The New Zealand dollar has taken an absolute beating as of late, as markets thrashed it in the wake of Reserve Bank of New Zealand (RBNZ) comments and weak commodity data. This was further confirmed yesterday with the recent Fonterra milk forecast payout; while not an economic calendar event, it should be, given the impact the dairy sector has on the economy.

The Milk impact is largely missed by overseas investors but it has a large impact on the economy, and especially when it comes to spending, and the $6/kg payout will have a very large impact as 4 billion dollars is going to be cut from the primary economy where there otherwise would have been spent based on estimated forecasts earlier on. With the lack of spending in the economy, it will certainly influence inflation, which has so far been a little weaker, and as a result the RBNZ has held back from raising interest rates. This hit to the payout will undoubtedly lead to a flow on effect too inflation and we may now not see any further interest rates rises until the end of year or until early 2015.

Despite all of this it’s not all doom and gloom for the kiwi dollar for currency traders. Yes, we are going to see weaker times for the NZDUSD in the short term, but in the long term, it's still a very attractive for carry traders who are looking for fixed interest returns.

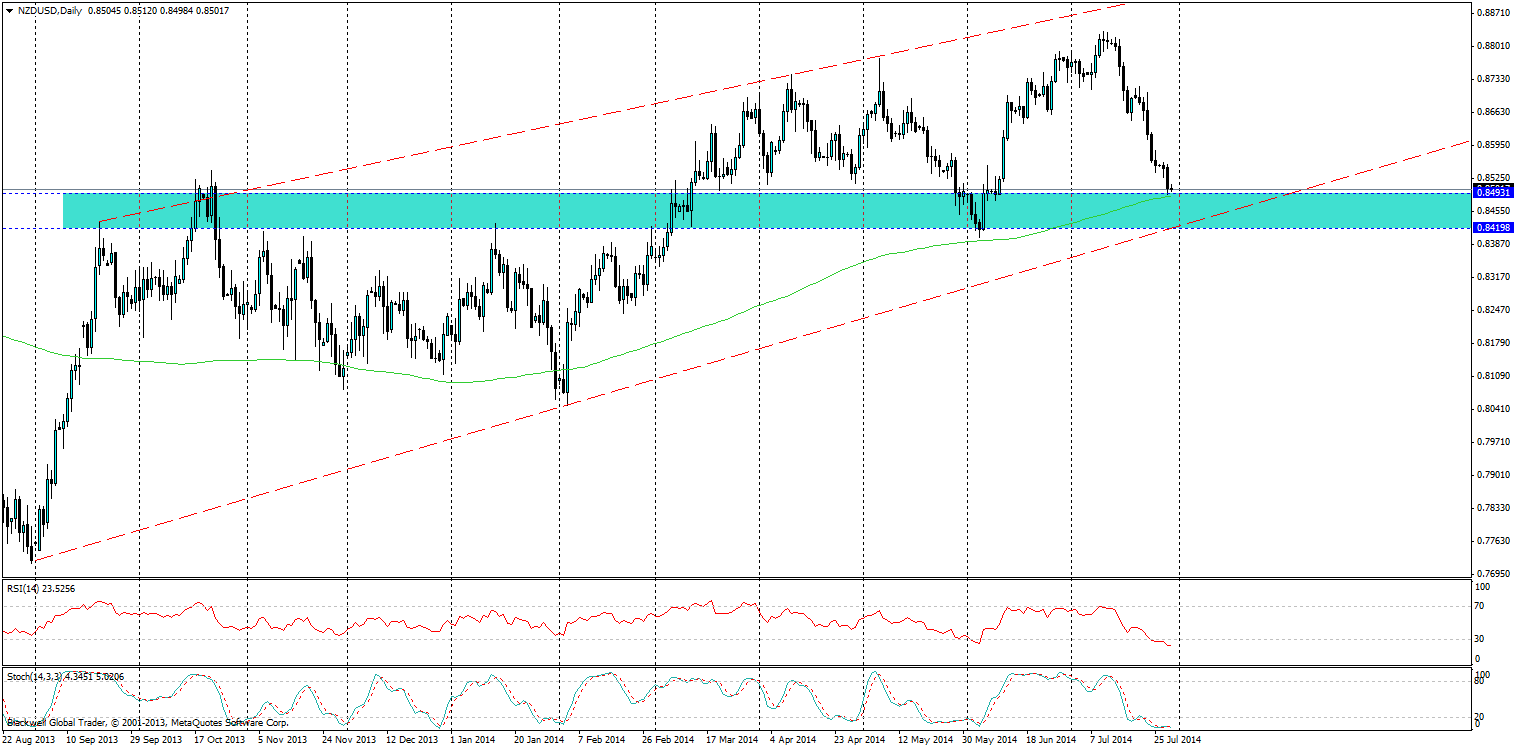

Currently the NZDUSD is sitting just below the turning zone that many will be looking to watch and see. The NZD has been in a strong channel for some time now and that bullish sentiment still remains despite the weakness, and the carry traders will be looking for a turning point in the market and they will find it at the trend line which is presently in the market.

When targeting the NZDUSD the 0.8493-19 zone on the trend line is likely to see a lot of volatility as the market battles it out to see if we will see a push higher, or in fact a push lower through the trend line and into bear territory. I would expect the bullish traders to come back into the market after being scared away in the recent weeks, and the trend line is where they will target. If you look at the indicators you can see that the market is heavily oversold in its present form as people hold of buying at present, momentum as well is still in favour of the bears.

So while the movement is southwards currently, it’s not because traders have abandoned the market, they are instead waiting to strike and they are getting ever closer to the point of coming back into the market at present. Look for movements higher out of the present zone or a breakdown on the trend line as it’s likely we will see a bounce back as traders come back into the market hunting for yield.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.