The USDJPY is looking interesting when it comes to market movements.

Over the recent months the USD weakness has been riding the markets heavily, many would argue that US weakness will continue for some time – and most likely they are right. The US economy is going through a bit of a bad patch when it comes to GDP. However, the labour market is still looking very strong despite this downturn, which shows that firms are expecting a pickup instead of a deep recession.

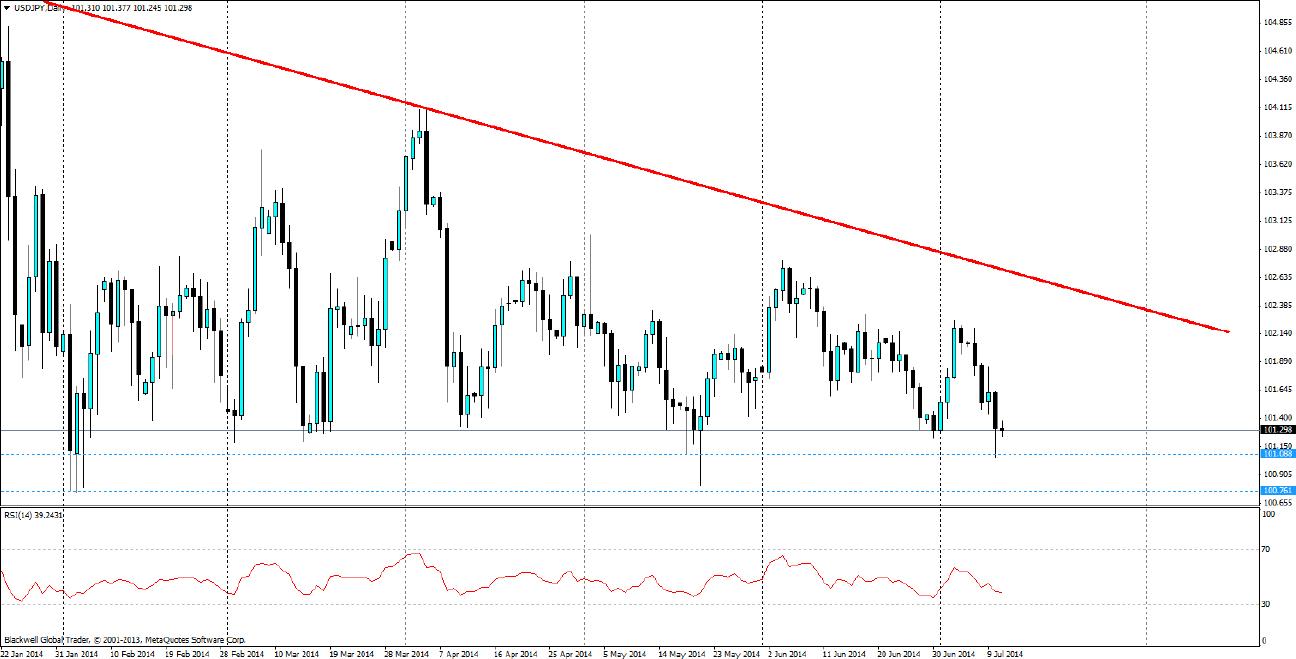

Someone should tell this to the USDJPY though, which has been slowly trending down now for some time. The Yen is not going to get any stronger from here, and for some time it has been acting in a bearish way; while mostly ranging.

The current market sentiment from the Bank of Japan (BoJ) is that the economy is going as planned so they are likely to hold until they see any changes that may warrant action. While the stimulus was talked up throughout the early months of the year, it seems less and less unlikely as CPI is currently in-line with the BoJ’s expectations. Many will now be waiting to see if CPI does actually drop off and if the BoJ will be forced into action. The reality of such an event is not so clear and seems rather distant.

What is clear though are the support levels at play in the market, and they have held for the most part. Current immediate support can be found at 101.088 and 100.761, both of which thus far have acted as serious levels of support and last night we even saw the 101.088 level tested. It’s likely we will see more testing of the 101.088 level of the next week as markets look to apply pressure.

Market participants will be watching the 100.00 level carefully as well, as this level is likely to stoke concern from the BoJ if reached, and may even cause some sort of currency intervention.

A ranging market is not always popular, people prefer a clear trend. In this case the support levels are quite strong and provide opportunities for traders. With small spreads, and a readable market I can see why the USDJPY is such a popular trade as of late.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns. Gold confirmed a symmetrical triangle breakdown on 4H but defends 50-SMA support.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.