The Euro has been looking on the back foot as of late, after Mario Draghi came to the party and smashed down the markets. Slashing interest rates and threatening exotic measures in his effort to fight the Euro.

What’s next for the Euro might be of little concern for a lot of people, but I personally believe it has a lot more room to fall further, despite the recent candles showing buying pressure still being there.

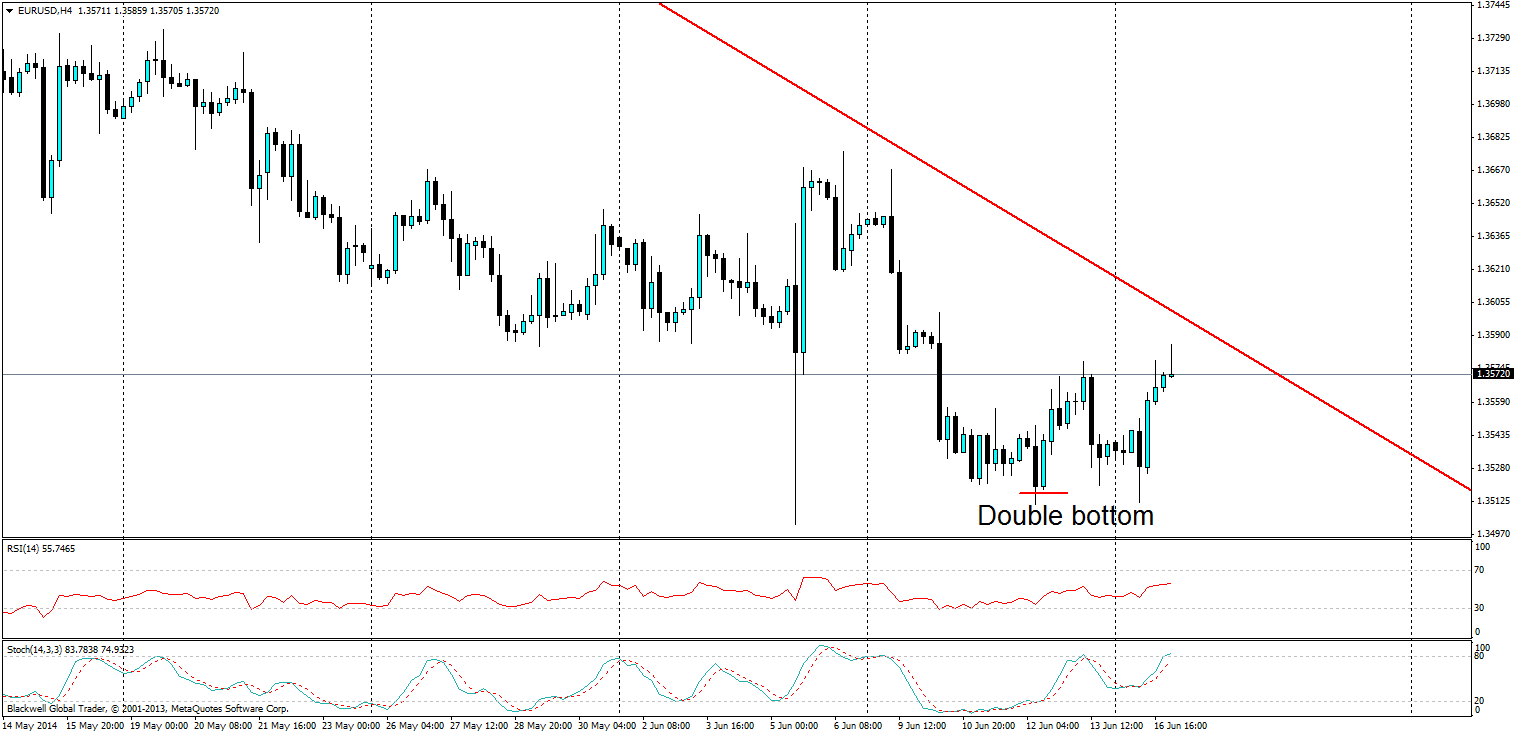

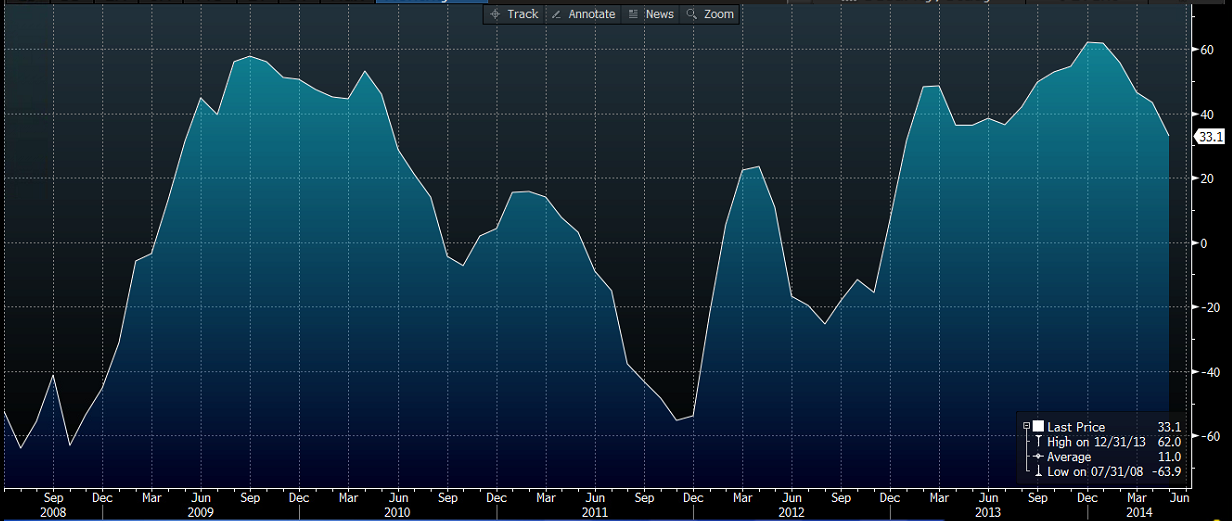

On the 4H chart (see chart above), we have seen a double bottom candlestick formation, this is generally indicative of a bull run for the pair. So far so good it has run higher, but it's stopped short of the current daily trend line, and I believe the market is cautious for the upcoming economic survey (see chart below).

