There is plenty of data out for the Australian dollar this week and we are likely to see the volatility ramp up. A dovish RBA could come head to head with positive Chinese data and put pressure on the ranging pattern on the AUDUSD charts.

Minutes from the most recent Reserve Bank of Australia meeting showed a concern about global growth, especially Europe, Japan and China. The RBA said that continuing its accommodative monetary policy stance will help support demand and strengthen growth over time. There are no real surprises here for the market and hence a rather muted response to it.

Shortly after we saw Chinese GDP and industrial production figures released that came in better than expected. GDP y/y was expected to fall from 7.5% to 7.2%, however, managed to beat the forecast at 7.3%. Similarly, Quarterly GDP figures fell less than expected to 1.9%. Industrial production was much stronger at 8.0% vs 7.5% expected, up from 6.9%. Australia relies heavily on China for export income, so it’s no surprise to see the AUD react positively to the strong data.

Tomorrow the CB leading and MI leading indexes will be released and give the market a snapshot of the current state of Australia’s economy. Not long after the market will be watching Australia’s CPI figures with keen interest. Quarterly inflation has been falling somewhat with last quarter’s CPI at 0.5% q/q. We could see this come in a bit stronger this month as the Australian dollar has fallen considerably in the previous two months, inflating import prices. A positive result would be bullish for the AUD.

Thursday will see a speech from RBA governor Glenn Stevens. The market will take note of the tone he uses to get an indication on his position on the dollar. He likes to talk the dollar down and he could reiterate the stance that the accommodative monetary policy is likely to remain for some time.

Also on Thursday we will see HSBC release their Chinese Manufacturing PMI. This is generally a big news item for the Aussie Dollar as the majority of Australian coal and iron ore exports go to China. If the Chinese manufacturing sector is strong, the Aussie will benefit. The PMI has been hovering just above 50 for a few months and is expected to remain there or thereabouts. Anything sharply differing from market expectations will have a big effect on the Aussie.

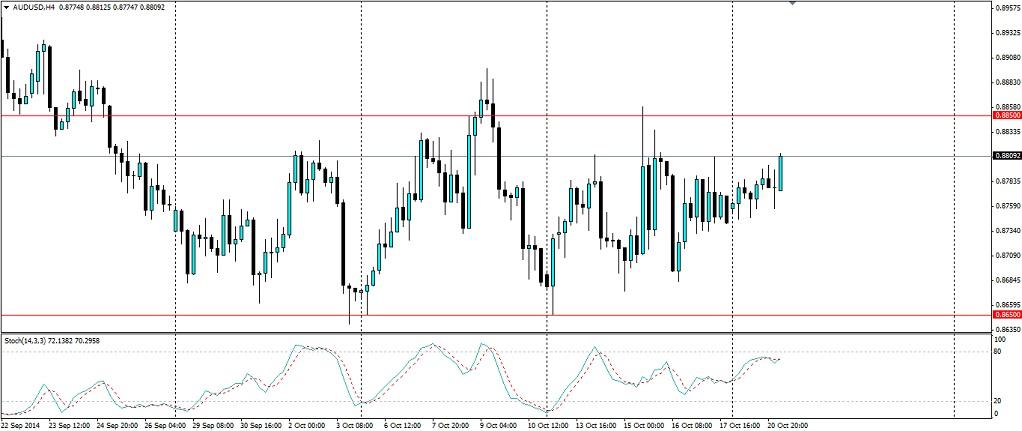

The AUDUSD pair is currently in a ranging pattern between 0.8650 and 0.8850. The data out this week will certainly give it direction, but we may just see rejections off the limits of the range. The stochastic oscillator is certainly not much help, but it is showing more of a bullish bias as the price drifts towards the upper limit.

As volatility globally subsides, look for the range to hold unless we see some very strong Chinese data or a marked change in the tone from RBA Governor Stevens.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.