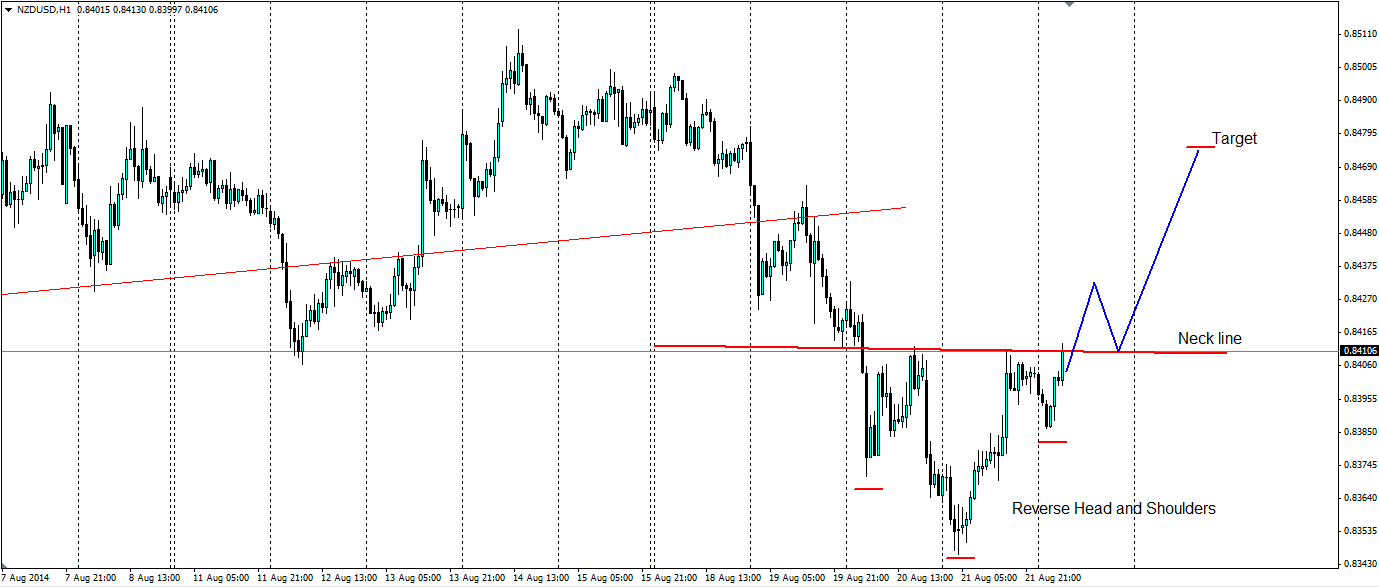

A reverse head and shoulders pattern has all but formed on the NZDUSD chart that could signal an end to the long and arduous bearish slide the kiwi has suffered over the last month and a half.

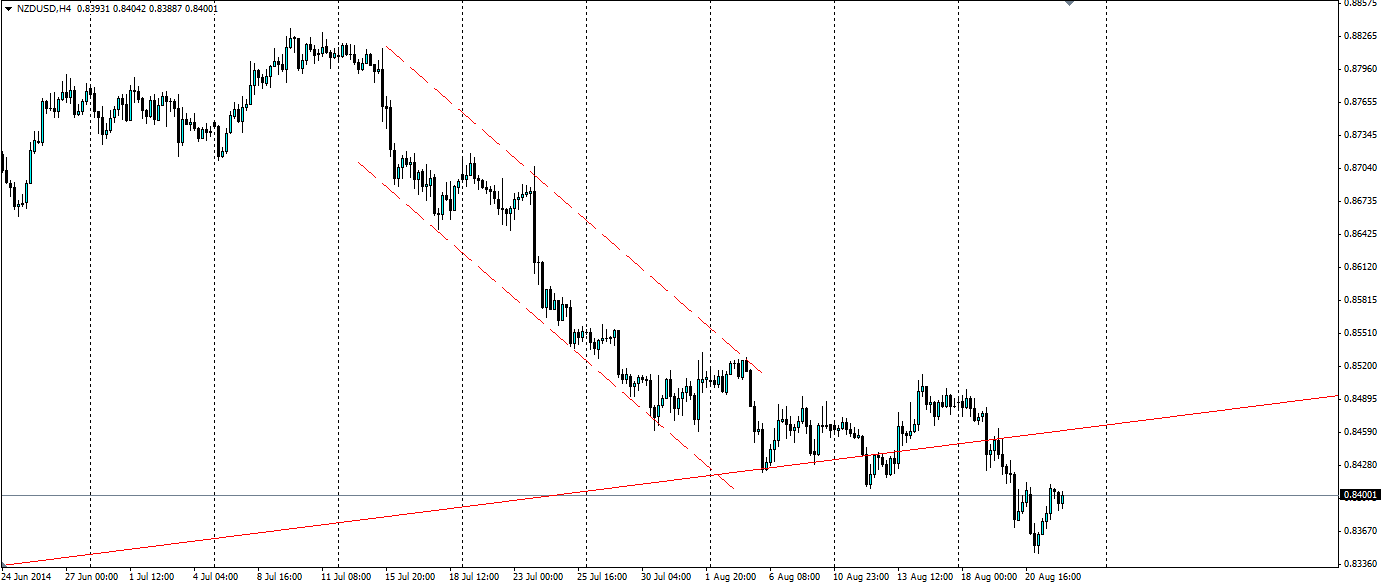

It’s been a tough six weeks for the Kiwi dollar. The primary reason is that the Reserve Bank of New Zealand (RBNZ) has taken a break from raising interest rates amid some disappointing economic data and the markets have punished the NZD, taking over 400 pips off its value against the US Dollar. The markets had been anticipating interest rates to hit 4.50% by mid next year from 2.50% at the beginning of 2014. The loss of potential return has seen a flight of capital, however, the NZD still makes a good carry trade with interest rates currently at 3.50%.

We do not need to look far to find the disappointing data mentioned above. The New Zealand economy relies heavily on exports of dairy products and these have been fetching disappointing returns as of late. The global dairy index has slid over 40% since February, wiping billions of dollars off the value of New Zealand’s exports. Furthermore inflation expectations were downgraded from 2.4% to 2.2% as the RBNZ released the results of a survey.

The silver lining for the Kiwi is that it is still an attractive carry trade with interest rates at 3.50% and unlikely to be reduced unless things take a drastic turn for the worse. Contrast this will the major central banks around the world and it becomes clear just how much the Kiwi is returning. The US interest rate is <0.25%, the Euro is 0.15%, the Swiss is 0.0% and Japan is 0.10%. This carry trade could explain why the Kiwi may be about to reverse its downward slide with a reverse head and shoulders pattern.

The above chart shows the potential reverse head and shoulders pattern forming. The ideal outcome (in blue) will be for the price to break through the neck line and come back to test it, using it as support before a larger movement up towards the target. The target for the movement is 65 pips above the neck line. This is our target because the ‘head’ of the structure is 65 pips below the neck line.

Traders looking to take advantage of this formation must wait for the neck line to be breached and for the price to pull back to it. If the neck line, acting as support, holds then it will be game on and we should see a big movement off it towards the target at 0.8475. Be wary of previous levels of resistance at 0.8438 and 0.8463 as these may hold up the price. Ensure a stop loss is set below the neck line in case the market has other ideas about this structure.

The NZDUSD pair looks to be forming a head and shoulders pattern that could see a reversal of the recent bearish trend the kiwi has been following recently. If it forms, it could prove lucrative for anyone bullish on the Kiwi.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.