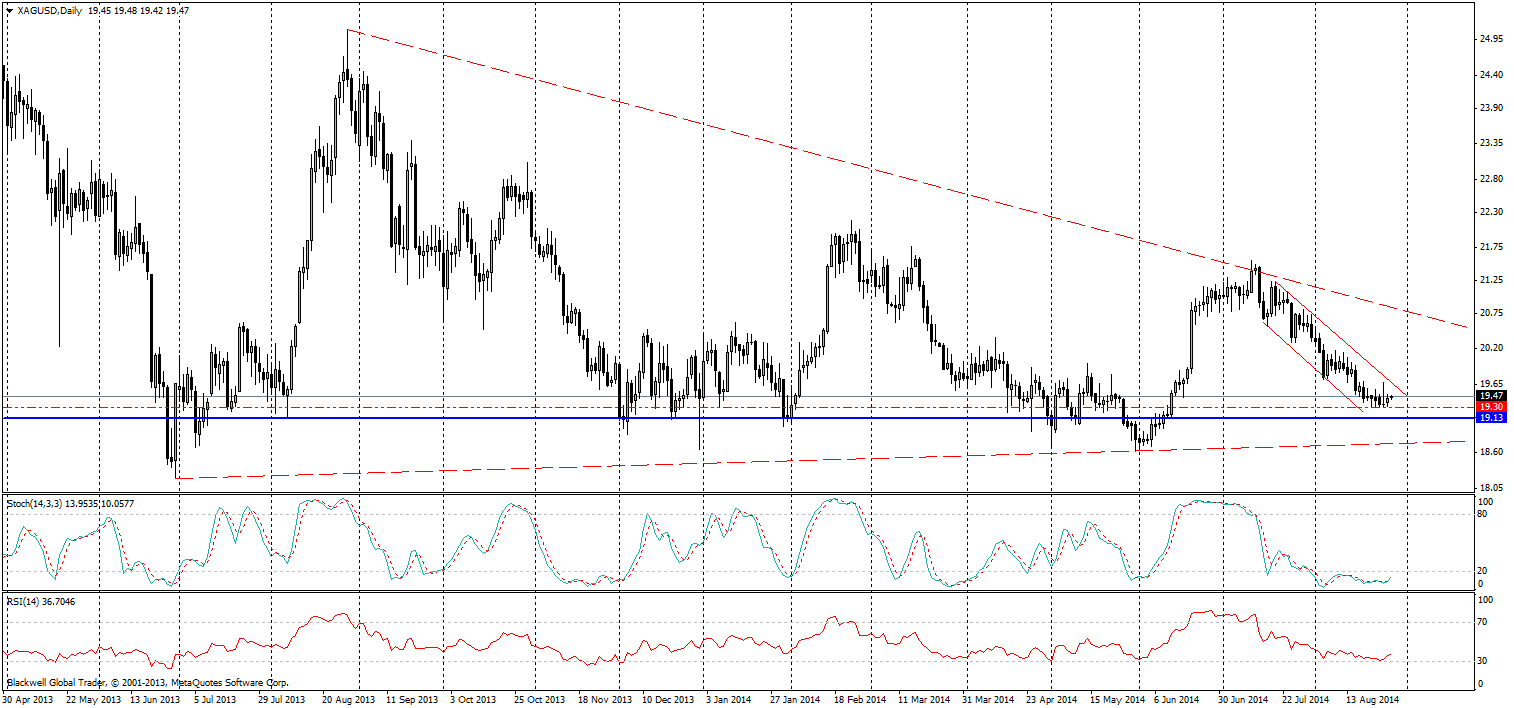

The silver market has rushed down the charts as mentioned in previous articles and now looks to be going through a period of consolidation. I had thought that a further dip lower might have been possible, but it looks to me like the market has run out of steam when it comes to silver.

The current price floor can be found at 19.30, and we have seen the market pull back upwards on a number of occasions. However, there just has not been the momentum to carry it any higher, particularly with a USD that is strengthening for a change.

A quick look on the daily chart shows there is still another strong level of resistance further down followed by a much more solid long term floor that is part of the current triangle pattern.

Tonight we will see strong movements in silver, especially with the US unemployment claims data coming out - which has the power to move markets strongly.

Currently we are consolidating on the chart with the news out tonight we could see some very sudden movements.

What’ is interesting to note though is the correlation between gold and silver; at present there is some justification in the market that gold is slightly bullish – even though long term is all down hill by the looks of it. So tonight’s market movement if it were bearish and gold dropped we could expect to see silver react accordingly.

Though, it’s also worth nothing the divergence between the two metals in terms of movement over the past year. No longer hand in hand do they move, but they do still somewhat move together. So it’s something to pay attention to at present.

Overall, silver is consolidating before the next big move. It’s clear that there can be some move lower in the trend line, and that could be followed by an opportunistic patch of consolidation.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.