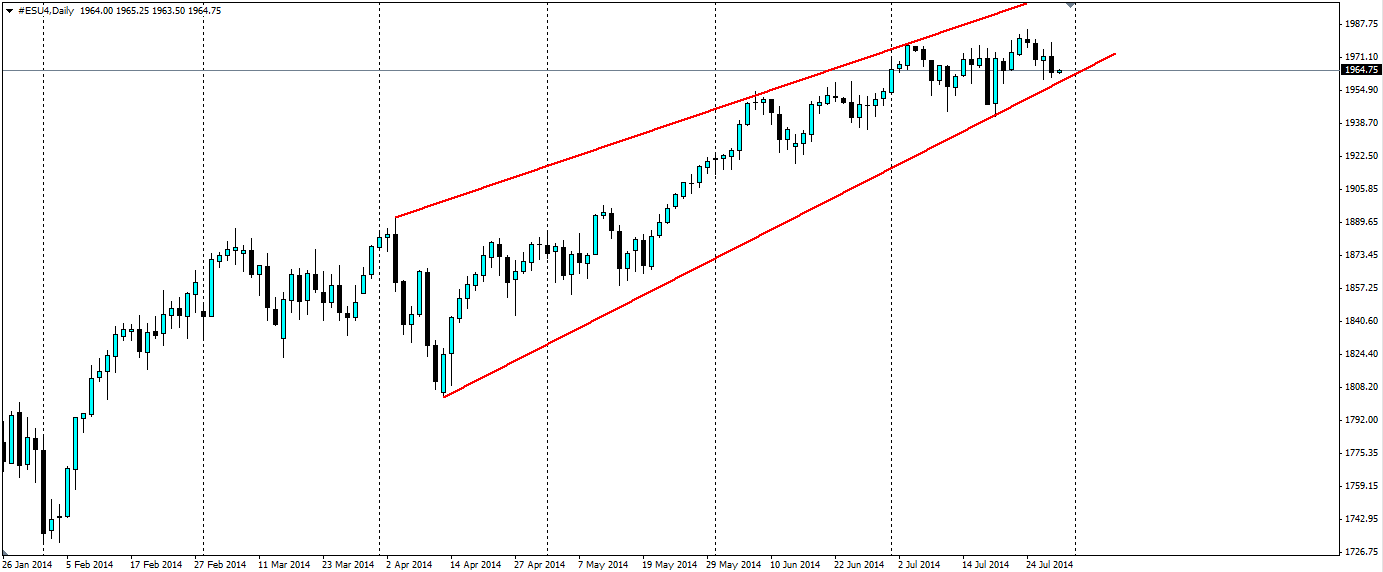

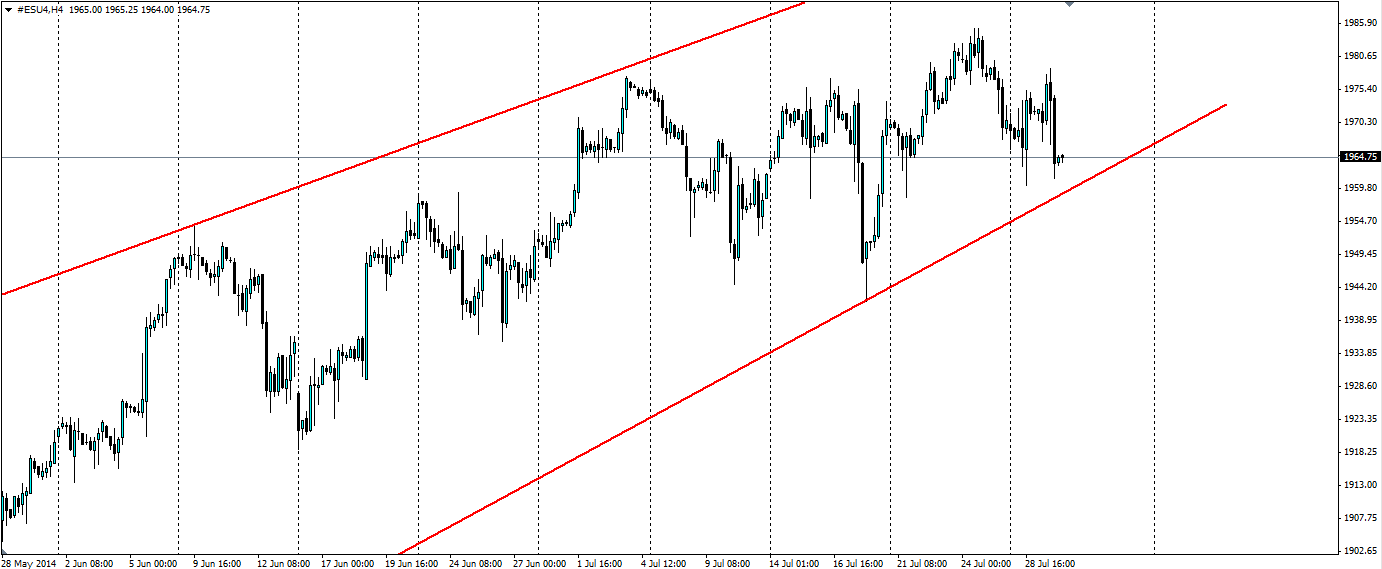

The S&P 500 index currently following an upward sloping wedge as the price moves north in an ever tightening band. It looks to have just bounced off the trend line and will target fresh all-time highs in the weeks to come if the US economic data stays favourable.

The earnings season in the US is a big driver of the S&P 500 index and so far it has been positive. 46% of companies in the S&P 500 have delivered results and a solid 80% of those have announced positive. This optimism had pushed the S&P 500 to an all-time high during the week, however, it pulled back late in the week as traders took profits and one or two big companies announced losses (such as Visa and Amazon). The general consensus is that the earnings season will end positively and this should help the index respect the current bullish trend line.

The big test will come later this week when the US Non-farm Payroll data comes out. The last two reports have showed strong job creation (+217k and +288k respectively) which pushed the S&P 500 index to all-time highs on both occasions. This month has a higher estimate than both of the previous two, which could put more pressure on the report if it does not excel, however, this reflects the optimism in the US at the moment and provides a good omen for US bulls.

There is plenty of other data that could buoy the S&P this week. Advance GDP later today (30th Jul 12:30 GMT) will give a good snapshot of the state of the wider economy and couldn’t possibly be worse than last quarter’s -2.9% (annualised). This round the market is expecting +3.1%, which is a massive turnaround if it comes in as expected and will no doubt boost the markets.

The Federal Funds Rate and FOMC statement also today (18:00 GMT) will give the market an idea of the current thoughts of the US Federal Reserve. The interest rate has a large impact on equities as it creates demand based on the yield differential. Equities have been on a dream run partly because the interest rate means borrowing costs for investment are low and also because equities yield more than deposits. Interest rates are expected to stay at 0.25% and Quantitative Easing is expected to be scaled back by another US$10b. Any hawkish talk from the FED will negatively affect equities as there will be less cash to boost asset prices, however FED Chairwoman Janet Yellen is seen as dovish so do not expect any hard talk this time around.

The S&P 500 is likely to keep a very close eye on the economic calendar along with the remaining companies yet to report earnings. The consensus is for more positive data and if that is the case look for the bullish channel to hold firm and the all-time highs to be tested. Beware, as all of this news will increase volatility, which could knock out stop losses before the party begins.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.