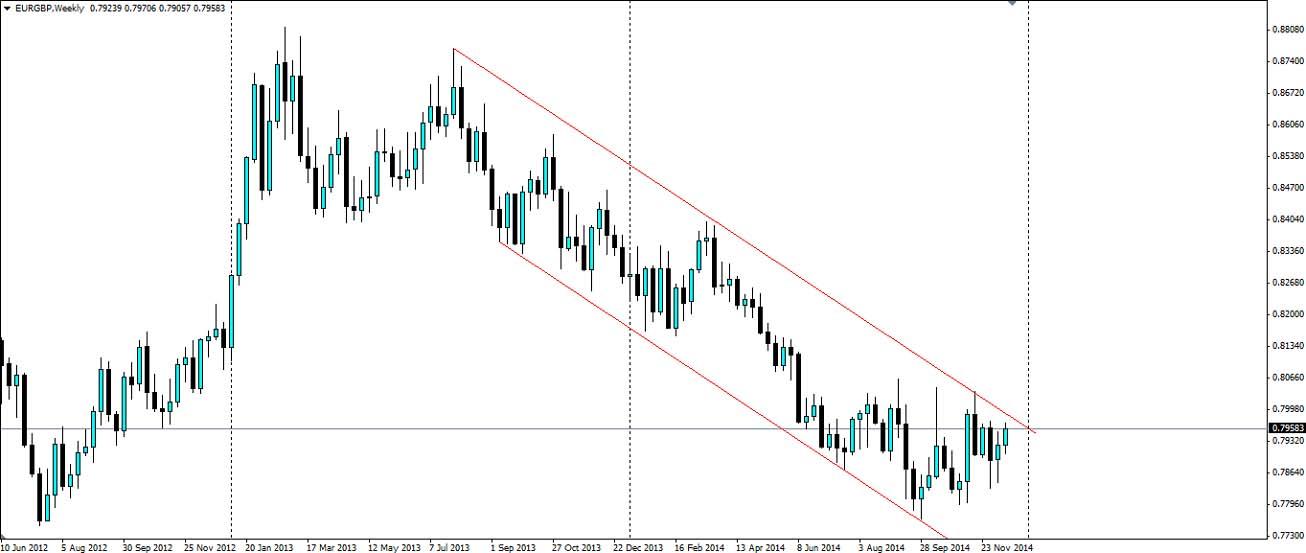

The Euro versus the Pound has been in a bearish channel for over a year and it looks likely to hold if we see another test of the upper level. With a big week ahead for both currencies, this could be an important technical pattern.

The channel on the above EURGBP weekly chart has been tested on numerous occasions and has so far held firm. With growth and inflation rates in the UK at much higher levels than in the EU, it is easy to see why the channel has formed.

The week ahead could certainly increase volatility between the pair and that could lead to a test of the upper level. If fundamentals hold their current state, we will see the channel hold and the Euro weaken against the Pound.

From the Euro’s side of things the Greek general election is the biggest item of note and it takes place on Thursday. The party leading the polls, Syriza, has vowed to end austerity and any co-operation with the EU and IMF lenders. If elected, Greece could end up exiting the Euro which could start a chain reaction. The Euro could certainly take a dive on the election results.

Before the election, Manufacturing and Services PMI results will be released for France, Germany and the Euro. The ZEW institute will also release their German Economic Sentiment report, which could shift the Euro.

The UK has a plethora of economic data out this week. Later on today the Bank of England will release its Financial Stability Report along with the results of the bank stress test. Shortly after UK inflation figures will be released and could see the pound tumble if CPI is less than the 1.2% the market expects.

Wednesday will see the Unemployment rate and the Monetary Policy committee voting breakdown, which will give an indication of the stance of each board member. We also have Retail Sales figures to round out the week.

The EURGBP pair has found a bit of resistance at the present level after a touch off the 200 day moving average. If volatility increases as expected, look for the upper level of the channel to act as solid dynamic resistance. If the price breaks out, it will find resistance at 0.79958, 0.8033 and 0.8083. If the channel holds as expected, price will look to find support at 0.7909, 0.7851 and 0.7800.

The EURGBP pair is currently in a bearish channel. With a big week of news ahead for both currencies, volatility will increase, but the channel is likely to hold firm, sending the pair lower.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.