Market Commentary

US equity index futures and European equity indexes gapped lower at the open following the weekend, with weak Chinese Industrial Production data providing the catalyst for initial downside. Industrial production slid from 9 to 6.9 in August compared to Aug-2013.

The downside in risk assets seems to have been contained for now, with European equity indexes and US equity index fu-tures trading within the vicinity of the highs of the session at the time of writing this repot.

Empire State Manufacturing report for September came in mixed, with a strong beat on the headline (27.54 vs. prev. 14.69). Yet, the employment sub-index saw a strong correction lower to 3.26 vs. prev. 13.64.

In the FX space, USD strength that has been a predominant force in catalyzing price dynamics over the course of last week, seems to be abating for now. It is a must to monitor USD dynamics this week in the run up to FOMC rate decision on Wednesday.

Intraday Strategy: E-mini S&P

E-mini S&P broke out of its 3-week range on Friday and gapped lower from Friday’s close following the weekend. From the tech-nical perspective, the lows of the aforementioned range will need to be confirmed / rejected as resistance - this is the premise that we will be basing our strategy for the session ahead. Empire State Manufacturing came in mixed - perhaps limited scope for further escalation higher. Industrial Production data might pose as a po-tential caveat - watch out for surprises vs. prev. data.

Make sure that if you do sell, you do so on waning upside momen-tum. Be careful with fade-type setups and with being proactive in positioning.

Intraday Strategy: EUR/USD

The EUR/USD entered a consolidation phase last week having printed the low at 1.2859 (circa 6% off the highs of the year at the 1.40 handle). The consolidation phase entailed, at times, height-ened volatility, yet the directionality of market moves in this curren-cy pair has been muted.

Taking into account the limited newsflow scheduled for today’s ses-sion we feel the most appropriate approach to the EUR/USD is a conservative one. As such we would aim to sell into waning mo-mentum at the highs of the current range.

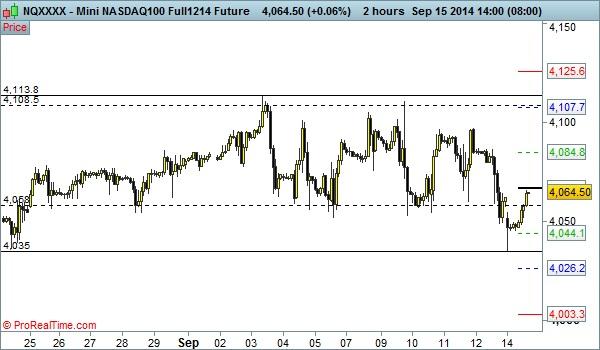

Technical Analysis: Nasdaq and DJIA

Gradual markdown moves in the Nasdaq and DJIA throughout last week.

Technical Analysis: Bund and US 10-year T-note Futures

US and German 10-year yields on a gradual path higher. For the US, with cautiousness ahead of FOMC this Wednesday.

Technical Analysis: GBP/USD and USD/JPY

GBP/USD has been consolidating last week’s sharp round trip since the latter part of last week. USD strength abating mildly vs. JPY.

City Trading & Investment Ltd are an incorporated entity registered in England & Wales. Company registration number is 08677745. Registered address: 37th Floor, One Canada Square, Canary Wharf, London, E14 5AB. Trading futures contracts on margin carries a high level of risk and may not be suitable for all investors. This excessive leverage can work against you at a significant capital cost. Before deciding to trade futures products you should carefully consider your investment objectives, level of experience and risk appetite. It is possible that you may lose some or all of your initial capital/investment and, there-fore, you should not invest money or financial assets that you cannot afford to lose. You should be aware of all of the risks associated with futures trading and trading financial instruments in general. You should seek advice from an independent financial advisor.

Any opinions, news, research, analyses, prices or other information contained in these reports is provided as general market commentary and is for educational purposes only. The content does not constitute investment advice in any shape or form. City Trading & Investment will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. The content of this report do not constitute an offer to sell or solicitation of an offer to buy any securities or financial instruments. Furthermore, the content of this report does not constitute advice or a recommendation with respect to such securities or other financial instruments or investments.

The content on this report is subject to change at any time without notice, and is provided for the sole purpose of assisting the educational appetite of traders. City Trading & Investment has taken reasonable measures to ensure the accuracy of the information within this report; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content of the report or from your inability to access the report, or for any delay in or failure of the transmission or the receipt of this report. Furthermore, no part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of City Trading & Investment Ltd.

This report is not intended for distribution or use by any person in any country where such distribution or use would be contrary to local law or regulation. None of the services or investments referred to in this report are available to persons residing in any country where the provision of such services or investments would be contrary to local law or regulation. It is the responsibility of the readers of this report to ascertain the terms of and comply with any local law or regulation to which they are subject.

Investment asset valuations and pricing can go up and down. Investment price fluctuations can be violent and can result in the loss of some or all of your initial investment/capital. The financial assets referred to in this research and the potential income or losses from them may also fluctuate violently as described. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Certain transactions, including those involving futures, options, and other derivatives, give rise to substantial risk and are not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.