The NZ dollar is looking more and more bearish on the charts as of late, especially after the most recent batch of economic data and commodity results.

Yesterday’s CPI data disappointed the markets heavily as it fell to 0.3% q/q, while markets were expecting 0.4%. This is an interesting development for the New Zealand economy, as inflation worries had been helping to drive interest rate rises from the Reserve Bank of New Zealand (RBNZ) as it has looked to put the brakes on an overheating economy growing off the back of positive commodity growth, and strong construction growth in the Christchurch region.

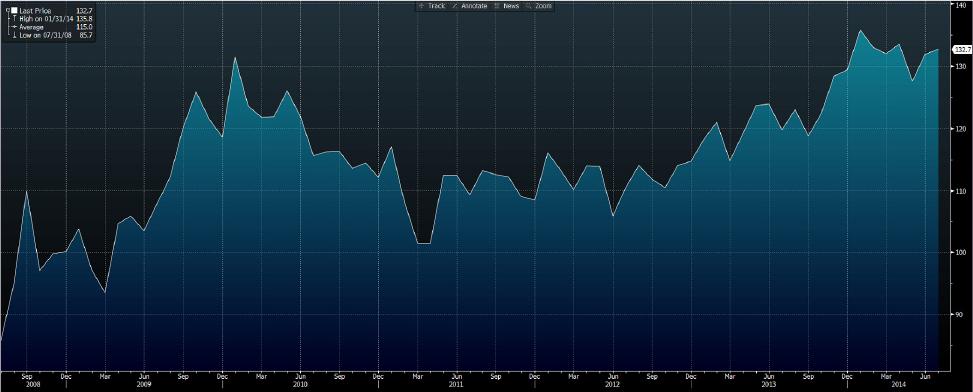

While the consumer confidence index lifted slightly (see chart below) it looks to have stabilised and further rises may be a little hard in the coming months.

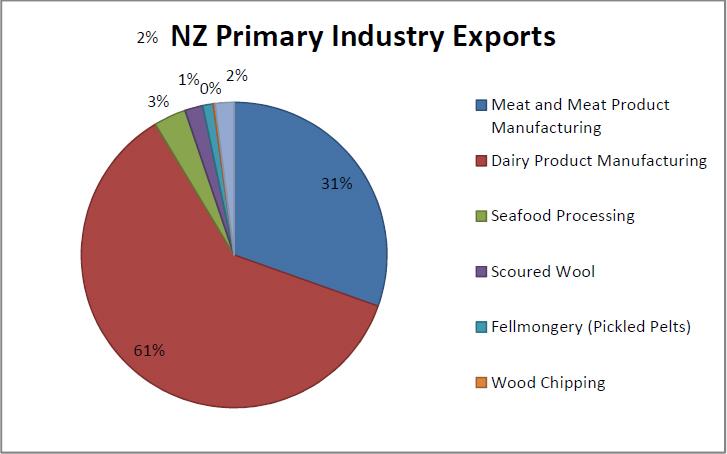

Commodity prices though are certainly a real problem in the New Zealand economy. Currently New Zealand farmers over the last decade have chased the money and put ‘all their eggs in one basket’. One only has to look at the export statistics for primary industry sectors to see how much the dairy industry dominates the landscape (see graph below). Total exports from New Zealand show that 25% is dairy related products, which is a very large portion of total exports when compared to other nations.

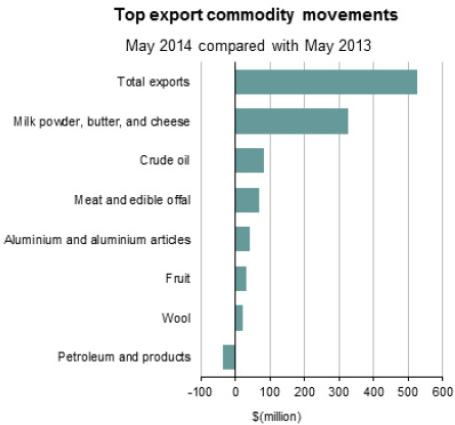

So with the recent data from the online milk auctions, we can certainly see some worries appearing on the horizon for the New Zealand dollar. Milk prices dropped 8.9% as a whole on the global dairy trade index – this is a significant drop and could show that demand is starting to slack off in the current environment. Either way it’s likely to heavily affect the New Zealand economy when you have lower milk pay-outs coupled with rising interest rates – all of which will put heavy pressure on the agricultural sector.

