The kiwi dollar has taken a beating in the last few weeks. There are good reasons for this, with dairy products at the top of the list, and now it looks like it has one more level to test before a breakout will spell an end to the high 80’s for a while.

At the last monetary policy statement meeting, the Reserve Bank of New Zealand (RBNZ) said it would pause and asses the economic situation before raising interest rates any more. This is what the bears had been hoping for and the Kiwi took a tumble as a result. Falling commodity prices and an inflation rate that is not really threatening (at just 1.2%) has been the catalyst for the stance of the RBNZ.

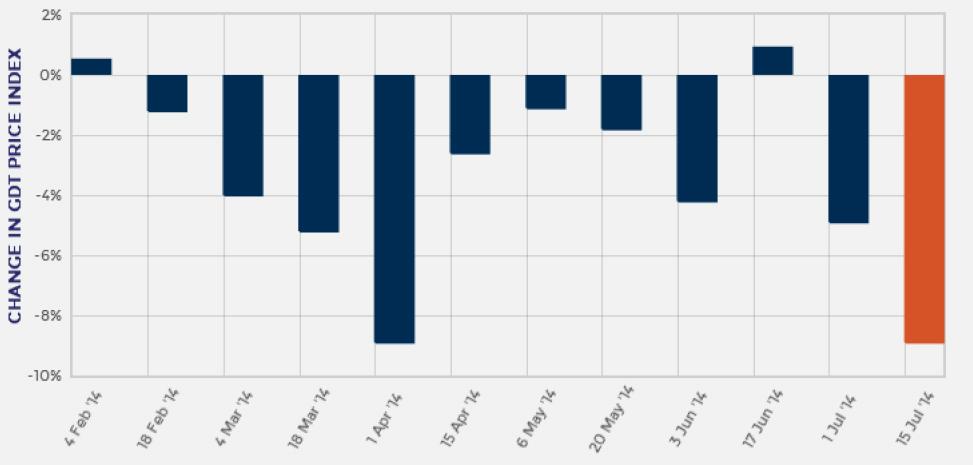

Dairy, New Zealand’s largest export commodity, has come off its highs recently and has brought the Kiwi dollar with it. Since February this year, 10 of the last 11Global Dairy Index auctions have seen a drop, with the latest falling 8.9% (in red below). This has effectively wiped billions of dollars off New Zealand’s export receipts. The latest blow for dairy farmers is that Fonterra, New Zealand’s largest milk processor, will be paying the lower end of expectations at NZ$6.00 per Kg of Milk Solids, down from a peak of $8.65 last season.

A report of Business Confidence by one of Australia’s largest banks, ANZ, shows a particularly worrying trend. The survey hit a high in February of 70.8 (above zero denotes optimism) and has steadily fallen to the most recent reading last week of 39.7. While this result is still showing optimism, the consistency of the falls are of concern for the Kiwi dollar and the wider New Zealand business community.

