Market movements overnight were extreme; with the VIX hitting a 3 year high as the market panicked on recent data about the future prospect of rate rises in the US, and the slowdown of global growth in major economic zones such as Europe and Asia.

The volatility has been immense and the markets overnight were impressive, scary, and downright intimidating for traders. Massive moves were a result of the recent downgrade in future prospects and the USDJPY, NZDUSD and all equity indexes moved sharply as money rushed to find returns and safety globally.

Safety and something tangible is what the market seems to hunger for when stuck in an extreme situation. We’ve seen that with gold time and time again, sudden rises in the precious metal as investors rush into it. But gold got stuck as well. In fact, I was surprised how small the movement was given the panic in equity markets.

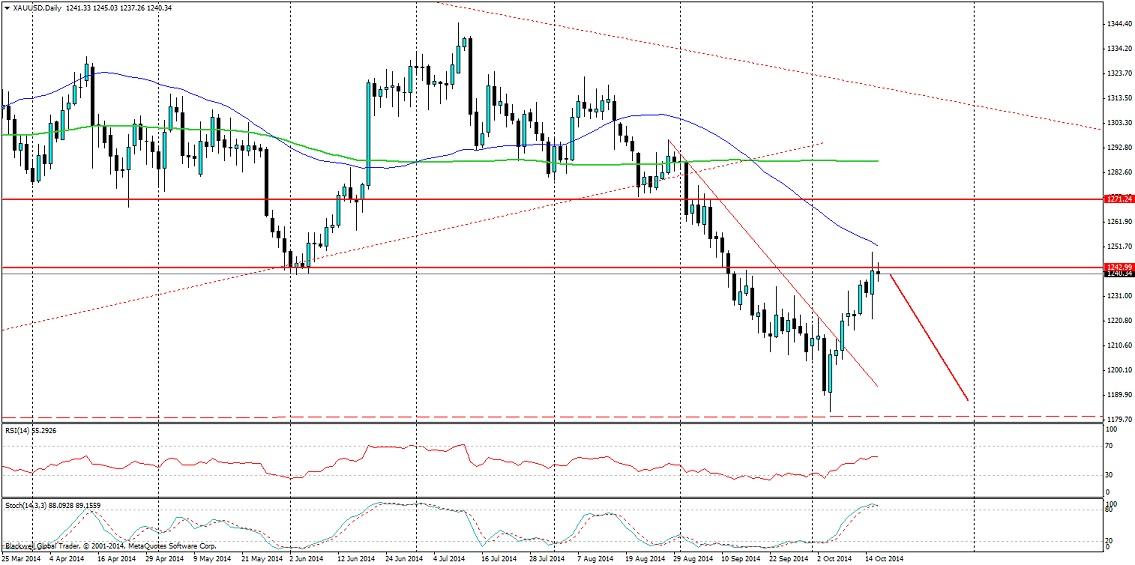

In fact gold went and hit the resistance level at 1241.00. This was a very strong resistance level in the market and it was not surprising, but past movements with gold and less volatility have seen larger movements which have smashed out resistance levels easily. So you can understand my apprehension to start longing gold in the market.

I think it’s even possible that we might see gold pull back from the resistance level in the market at present. In order for this to happen, we may need to see more bearish candles on the chart. Rushing in now would be foolish and I would look to see a solid bearish candle pushing lower and joining in via some momentum trade. Also the time window may very well be in the short term, but I feel that a movement lower, especially with some positive data, could cause a big swing lower.

Gold may well move a bit higher, but after last night’s result it was much less than anyone expected. I feel that markets may be tired of gold overall, and that there could be a swing lower if we see a solid bearish candle. Tonight will certainly give us the picture we are looking for when trading this precious metal.

Recommended Content

Editors’ Picks

GBP/USD remains on the defensive below 1.2450 ahead of UK Retail Sales data

GBP/USD remains on the defensive near 1.2430 during the early Asian session on Friday. The downtick of the major pair is backed by the stronger US Dollar as the strong US economic data and hawkish remarks from the Fed officials have triggered the speculation that the US central bank will delay interest rate cuts to September.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.