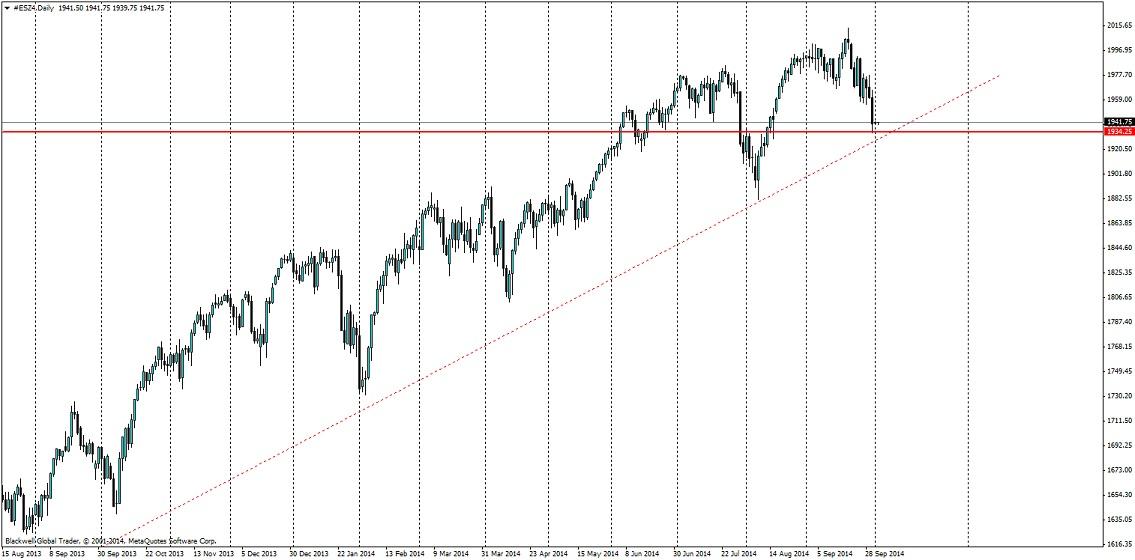

The S&P 500 has broken down lower overnight, after it formed a descending wedge.

The S&P 500 has had a strong talking point after pushing through the 2000 levels on the charts, with many predicting further bullish rises. The doomsayers have had a good crack at talking down the prospect of further rises in the S&P 500 and they may be right in this case after the recent solid breakdown of the bearish wedge.

However, with the S&P 500 you’ve got to take a look at the bigger picture and in this case there certainly is one on the daily/weekly charts. Which shows that there have been minor corrects each time on the charts.

The above chart shows the extent of these minor down trends, each one has been followed by a push back up higher. Something that many people should focus on when trading the S&p 500; where a down trend is not the bearish markets that people are looking for.

Instead, people should focus on the above trend line as an initial guide for further lows. It may not go this low or it might break through, even though a bear market would be some time away as there is plenty of space to go on further long term trend lines. For now though be aware that the US is recovering and there is still potential upside in the S&P 500.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.