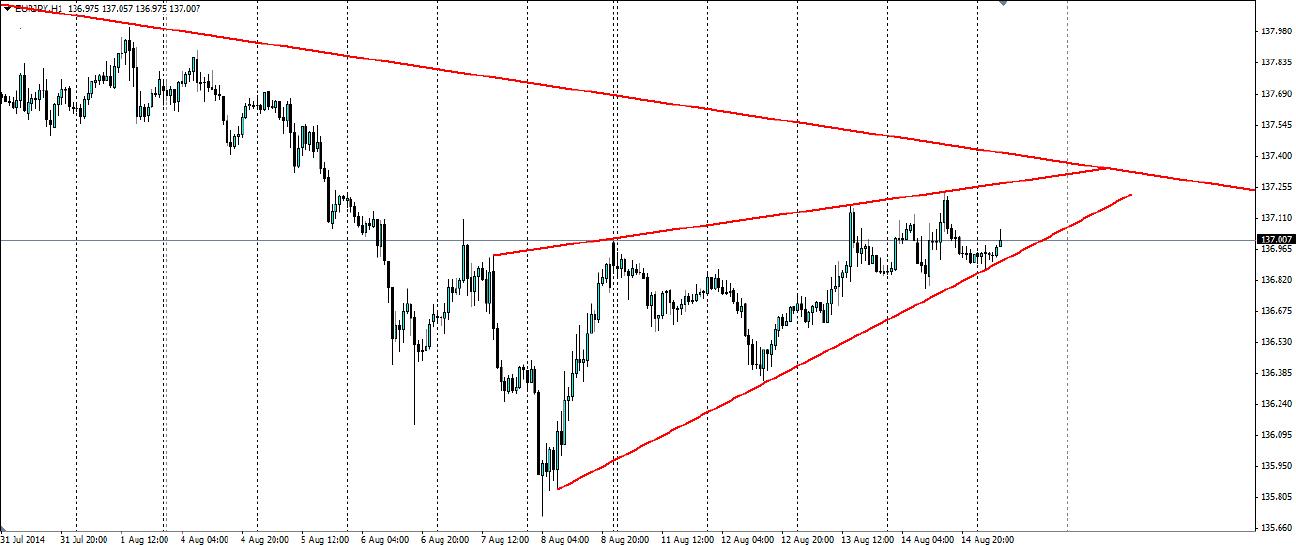

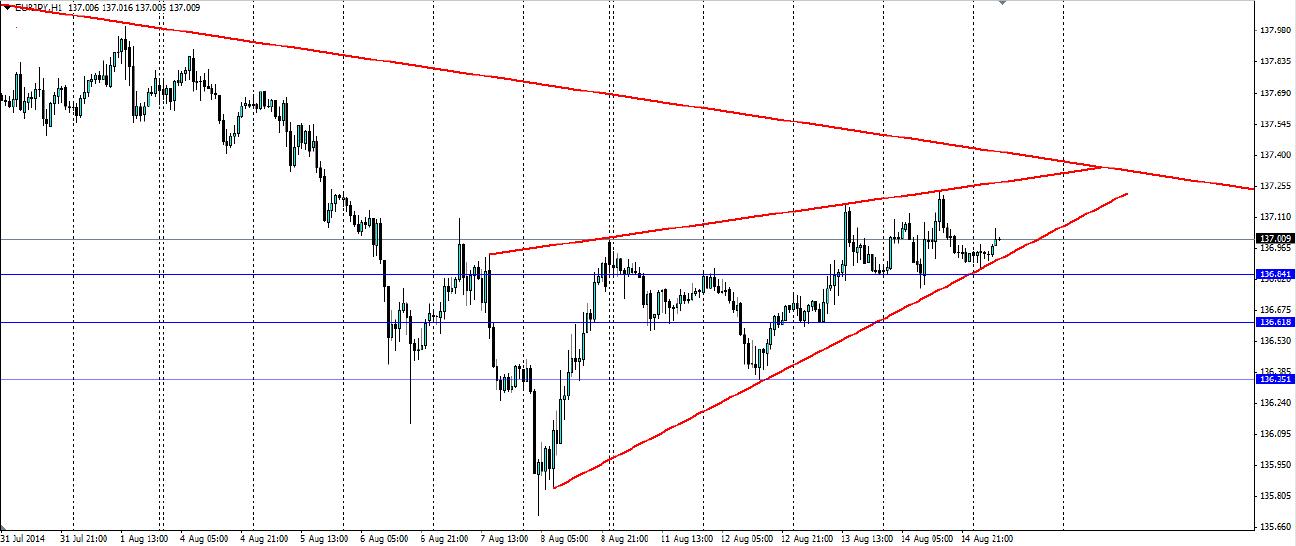

The EURJPY pair is forming an upward sloping wedge as it heads towards the upper level of a bearish trend. A breakout could be to the downside, taking the Euro passed the recent nine month low.

The Euro Yen pair is an interesting one to watch as they battle for prize of ultimate central bank. At this stage the Bank of Japan (BoJ) seems to be winning as Japan comes out of decades of deflation. The European Central Bank (ECB) hasn’t taken such an aggressive approach, opting more for talking the currency down and acting only when absolutely necessary. The result is that the yen is looking more robust as Japan recovers and the Euro continues to weaken as more stimulus is likely.

The leaves the EURJPY pair in a downward channel and the price looks set to touch the upper channel and bounce off it lower. This will coincide nicely with the point of the upward sloping wedge that has been forming on the H1 chart below.

There is little news out for either the Yen or the Euro over the next 24 hours so we should see technicals take over and the price to continue to consolidate. It would pay to catch the momentum down only once a breakout has been confirmed. It would also pay to keep an eye on key technical levels as they may stall to downward momentum. These can be found at 136.84, 136.62 and 136.35.

The EURJPY pair is looking to continue consolidating in a upward sloping wedge before it comes in contact with the upper level of a bearish channel. This could provide a decent breakout to the downside.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.