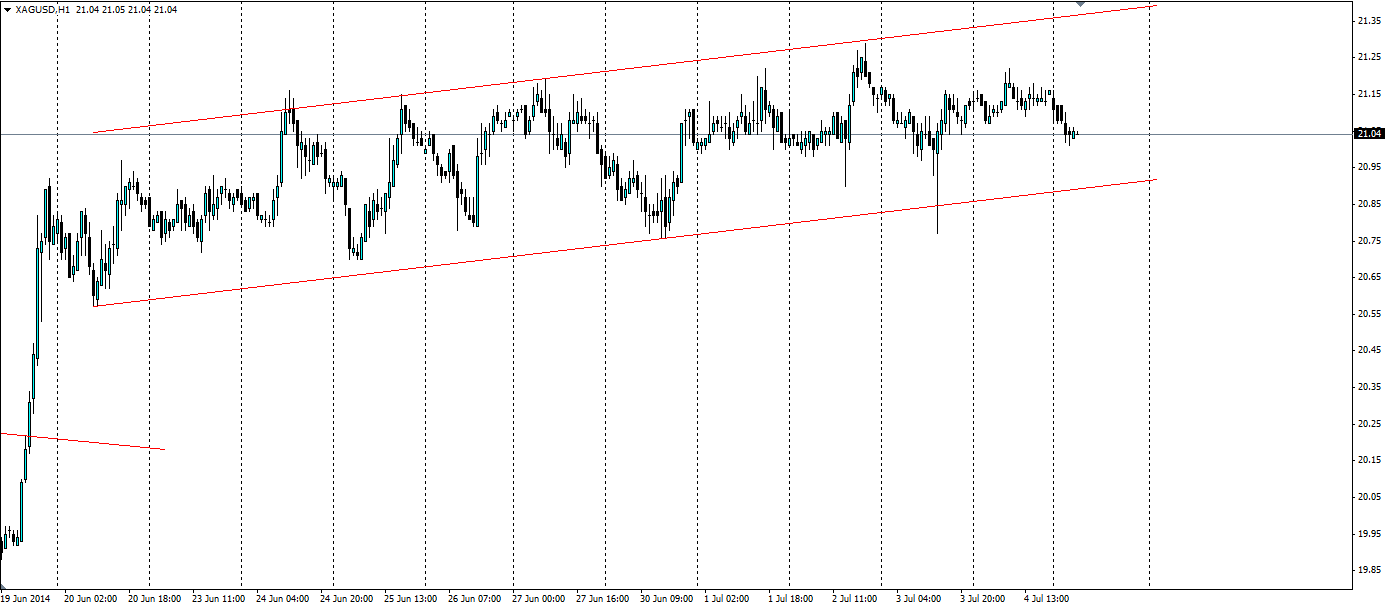

Silver is currently insistent is forming a range pattern with a slightly bullish trend to it that can be taken advantage of as it heads down to the lower end.

