The oil markets are interesting to watch at present given the global circumstances, and the threat of war on a day to day basis between Russia and the Ukraine. You would think, or perhaps even safely assume, that it would in turn lead to a rise in oil prices globally. That has not happened at all, in fact, we have even seen a decrease in the markets.

The reason for this is not a lack of demand, which some may attribute a drop to, but instead the fact that oil markets are awash with oil at present. Despite the global crisis and conflicts many war torn nations like Libya are turning on the taps in an effort to prop up their economy. Coupled with fracking it is helping to turn the oil shortage from 5 years ago into the oil surplus which in effect will drive prices down.

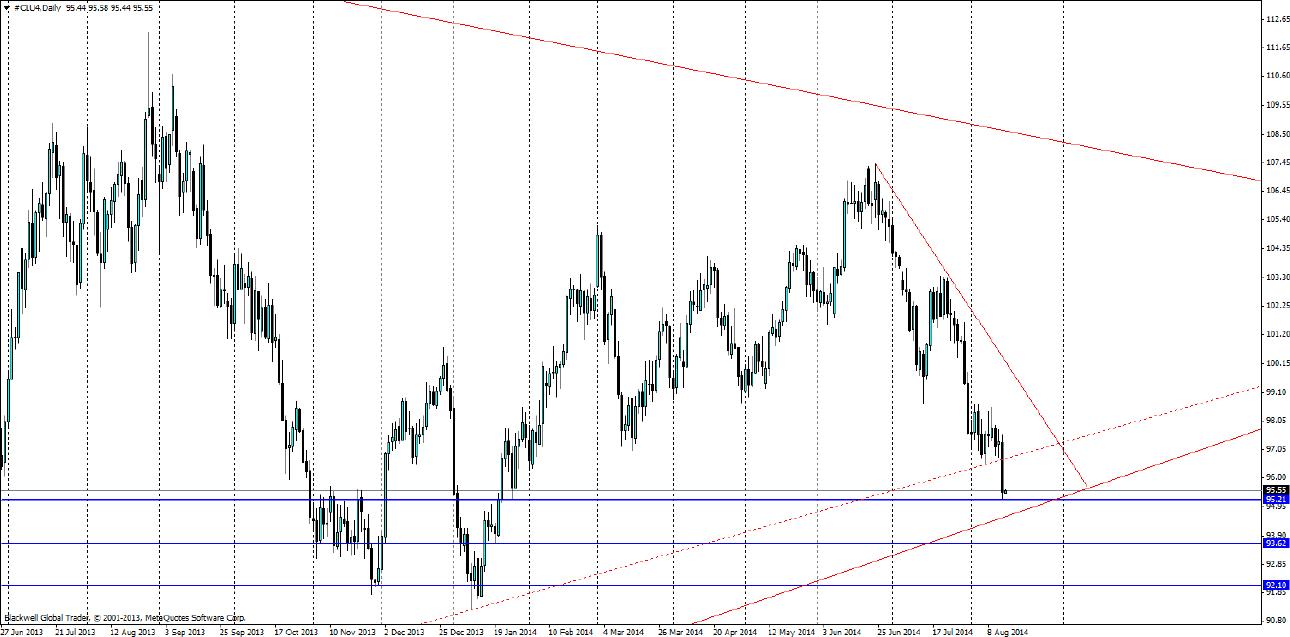

What this looks like on the markets is something quite interesting.

At present the oil markets are plunging lower and when we look at the charts, it looks like a steep bearish trend that might hang around for the short term at least. What is interesting to notice is the attitude of the bears in the market. The second that there is a sniff of breaking through support levels the market plunges strongly. A good sign of a bearish market.

After yesterday’s massive drop, we have a broken trend line from previous touches. So markets will now be focused on the new support levels in play. Currently we can find support at 95.21, 93.62 and 92.10; with 95.21 the support line which stopped the market overnight. This will hold in the short term I feel, but the bears are at work and the fundamentals are backing them up.

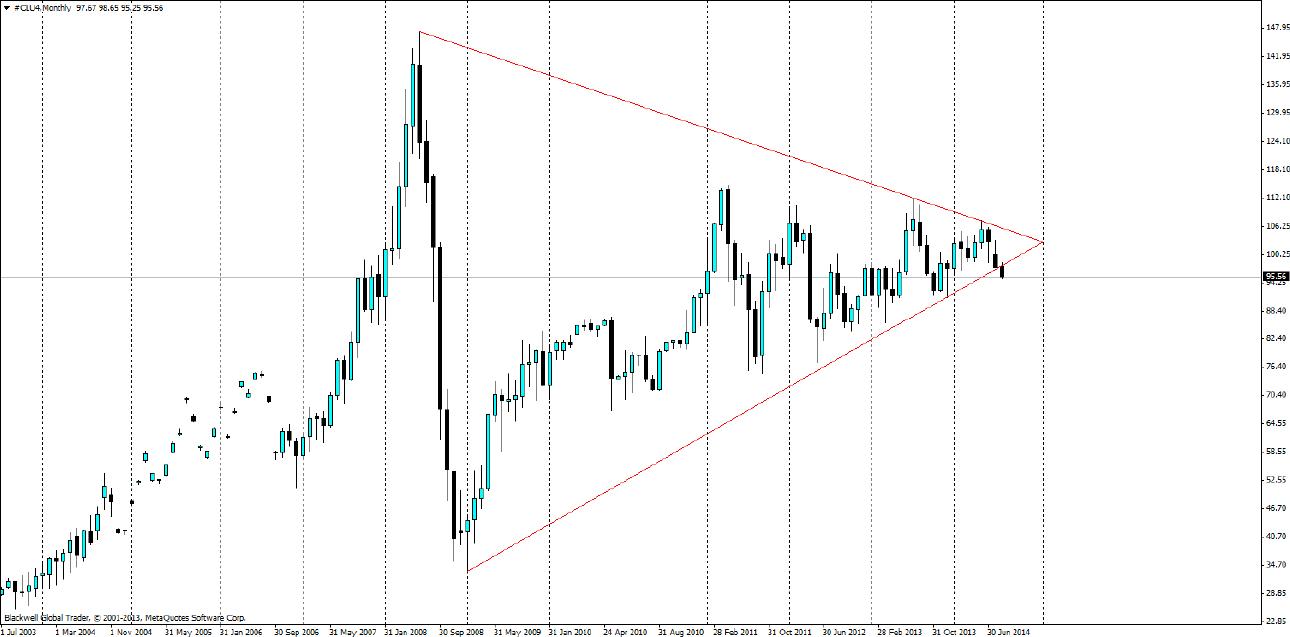

When we switch over to the monthly chart, we see that the pennant pattern which has come together has now dipped and is looking to shift lower, a strong bearish candle closing would signal to the markets that the bears are in control and only long term support levels can stem the tide as oil prices drop.

So with fundamentals pointing to a decrease in the price of oil (as seen in the chart above), and markets now sliding over the technical cliff, we could soon see oil return to $80 dollars a barrel. Certainly this would put pressure on supply, and we could see some pullback out of the market, but it could take some time for those sorts of changes come through. And most certainly renewable technology investment is breathing down the neck of oil markets as well further adding pressure. Long term, oil is going to stay with us for some time, at what price though many are unsure. But for now prices are looking south as a result of the massive shifts in supply.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.