Oil charts are really interesting if you are into technical movements, they seem to swing wildly on a variety of news, but they also seem to show great pattern and for the most part obey key rules when it comes to movements.

Oil movements were heavy during 2008 and there was massive volatility as people looked to commodities as tangible assets that had value in the face of everything falling apart. I don’t blame them, but oil over a hundred dollars a barrel is uneconomical in the present marketplace and was certainly uneconomical during that period in time.

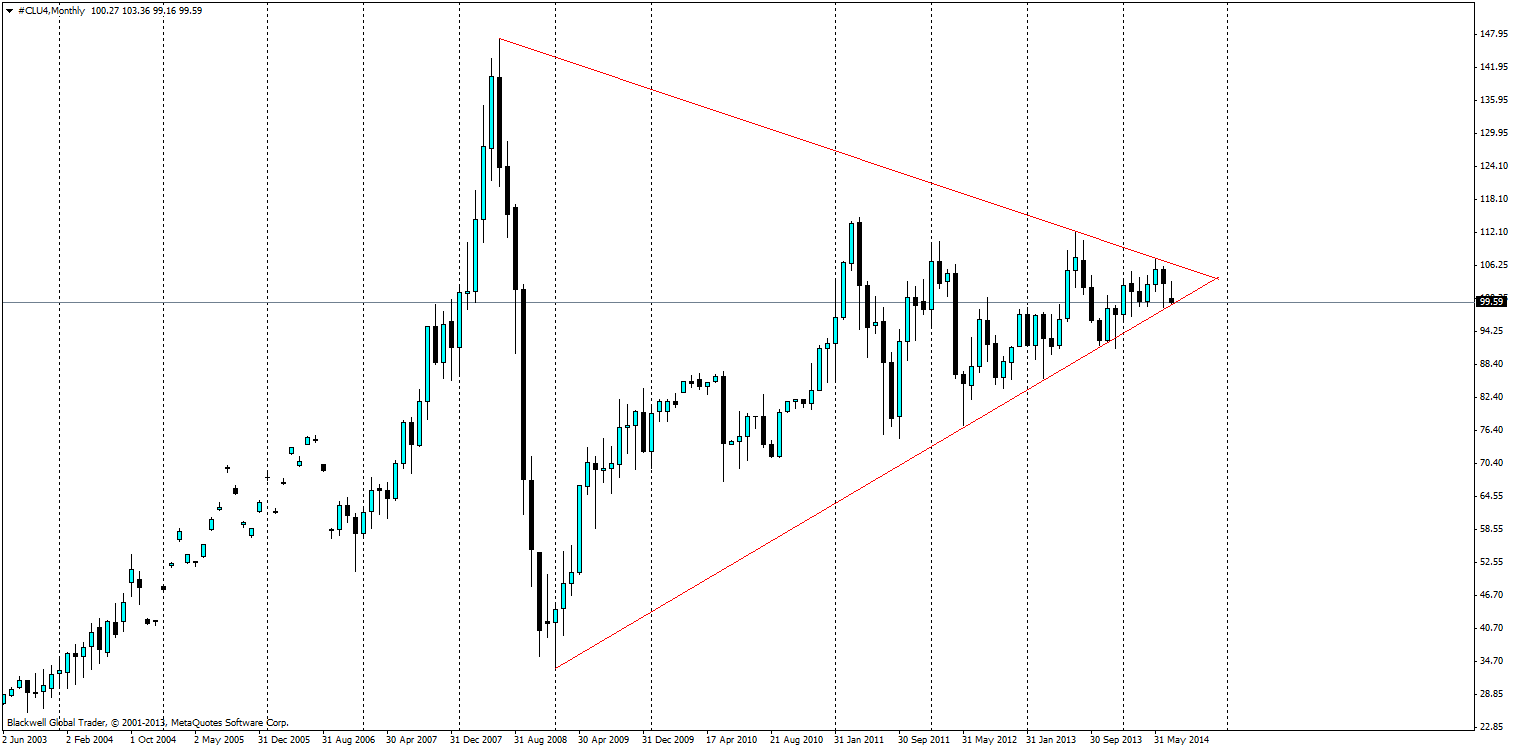

But, to get back to the main point, what I am talking about is the massive pennant pattern which has formed on oil charts over the last 6 years, and I believe something has to give in the coming months as a result of the pattern converging.

Currently there is only one day left on the chart, and a move higher could certainly be on the cards in the coming month as it looks to push off the trend line and back to around the 100 dollar barrel mark.

While so far I have talked up the prospects of 100 dollar barrel of oil, I am against it strongly in the long run. While it may be the lifeblood of the world at this present moment; the advent of fracking has been heavy on the oil market, as oil previously too hard to extract now becomes more accessible.

With the market going forward believe that oil will drop lower and Bloomberg forecasts also point to oil dipping longer in the long run over the coming years, the question is when will the market wake up to this key point and we stop seeing the bulls fighting the future of oil.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.