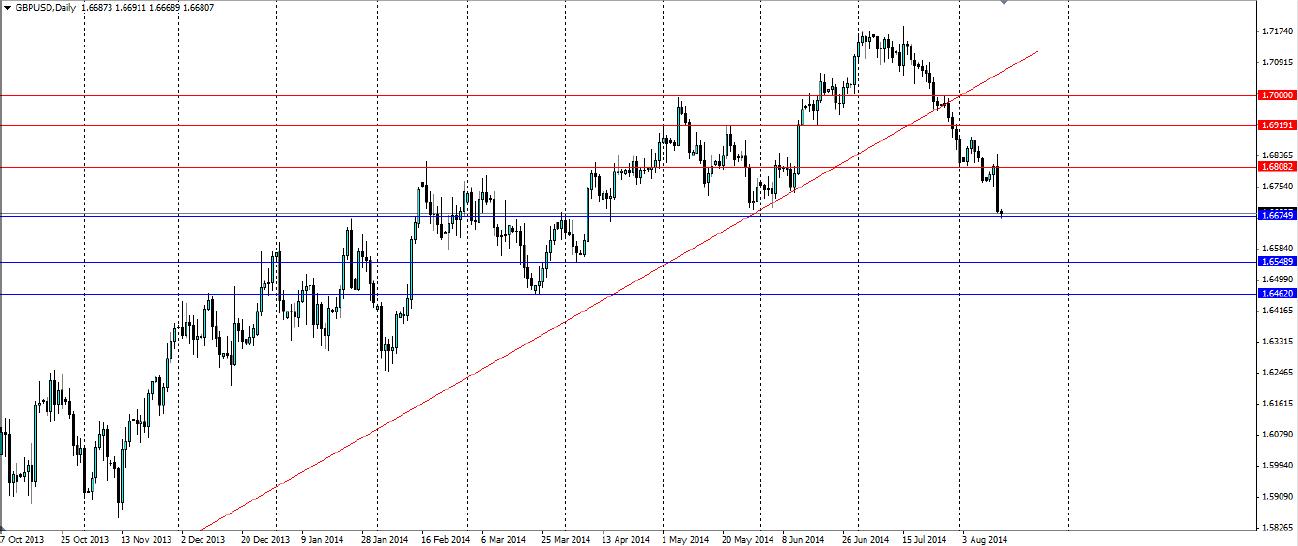

The GBPUSD pair took a massive hit yesterday when the Bank of England downgraded wage growth forecasts. Is this the signal the Sterling bears had been hoping for? Or is this an opportunity for the bulls to regroup?

The headline figure from the Band of England inflation report yesterday was that the BoE has halved its wage growth forecast. It now expects wages to rise at just 1.25% this year. Wages have slowed to their slowest rate since 2001 (when records began) at just 0.6%. The bank also said it will put more weight on wages in its assessment of spare capacity in the labour market.

The market took this as an indication that predictions of an interest rate rise later this year or early next year were too optimistic. Essentially, it was a very bearish signal for the market and the Pound Sterling was punished accordingly. The news was not all bad though. If we look a little closer there are actually some reasons to be optimistic and could bring the bulls back into the market.

What did not make the headlines was that the Bank of England upgraded their estimate for economic growth this year from 3.4% to 3.5% and its 2015 forecast was lifted from 2.9% to 3.0%. Furthermore the BoE believed the amount of spare capacity in the economy narrowed to 1.0% from 1-1.5%. This should give anyone bullish on the sterling cause to hope that these good figures will eventually feed through to wage and CPI inflation.

We cannot overlook the good result for unemployment also released yesterday. The headline rate fell from 6.5% to 6.4% and the claimant count fell by -33,600 vs an estimated fall of -30,000. Adding more optimism was the fact that the BoE’s medium-term equilibrium rate of unemployment was reduced to 5.5% from 6.5%. Logic would suggest that in an improving labour market, wages will eventually feel upward pressure. This may not materialise for some time, butit will give the bulls some encouragement.

It will pay to keep an eye on the preliminary GDP data that is due out tomorrow. This is expected to show the UK economy grew at 0.8% in the second quarter of this year. Anything to the upside of this will no doubt bring the bulls back into the market.

The fall in the pound yesterday was justified as the outlook for interest rates became a little bleaker. Looking further into we see there are reasons to remain optimistic about the future of the pound and the bullish sentiment is sure to return.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.