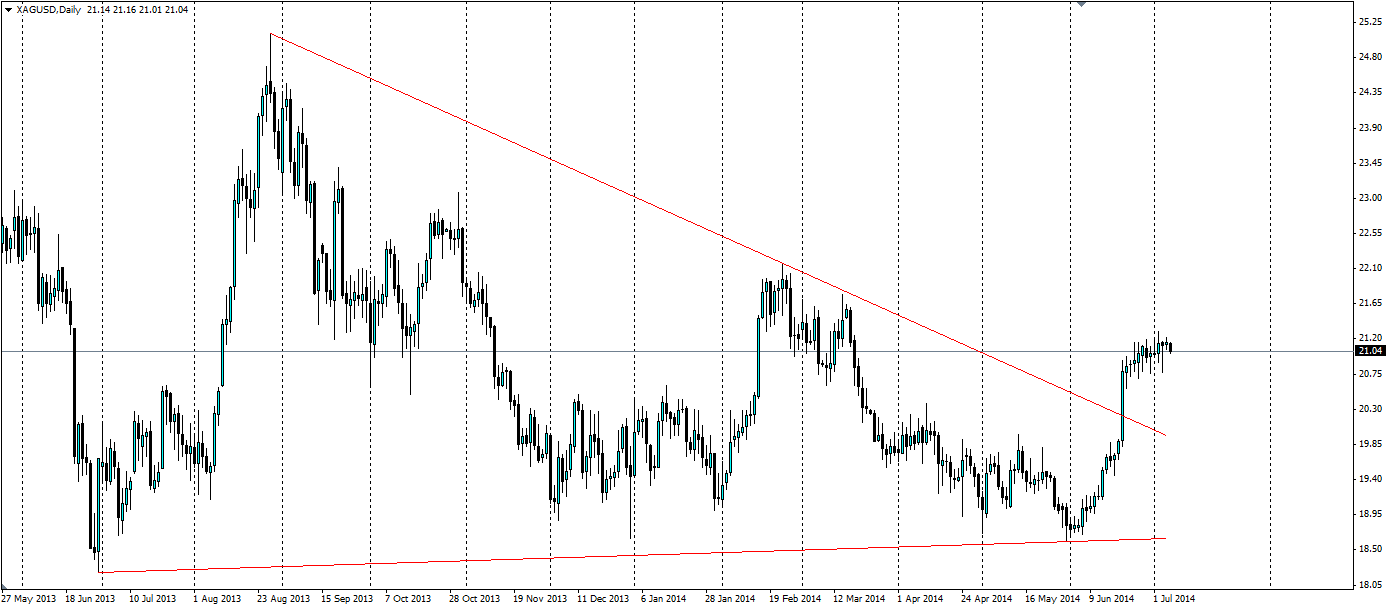

Silver recently broke out of a very old downward sloping triangle as it powered up over $1.00 per ounce, or over 5%. The breakout on the 19th June was largely down to the fact that the US Federal Reserve said that interest rates would remain low “for some time”. This in turn increased demand for haven assets, such as gold and silver, as the yield on US Treasury assets looks bleak. The strong breakout attests to how strong the triangle was.

The recent US nonfarm payroll data did not have as big an effect on silver as one might expect. The report showed the US economy added 288k jobs in June, much higher than the 215k the market was expecting. Logically, we would expect gold and silver to fall sharply on this news as it shows the US economy recovering, however the response was muted as the market is wary of the recent negative GDP data (-2.9% annually)and the uncertain outlook on interest rates. The resistance held firm at US$20.77 per ounce and a large bullish rejection wick formed as the price pushed over the $21.00 mark.

