The Bank of England holding interest rates at 0.5% and the European Central Bank lowering theirs has helped the FTSE100 index break through resistance. But a fairly ominous looking rejection and double top could point to a wave back down.

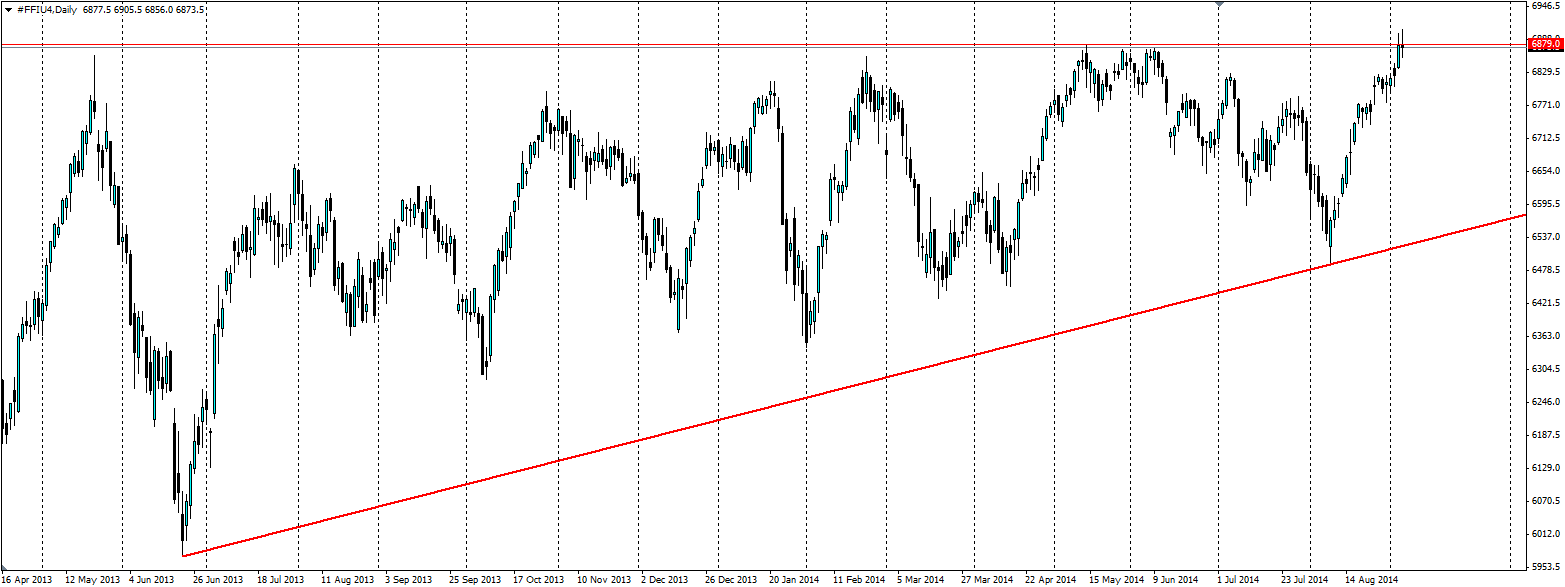

One of the most obvious features of the FTSE100 daily chart over the last 15 months is the wave pattern that has seen momentum swing between bullish and bearish in long and reasonably predictable waves, all the while respecting the resistance at 6879.0 and the bullish trend line. So it is a little surprising to see the FTSE break out of the resistance and hit a 14 year high. But then again, given the circumstances, maybe it’s not so surprising.

The ECB surprised the market by reducing interest rates by a further 10 basis points and implementing a programme of buying asset backed securities from the private sector. Secondly we saw the Bank of England once again keep interest rates on hold at their historic low of 0.50%. Both of these monetary policy decisions provide a boost for equities as they make the yields on stocks relatively more attractive.

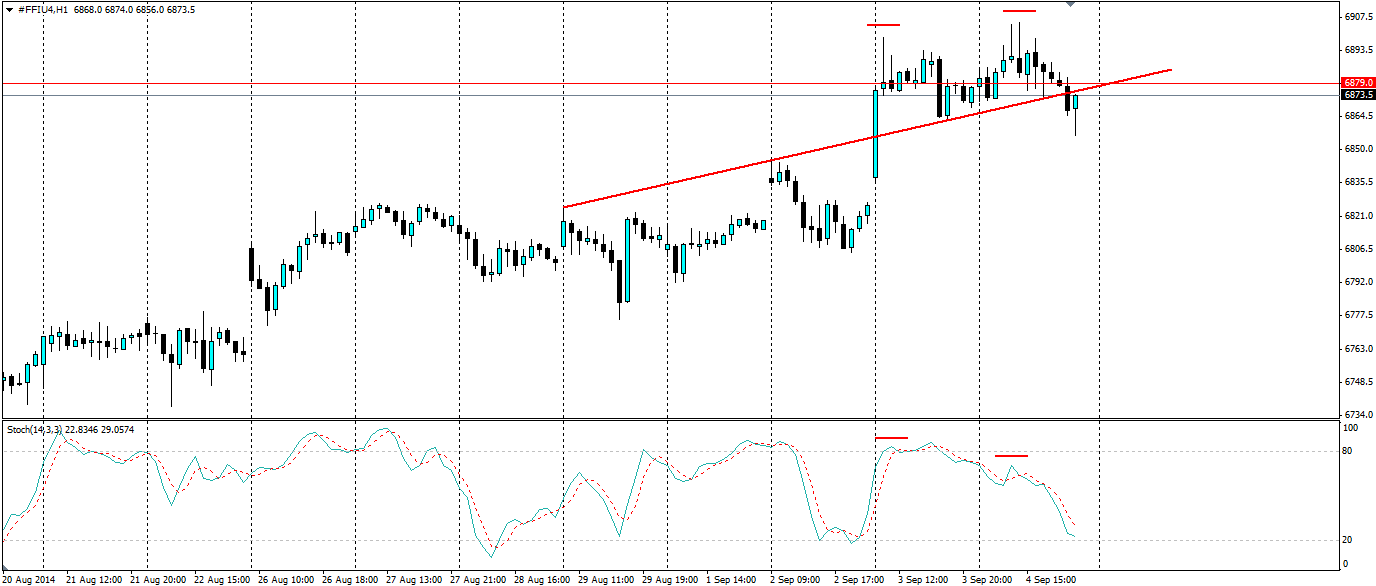

Looking at the daily we can see an ominous looking rejection sending the price back below the resistance. On the shorter timeframe (hourly) chart we can see a fairly interesting looking double top pattern forming. This neckline is slanted and correlate with previous levels of resistance. The price has moved back below the neck line and may look to use this as resistance before a final rejection off and a movement lower.

The Stochastic oscillator is certainly looking bearish on the H1 chart. In fact we can see a bit of divergence where the tops of the double top are concerned. The price has posted a higher high on the second top, however the Stoch has not. This is a bearish indicator and it will be interesting to see how the FTSE behaves today, particularly with US Nonfarm Payroll data due out later.

The FTSE has broken a 14 year high on the monetary policy decisions of the Bank of England and the European Central Bank. A double top could point to a short lived high and a reversal of the current trend.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.