The forecast is currently for an improvement in economic sentiment, sure it’s possible. But the Germans are a very conservative people, and I strongly doubt they will be pushing for anything higher than the previous month; especially when the European Central Bank has just recently taken action to fight off deflation.

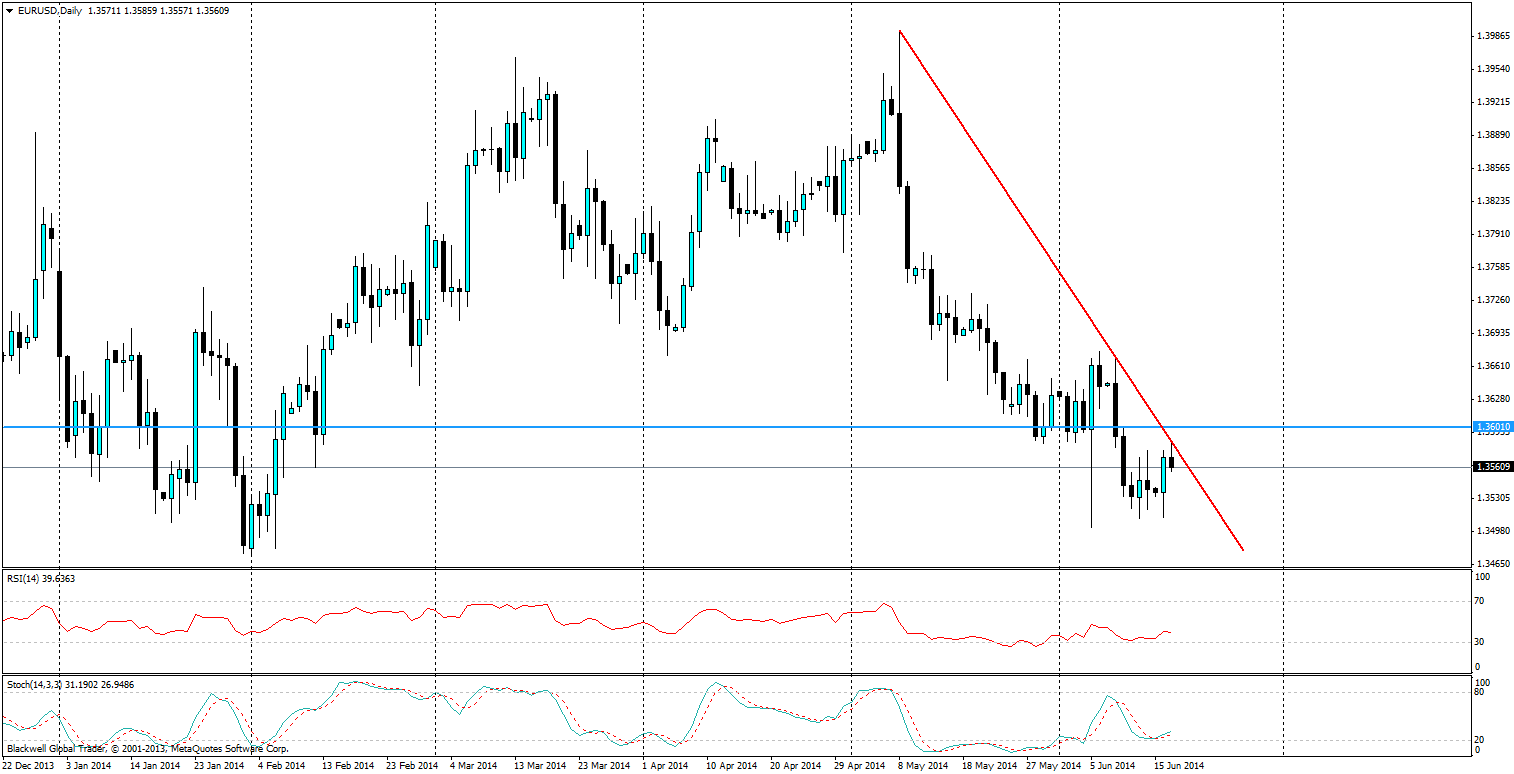

The daily chart (see chart above) shows the bears at work though, and it's looking very strong -- especially after today’s touch and pull back. For the bears to be defeated and the bulls to take charge I would have to see a breakthrough on the current trend line and a push up to at least 1.3601. However, in the short term I am very much bearish on the EURUSD cross.

It’s easy to see why, we have had a brief double bottom and now the market is starting to turn on the daily after a trend line touch, I expect to see further lows as the trend line looks to hold. Only a shockingly positive economic sentiment survey could sway the market, and the Germans are certainly not optimists.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.