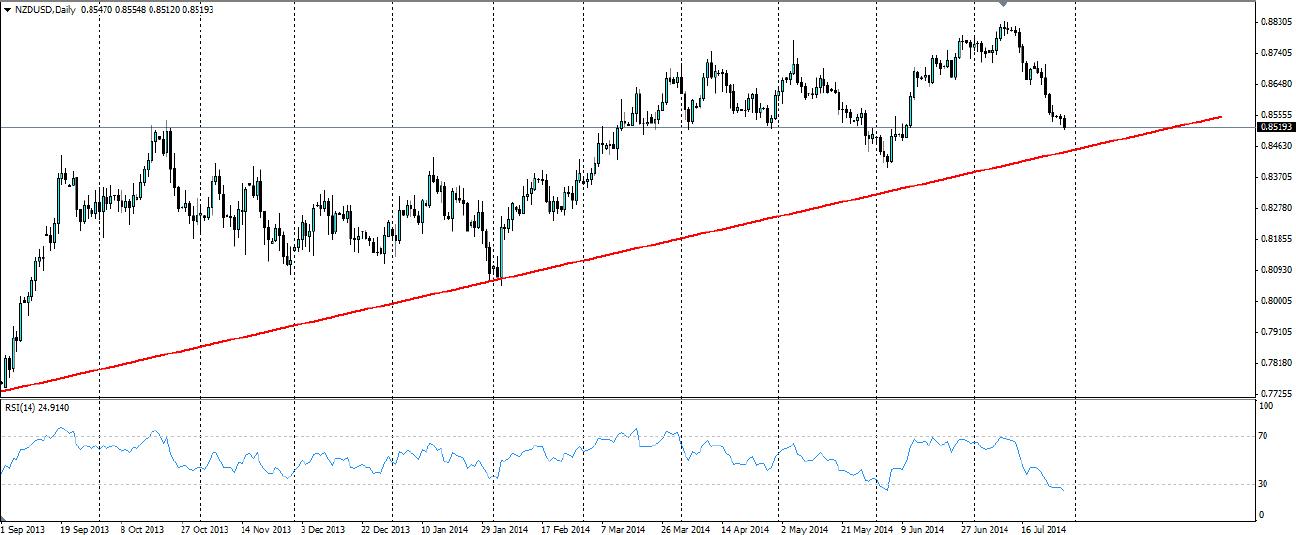

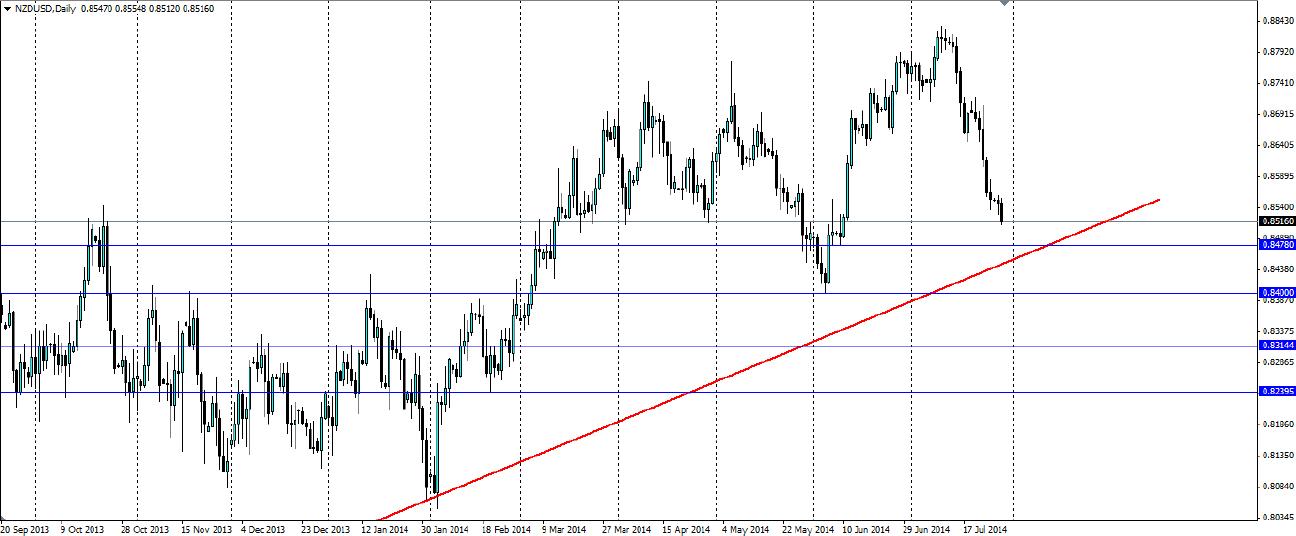

So where to now for the Kiwi? The first and most likely target is the bullish trend line, which the current downward sloping channel should intersect within the next few days. This may hold up the bearish price action for a time, however, the outlook for the kiwi is now as bleak as it has been for quite some time. Once the long term bearish trend breaks down, we could see a fairly quick movement down to levels not seen since the beginning of the year.

Look for support at 0.8478 to potentially come into play before the bullish trend acts as dynamic support. If the price breaks out of this it is likely to target 0.8400, 0.8314 and 0.8239 as it moves down. These could all act as good exit points for a short taken after a breakout of the trend.

The Kiwi dollar has been on a dream run for the past six years, however, the strong bullish trend that has been in play since last August now looks like it is going to come under pressure. Given the circumstances, it is not likely to hold for long and the Kiwi will be targeting the low 80s after that.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.