I love the silver market. If you read my articles you can understand why, because when it comes to the technical side of things it loves to play along and has done so for some time.

In the current period silver has been going through a strong technical pattern of consolidation. This has been after a steep down trend over the previous months, where a lot of metal traders took full advantage of the situation. The reason for this down trend was the appreciation of the USD and the outlook remaining positive for the US economy – nothing keeps the speculators further away than a booming economy for a change.

With a ceiling at 17.55 and a floor at 17.07, the markets will be eyeing up the possibility of a fall below the 17.07 level, a solid bearish candle below this level could bring the bears back into the market to swipe down silver once more. This is not something that is unreasonable either when you think about it, despite some recent US woes the labour market and consumer sentiment is still very strong. The prospect of rates is ever more increasing as a result.

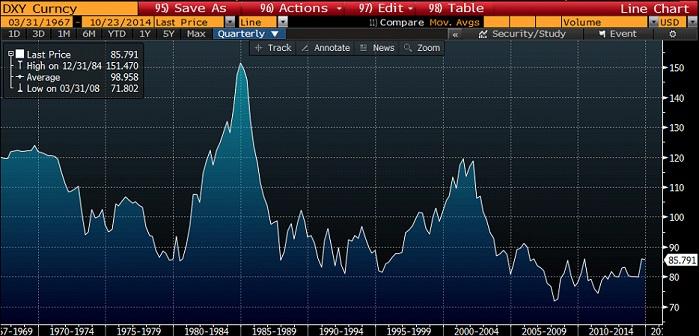

To put it in an even better perspective long term; we have seen the dollar index well below its average against other trade weighted indexes. This is unlikely to remain the same in the long term as other currencies look to devalue themselves in an effort to stimulate their economies. In the long term metals will likely fall against the US dollar as a result.

Overall, silver in the long term looks likely it will drop further and it is just a matter of time. In regards to justification, I look fundamentally to the US dollar strengthening and demand for precious metals tapering off further. From a technical point of view we have seen silver consolidate a few times before a large drop, and this looks no different.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.