So while the Reserve Bank is keen to raise interest rates to stop the economy overheating, what we may be seeing is the economy starting to slow down. The Reserve Bank will be acutely aware of such a threat to the economy, especially with the Australian economy looking very sluggish next door and the impact the dairy industry has on the economy, especially when you compare growth from last year.

While many will now be wondering what will come of the New Zealand economy and especially its dollar (which garners the most interest). It is clear that the Reserve Bank of New Zealand may actually have to pause interest rate rises in the medium term until the New Zealand economy starts to stabilise. Else interest rates actually damage the economy in the long run, as the economy slips backwards coupled with more stress on homeowners and consumers.

So while there is a lot to take on board, it's clear that the impact on the New Zealand dollar has been heavy, a quick look at the most heavily traded NZ pairs tell us a lot.

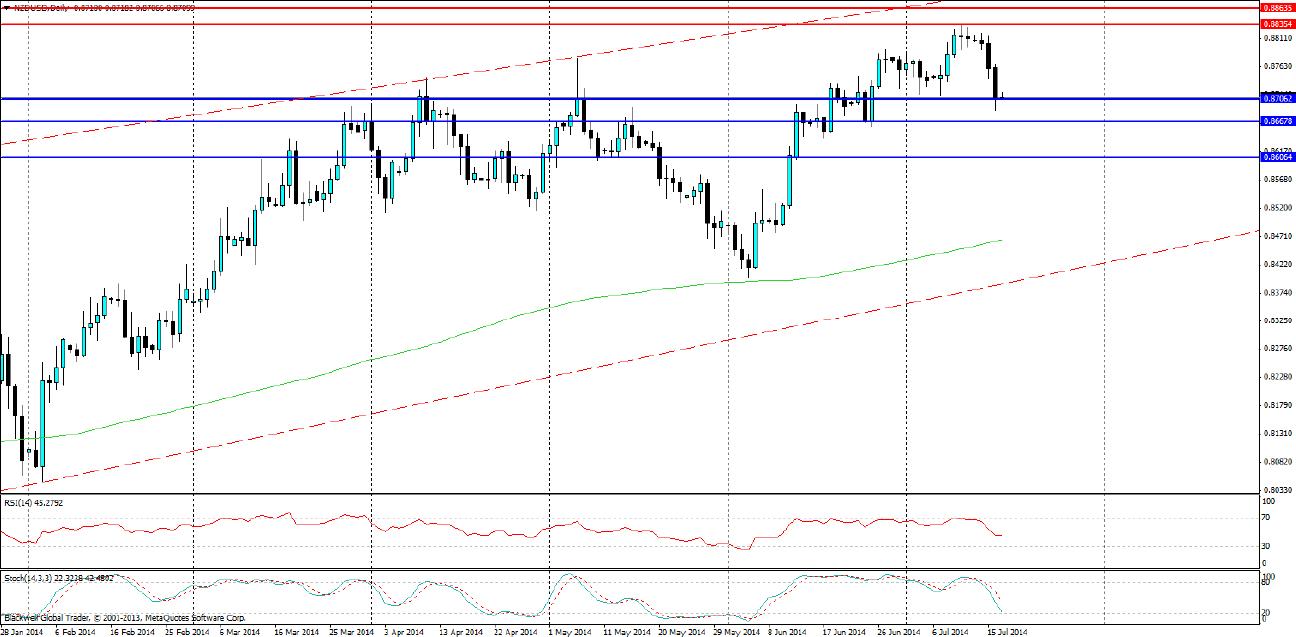

Currently the NZDUSD is looking very bearish as a result of the recent market data. Despite it being in a bullish channel as seen on the chart, it’s likely we will see further falls in the short term. Currently support is holding at 0.8706 and many will be watching to see if there is a brief push upwards with the possibility of a head and shoulders pattern forming. However, long term trends are certainly bearish after the last two days of trading.

