Gold surprised markets recently as it managed to claw back up the charts before hitting strong resistance in the market place. This was in part led by the recent volatility, which has occurred in the market place, but I believe that gold has lost a lot of its lustre in recent times, and that it may not be the metal you think it is anymore.

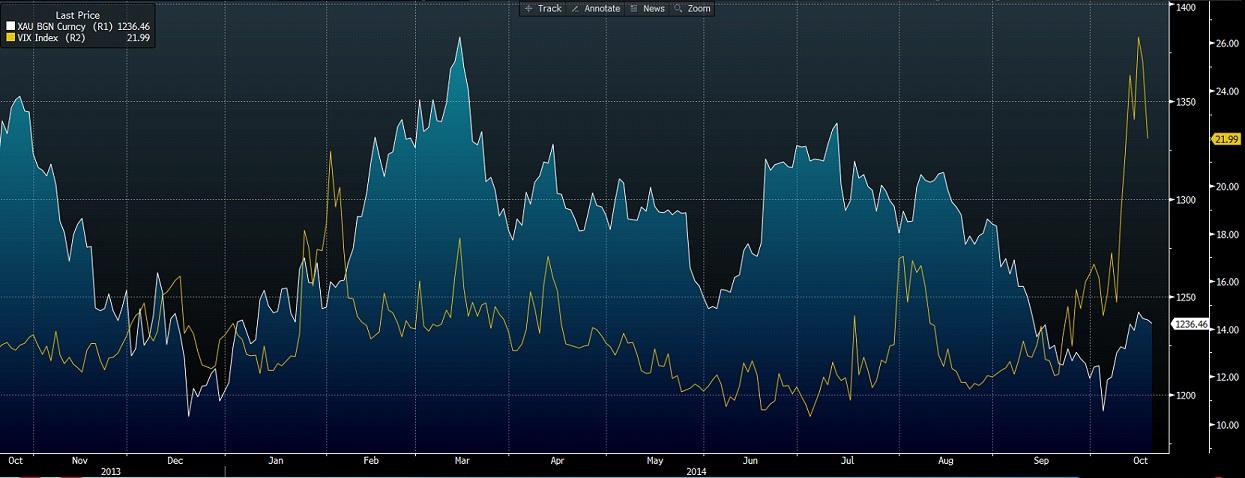

A quick comparison to the VIX index reveals what the majority of market participants already know, and that is that gold is not reacting with the VIX index. People primarily use it as a hedge for inflation -- during the GFC it was for hyper-inflation – which never occurred -- in the US market.

People have instead looked to other traditional safe havens, and the heavy appreciation of the Japanese Yen during the equity turmoil should come as no surprise in the market place, as it always has been the financial market safe haven in troubling times.

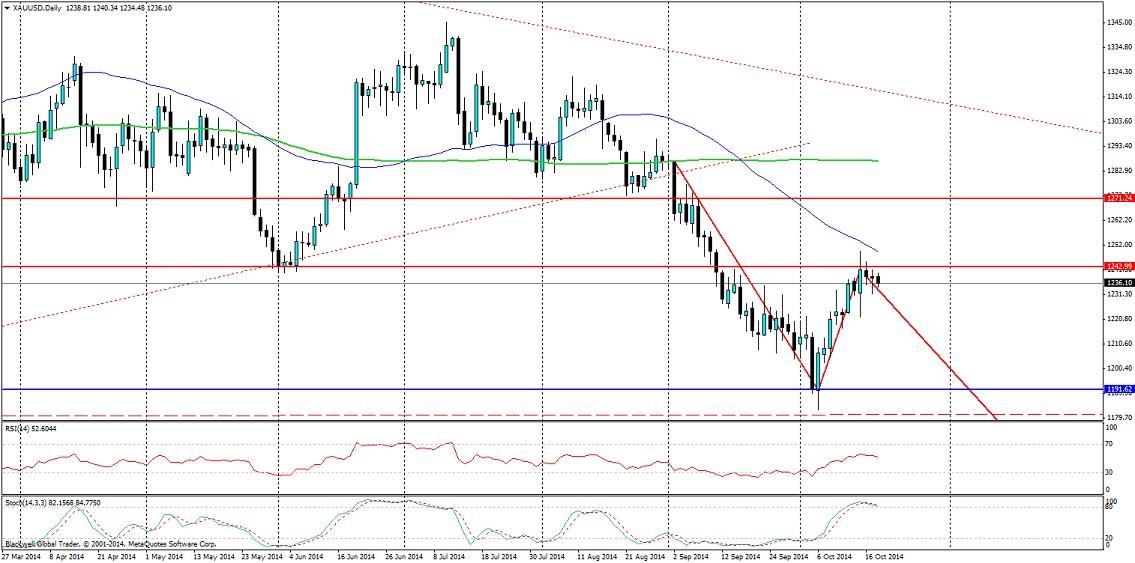

What can be seen on the charts when concerning gold is the strong ceiling at 1242.00 as gold has hit resistance here and started to trend back downwards. It looks likely that this will continue from a technical perspective, as currently stoch has shown a cross over and it looks to be trending lower right now, in line with the market movement.

Also, when you consider the fundamental aspect you have to take into consideration the labour market at present in the US. Which so far has been very robust, even unemployment claims came in at a record 264k last week, which is the lowest result in 14 years! The 10 year average is 385k which is quite abnormal given the GFC which impairs the data.

This strong labour market, coupled with the now falling oil prices enables the US economy to pick up the pace more than people realise. It’s likely we will see further falls and even the strong possibility of Yellen talking up interest rates, which in turn will lead to gold falling sharply again. Further compounding the prospect of US growth was the most recent Michigan consumer sentiment survey: which found consumers were upbeat about the economy and this bodes well for the economy as a whole.

Overall, the US recovery is ticking along and gold as we have seen does not have the momentum to go higher, even when volatility and worry returns to the market. Expect gold to continue to trend lower in the short-medium term unless we see some sort of catastrophe out of the European markets.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.