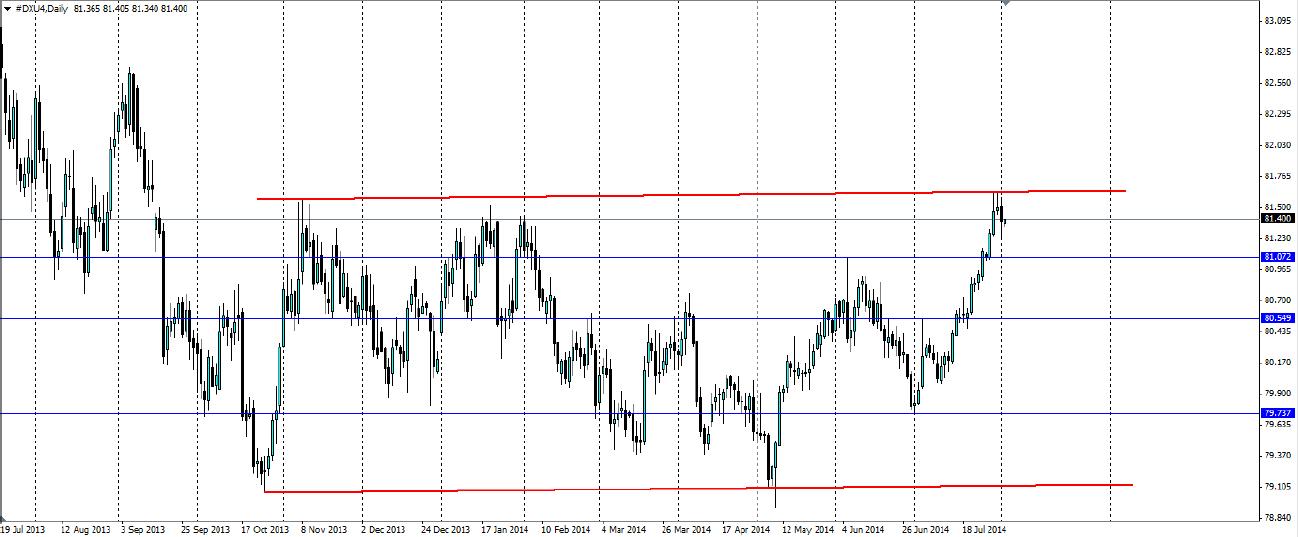

The Dollar Index has had a solid run in the past month or so, but taking a wider view shows the resistance it is up against. The price looks to have rejected solidly off the top of the channel and could begin to reverse down to the bottom of the channel.

The US dollar index has surged ahead over the course of July, as optimism about the job market from the US Federal Reserve fuelled the Dollar bulls. The month began with positive nonfarm payroll data that showed 288k jobs added to the US economy in June and the unemployment rate fell to 6.1%. Recently the Advance GDP figure added more upward pressure on the US dollar with a strong Q2 reading of 4.0% (annualised) growth. This is a good turnaround from the -2.9% in Q1.

The end of last week was the rain on the parade of the US dollar Bulls, suggesting the dollar may have overextended. The latest Nonfarm payroll data showed the US economy added 209k jobs in July. A good result, but below the 230k the market had expected and well below last month’s 288k. Furthermore the unemployment rate rose unexpectedly from 6.1% to 6.2%. This contributed to the rejection off the top of the channel and the formation of a rough triple top as seen on the below H1 chart.

The price is currently sitting under the neck line having broken through it and pulling back. The next effort will be to test the bullish trend line from the past month, and if this breaks down, we could see a strong movement towards the bottom of the channel. The RSI also points to a bearish movement, with several lower highs.

A reversal will look for previous levels of support/resistance as targets for the downward movement. Support for a bearish movement can be found at 81.07, 80.55 and 79.74. These could all act as exit points for traders looking to catch the downward momentum of a bearish reversal.

The US dollar index looks to have met some tough resistance at the top of a channel and could be overextended. A triple top and a descending RSI point to a possible bearish reversal which could take the US dollar much lower.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.