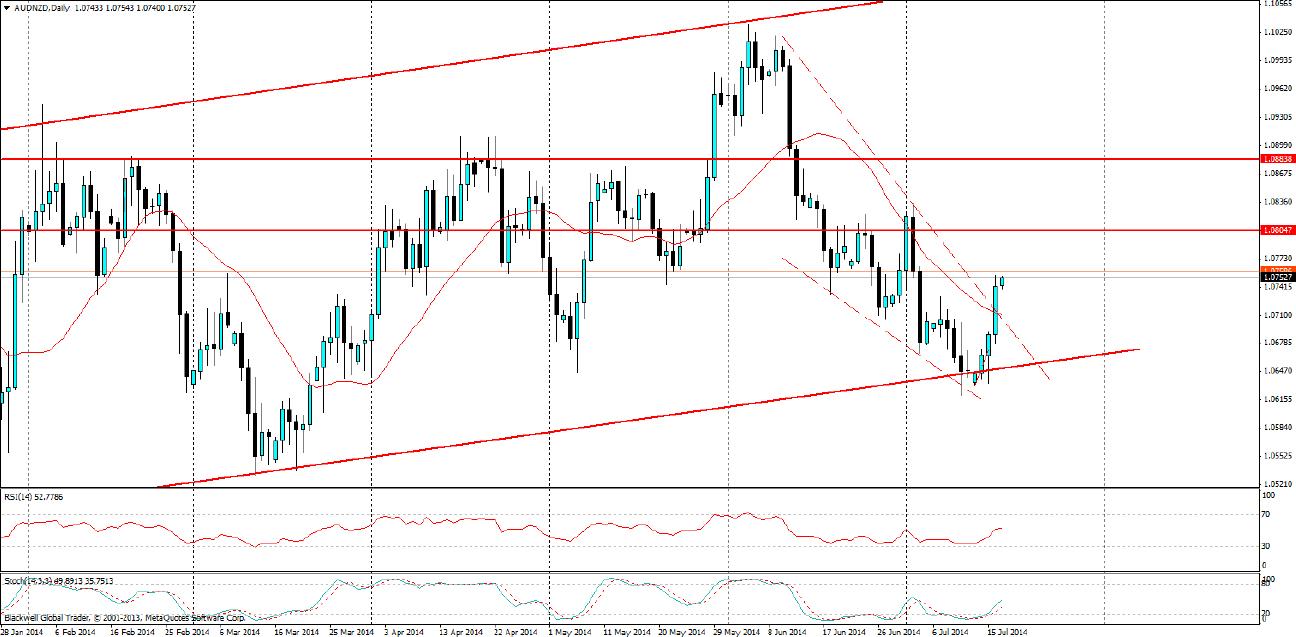

The AUDNZD is a little interesting, given the economies are very close and intertwined in some aspects. What’s important to note is the bullish channel has so far looked to hold and we may see more appreciation of the Australian dollar against the New Zealand dollar, especially as it sits at very depressed levels historically speaking. There is a lot of potential for this currency to climb higher and higher on the charts. Current resistance levels can be found at 1.0804 and 1.0883, and I would expect to see these tested and pushed. However the channel top will not be easy to break and may see a slow sloping bullish channel for some time or this pair.

The bullish channel has been in play for some time on the NZDJPY, however, there has been a serious level of resistance just below 90.00 and this certainly looks likely to hold now in the long term. The NZDJPY is looking to now drift lower and it looks likely it will touch the present channel in play. Markets will be watching to see if it holds at the line or actually breaks through lower. Either way the short term is bearish for the market.

Across the charts it looks likely to be a bearish trend for the New Zealand dollar as a whole. Many will now be listening very hard to GraemeWheeler's words after nextweek's interest rate rise. People will want to know how the RBNZ intends to act when the economy weakens, and may see more talking down of the New Zealand dollar in order to prop up a faltering commodity export sector. Either way the interest rate statement is going to be a big one and markets will be itching to propel themselves whatever is said.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.