The Oil markets have been in a fairly steep downturn in the past few months as more supply keeps coming into the markets. What most people would have heard is the big story about fracking and how it has turned the United States into a net exporter for the first time in over 20 years (though exports are banned at present for crude oil). Despite this the US is becoming a major supplier of oil - rather than a consumer; we’ve also seen a large number of countries turn the taps on.

The world has been very volatile for a number of years, and the middle east is no exception to this rule. The Arab Spring created new opportunities for a handful of nations, however, it also led to large scale destruction in places like Libya. Which is now starting to supply more and more oil in order to prop up its economy, and start rebuilding. Couple this in with Iran, Iraq and Russia – all of which can’t slow down oil production as they try and keep up their own economies, and suddenly you end up with a world flooded with oil.

So far, OPEC has taken notice of this decline in the price of oil, and a price under $100 a barrel is not ideal for the OPEC nations. Saudi Arabia in particular has taken large steps to cut supply from its own well by 408,000 a day, with more cuts likely on the horizon in an effort to stabilise oil markets.

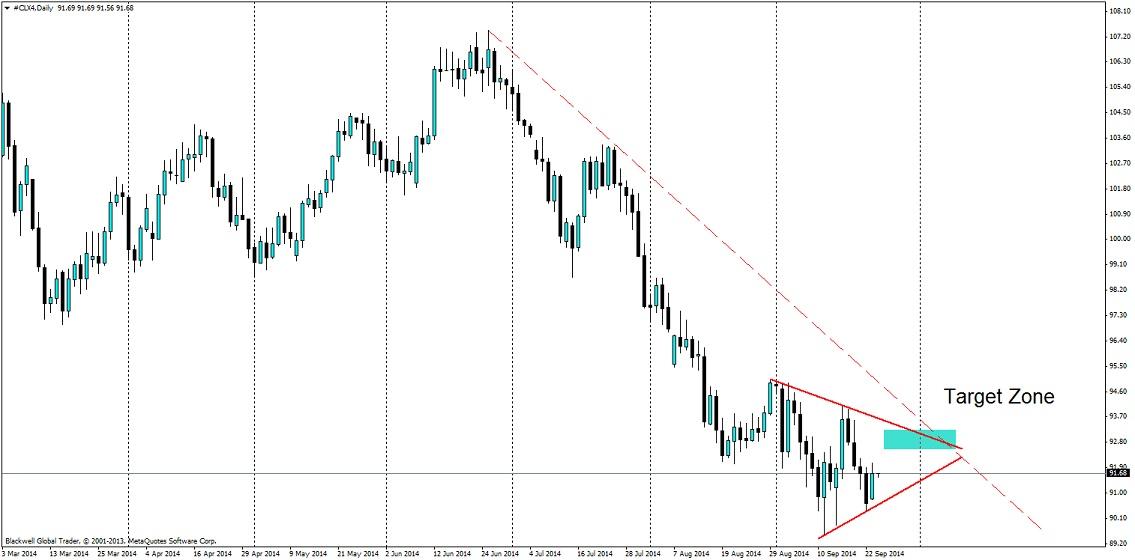

Oil markets on the charts are currently stuck in a pennant pattern as it starts to converge on pressure from oil producers trying to keep it in the 90 range. If you’re looking to trade oil then you have three viable options at present before the week is out.

Firstly, a push upwards to the pennant top level, which is likely given the volatility of oil and how aggressive suppliers are trying to be in the market when it comes to increasing prices. This could be helped further by the crude oil inventories data release, which is due out shortly. I don’t see it pushing through in the current market just yet, but it may have a crack if there is a deficit in the inventories.

Secondly, looking to play it lower off the top of the pennant pattern if it pushes up. This is a viable option, as I have previously stated more needs to be done in oil markets if we are to see any push back up in the price. Especially with all that supply in the market at present. I would look to catch momentum back down, aiming for the 92 dollar level.

Thirdly, the target zone. This is the key area I feel for oil, and where the volatility could certainly take off. At present we have the tightening of the pennant pattern coupled with the combination of the downward sloping trend line. We have two likely scenarios of either a breakout higher, or a strong break down lower. Either of these moves will likely be a big movement.

A side note worth mentioning and strengthening the case for a drop down is the current oil futures curve, which currently shows a long term trend for weakening prices in the market.

Oil has been looking very volatile, but there is something to be made out of volatility and going forward over the next few days and weeks we could see some big moves and possible breakouts.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.