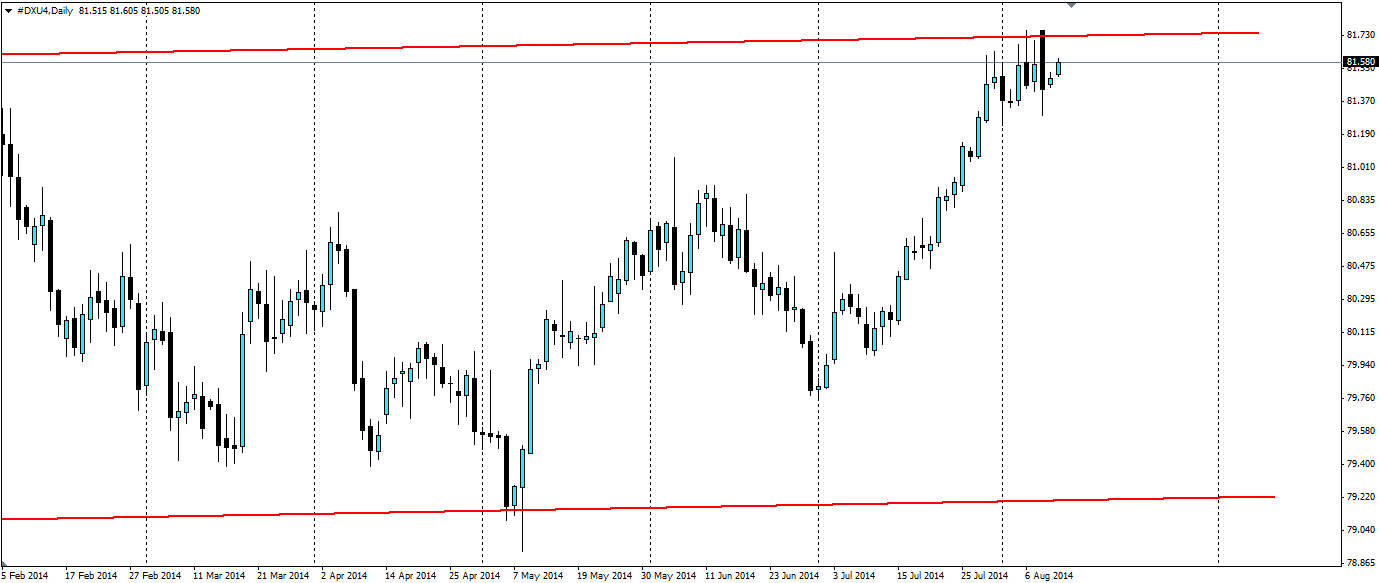

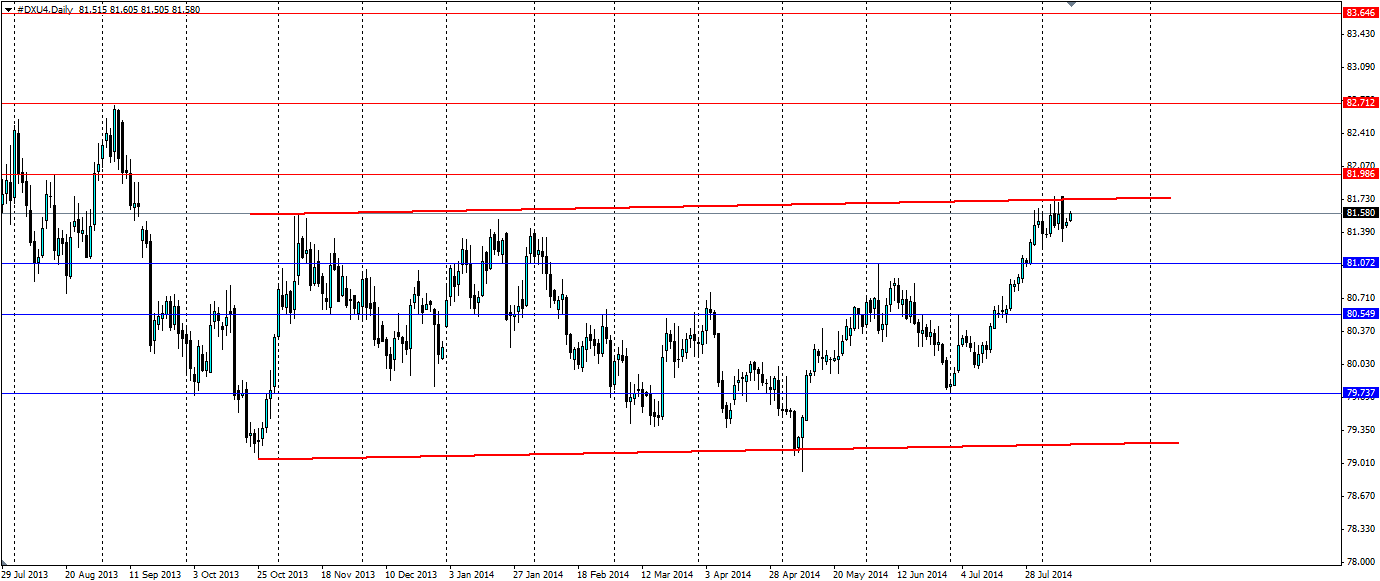

The US dollar index has had a strong run but met its match at the 81.75 level as global tensions mounted making it tough to break out. Could the reduction of global risks lead a breakout of the channel?

There has been a reduction in global geopolitical risk as of late with Russia announcing an end to the military exercises they were doing in regions that border Ukraine. This is surprising to many as it looked like they were preparing for an invasion. Nevertheless, this will ease tensions in the area and the US dollar will benefit as capital returns after hiding out in safe haven assets.

The US also announced it will aid the Iraqi military by performing airstrikes on the ISIS militant group trying to establish an Islamic state in the north of Iraq. This appears to be having an effect, halting their advance southward. A new Prime-Minister has been nominated in Iraq and US President Obama called the nomination “promising step forward”. He also urged the formation of a new government that represents all of Iraq’s communities.

The third piece in the set of reduced global tensions is the conflict in Palestine. Israel and Hamas appear to be abiding by a ceasefire that came into force three days ago. Israel is sending negotiators to Cairo for talks on a longer truce that could see the blockade lifted on Palestine.

All of this could lead to a resumption of the upward movement in the US dollar, which has been on for some time. Optimism can be powerful and certainly, from a risk point of view, it is returning to the market. This week will be a telling one for the US dollar and it is likely to test the resistance at 81.75. Traders looking to take advantage of any upward momentum should wait for the confirmation of a breakout, with a stop loss set back inside the channel. Look for a breakout to target previous levels of support at 81.99, 82.71 and 83.65.

In an environment of risk-on, the US dollar could break out of the channel it has been following for some time. There is certainly plenty of bullish sentiment that could lead to a resumption of the upward momentum.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.