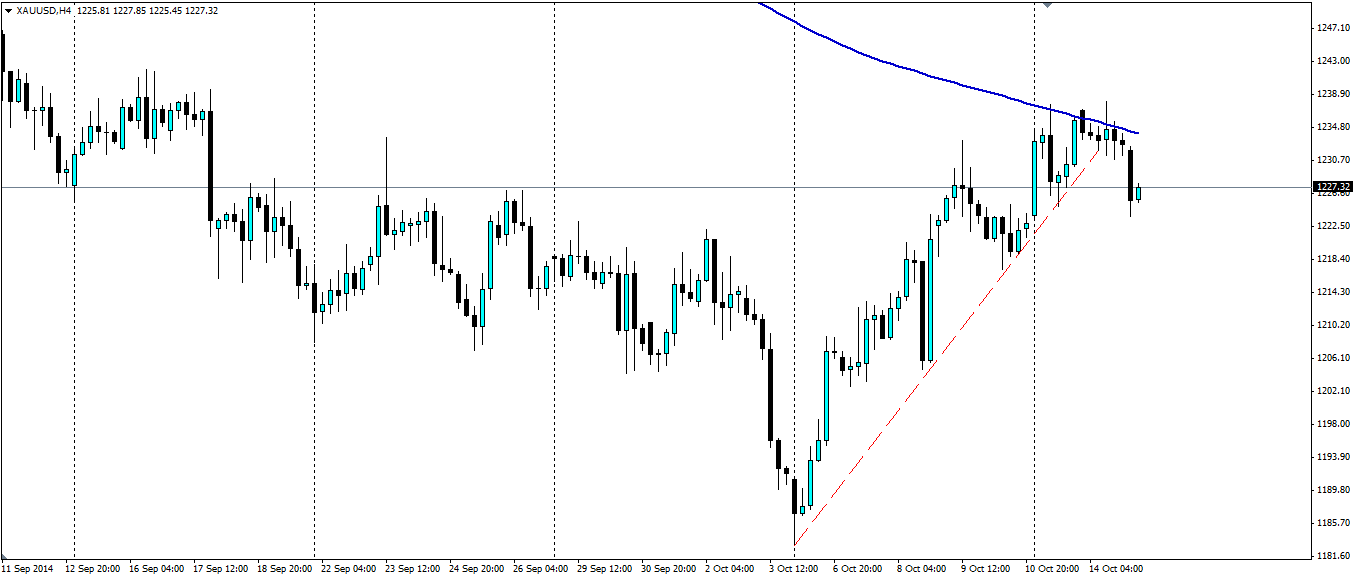

Gold markets have enjoyed the volatility that has punished the equity markets. The mini bullish run may be coming to an end as gold looks to have found resistance at the 200 MA on the H4 charts.