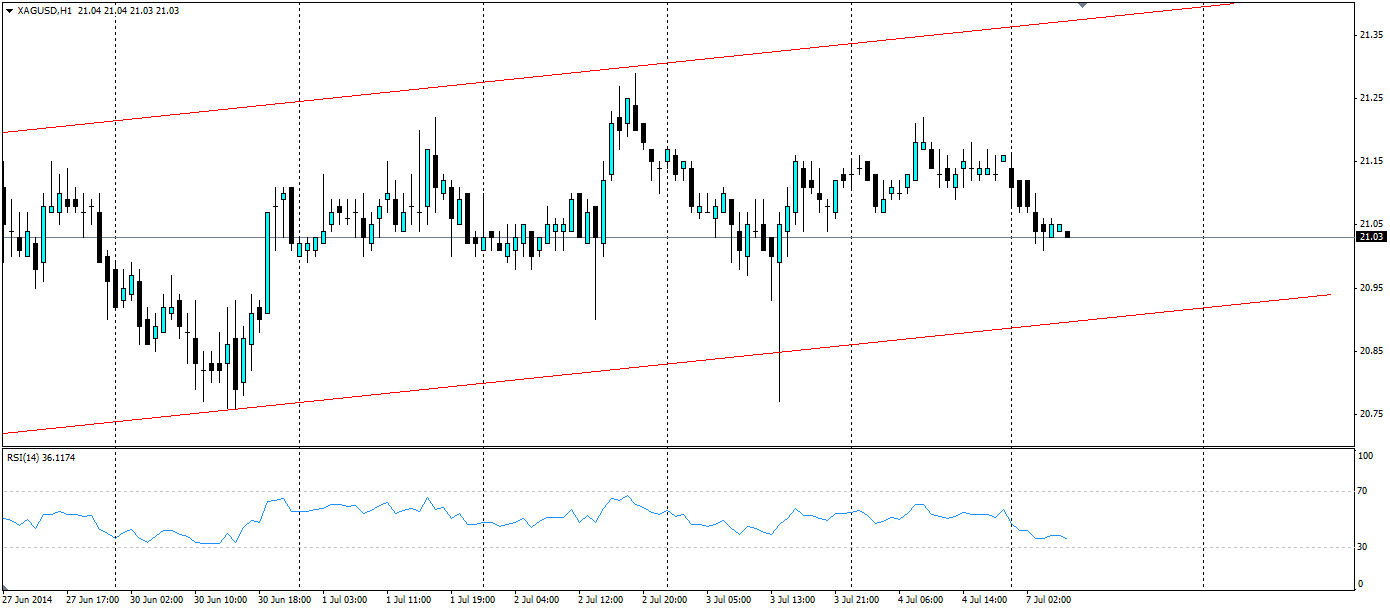

The ranging pattern has seen the support line tested several times with only the non-farm data providing a false breakout. This means the channel will hold in the near term and it will take quite a bit to break the channel down. Indeed the RSI shows the current momentum has reversed and is now back with the bulls having found support at 21.01. This could result in a touch of the upper resistance line.

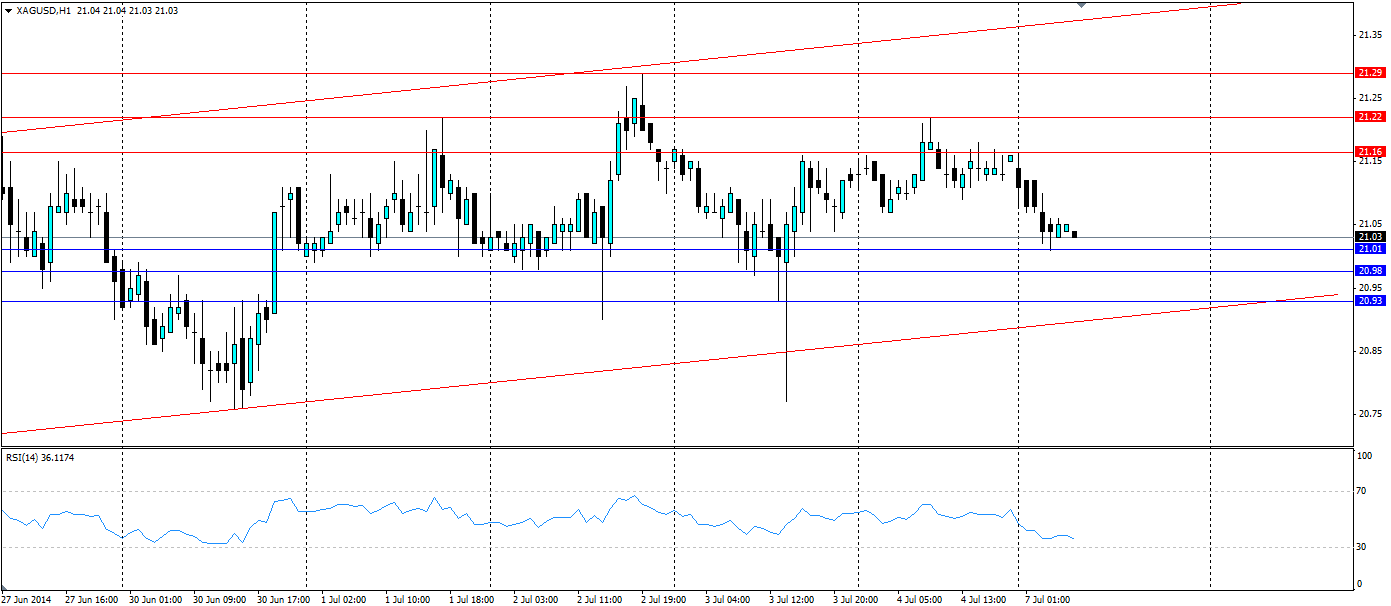

In this case there are four options for traders to take advantage of the price action. If there is a touch of the bottom support line, traders will look to have a stop sell below the trend line to take advantage of a break out, with a stop loss inside the line. At the same time a stop buy can be placed above the support line to catch the momentum of a bounce off the trend line.

If the price moves upwards to the top resistance line, a similar set up can be put in place. This will either catch a break out to the top side, or a bounce back down inside the channel. In any case, look for the levels of support and resistance when deciding price levels to target.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.