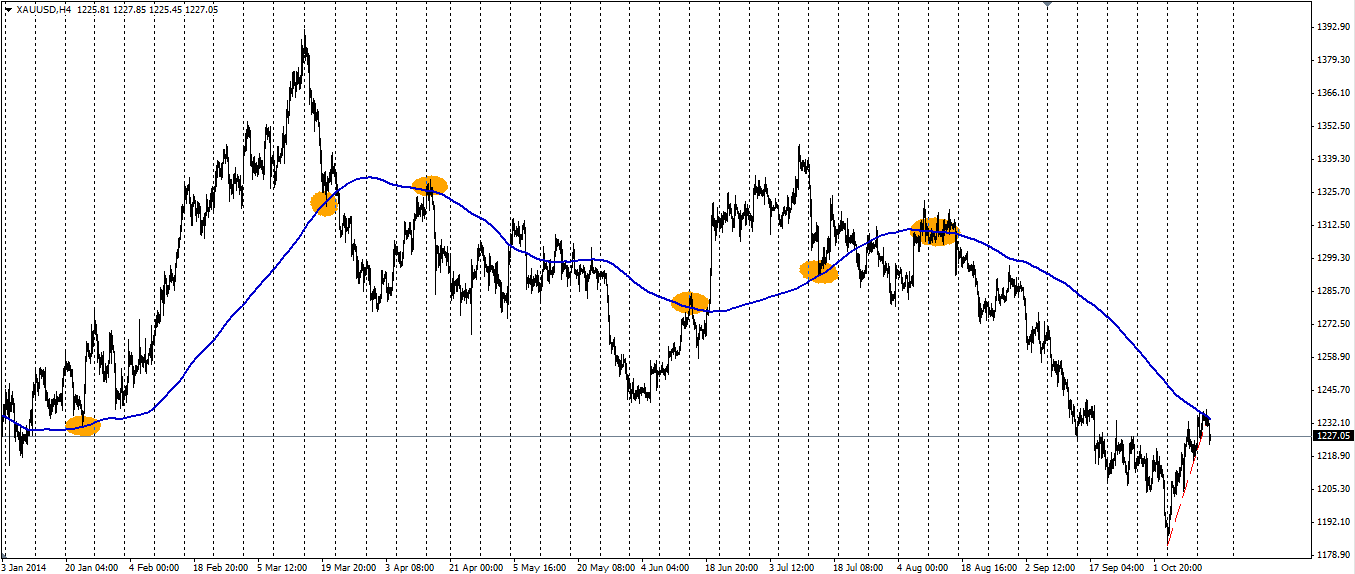

The short term bullish trend looks to have already been invalidated, suggesting the resistance at the 200 MA is strong. From here we could see a bearish reversal that could test the recent lows at $1182.94. This is certainly not the first time the 200 MA on the H4 chart has been used as a pivot point. The chart below illustrates over the course of this year.

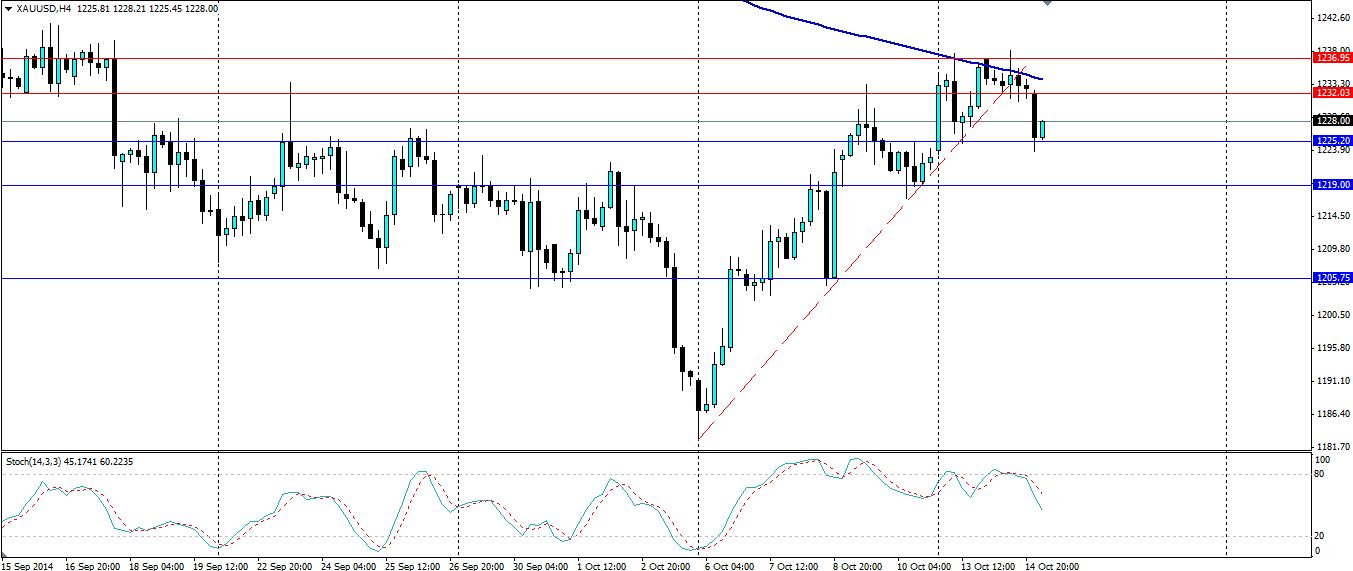

The Stochastic is beginning to look very bearish as the price pulls back from the touch of the 200 MA. Any bearish movements from here will look to find support at 1225.20, 1219.00 and 1205.72 before looking for the recent low at 1182.94. We may see a pull back and another test of the dynamic resistance at the 200 MA or the fixed resistance at 1232.03 and 1236.95.

Gold will have an interesting time over the rest of this week as equities begin to look very bearish. Look for US employment to remain strong, which will be bearish for gold, however, Janet Yellen is due to speak on Friday and could send investors back into gold if she says anything dovish.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'